-

Ocwen Financial's cost-cutting initiatives are bearing fruit toward returning to profitability, management said, although the company's third-quarter loss was slightly higher than the same period one year ago.

November 5 -

Inventory shortages, favorable tax policies and a dearth of affordable options caused homeowners to increase the number of years lived in their home, according to a Redfin report.

November 4 -

Early payment mortgage defaults went to the highest level in nearly a decade, particularly among loans included in Ginnie Mae securities, a Black Knight report said.

November 4 -

Nonbank and bank mortgage employment has leveled off in line with typical seasonal trends, but some lenders remain more interested in hiring than is usually the case late in the year.

November 1 -

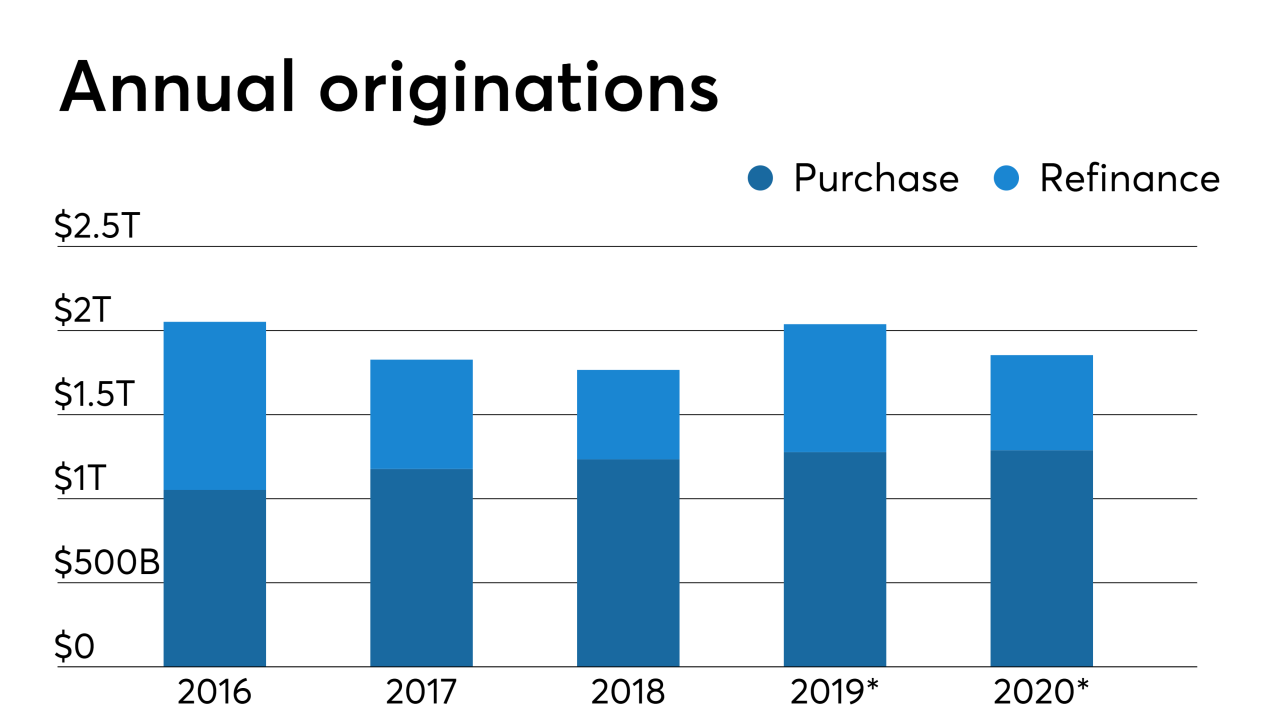

Freddie Mac is now forecasting back-to-back years of $2 trillion in mortgage loan originations rather than a drop-off in 2020.

November 1 -

More private mortgage insurers reported significant year-over-year gains in new business during the third quarter, mainly driven by the increase in refinance volume.

October 31 -

Record originations helped Mr. Cooper Group generate its first full-quarter profit since its formation through a merger between WMIH and Nationstar last year.

October 31 -

Mortgage applications increased slightly from one week earlier even as rates reached their highest level since July, according to the Mortgage Bankers Association.

October 30 -

Home lenders will benefit from elevated refinance activity through the first half of next year, but volume may then fall off quickly, according the Mortgage Bankers Association's latest forecast.

October 30 -

The acquisition of the Ditech forward mortgage business will double New Residential's year-to-date origination volume in the fourth quarter alone, and further double that next year.

