-

The latest round of earnings reports from home lending businesses and vendors continue the positive vibe for the sector as most reported year-over-year improvement in profitability.

October 24 -

The unexpected rise in refinancings during the third quarter affected mortgage industry business results in a mostly positive fashion for the period.

October 23 -

Interest rate swings during this past week resulted in a decline in both refinance and purchase mortgage applications compared with the previous period, according to the Mortgage Bankers Association.

October 23 -

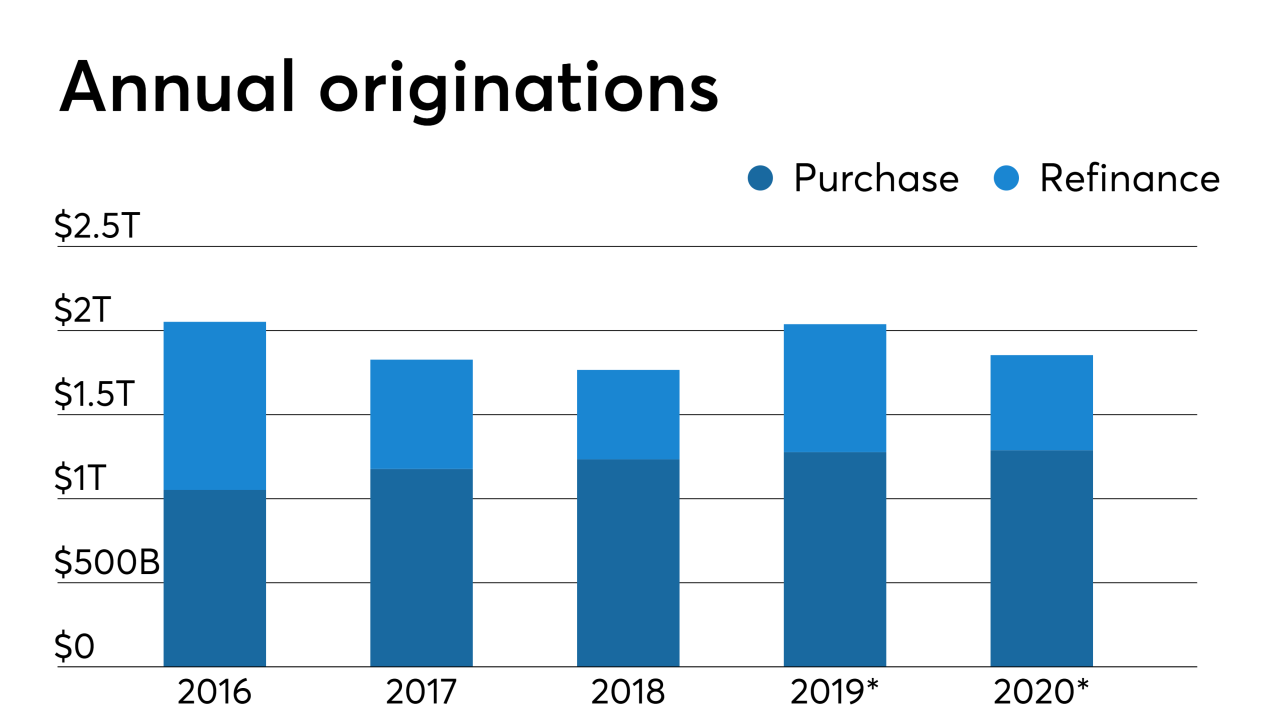

Single-family mortgage production this year is expected to be 3% higher than anticipated last month, according to Fannie Mae, which revised its estimates based partly on a stronger housing outlook.

October 17 -

Mortgage applications increased 0.5% from one week earlier, although interest rate instability affected consumers' ability to get the best price for their loan, according to the Mortgage Bankers Association.