October 25 -

The latest round of earnings reports from home lending businesses and vendors continue the positive vibe for the sector as most reported year-over-year improvement in profitability.

October 24 -

The unexpected rise in refinancings during the third quarter affected mortgage industry business results in a mostly positive fashion for the period.

October 23 -

Interest rate swings during this past week resulted in a decline in both refinance and purchase mortgage applications compared with the previous period, according to the Mortgage Bankers Association.

October 23 -

Single-family mortgage production this year is expected to be 3% higher than anticipated last month, according to Fannie Mae, which revised its estimates based partly on a stronger housing outlook.

October 17 -

Mortgage applications increased 0.5% from one week earlier, although interest rate instability affected consumers' ability to get the best price for their loan, according to the Mortgage Bankers Association.

October 16 -

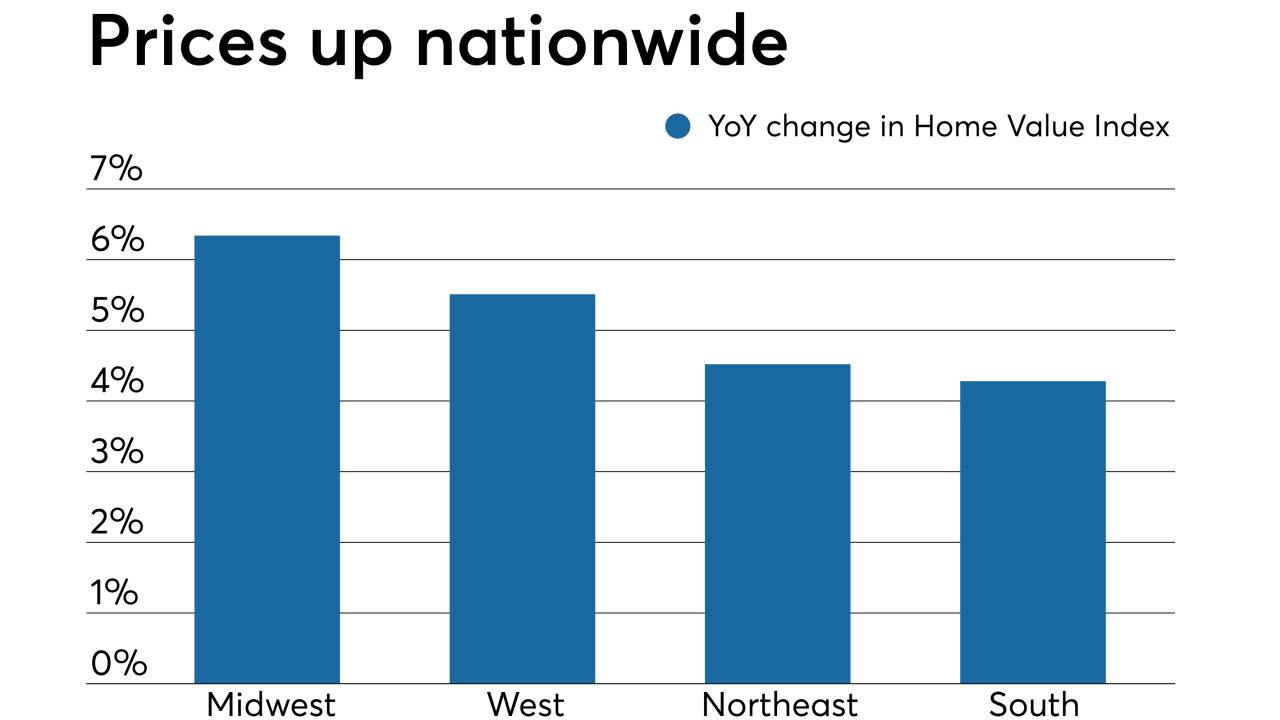

Home values posted the largest month-over-month spike in over five years due to continued buyer demand, according to Quicken Loans.

October 10 -

Mortgage applications jumped 5.2% from one week earlier as a drop in rates caused another surge in refinances, according to the Mortgage Bankers Association.

October 9 -

While home affordability reached a 32-month high in September, it could continue to increase in the fall months, according to Black Knight's Mortgage Monitor.

October 7 -

Bankers in St. Louis weren't surprised when mortgage data released this summer showed a drop in loans made between 2017 and 2018.

October 7 -

NewDay USA, a lender specializing in loans to veterans and military service members, is addressing rate-driven increases in refinancing by hiring more than 100 workers who are new to the business.

October 7