October 16 -

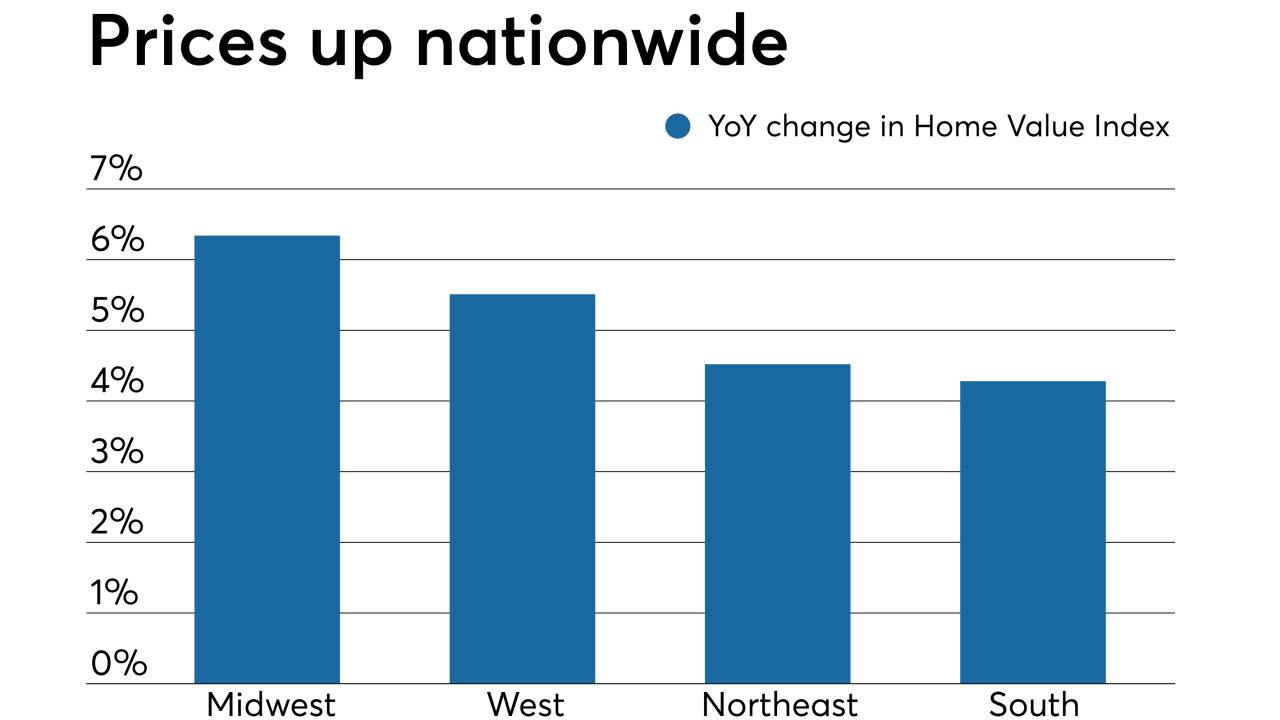

Home values posted the largest month-over-month spike in over five years due to continued buyer demand, according to Quicken Loans.

October 10 -

Mortgage applications jumped 5.2% from one week earlier as a drop in rates caused another surge in refinances, according to the Mortgage Bankers Association.

October 9 -

While home affordability reached a 32-month high in September, it could continue to increase in the fall months, according to Black Knight's Mortgage Monitor.

October 7 -

Bankers in St. Louis weren't surprised when mortgage data released this summer showed a drop in loans made between 2017 and 2018.

October 7 -

NewDay USA, a lender specializing in loans to veterans and military service members, is addressing rate-driven increases in refinancing by hiring more than 100 workers who are new to the business.

October 7 -

With housing affordability still a prominent hurdle to homeownership, prospective buyers — especially millennials — now get creative in order to find suitable homes, according to Chase and the Property Brothers.

October 4 -

Economic issues were the biggest influence on average mortgage rates in the past week, although two trackers moved in different directions.

October 3 -

Millennials took advantage of mortgage rates falling to near three-year lows in August, increasing their refinance share to the highest percentage since December 2015, according to Ellie Mae.

October 2 -

Mortgage applications increased 8.1% from one week earlier as conventional mortgage rates fell under 4% again, according to the Mortgage Bankers Association.

October 2 -

The switch to a buyer's home purchase market, as well as fewer natural disasters helped drive the five-month-long decline in mortgage application fraud risk, First American said.

September 27 -

The recent spike in mortgage interest rates reduced home purchase application activity last week, contributing to a 10.1% decline in total activity, according to the Mortgage Bankers Association.

September 25 -

Denmark is about to become a test case for what happens when banks start charging a lot of customers to store their money.

September 23 -

Foreclosure starts dropped to their lowest level in 18 years, and properties foreclosed on but not yet sold fell to a 14-year low in August, according to Black Knight.

September 23 -

The number of mortgage holders with refinancing potential dropped by 1.5 million as the average long-term rate for home loans continued to rise, according to Black Knight.

September 20 -

Mortgage applications decreased 0.1% from one week earlier as conforming and jumbo interest rates climbed back above 4%, which slowed refinance activity, according to the Mortgage Bankers Association.

September 18