-

Appraiser and homeowner estimates of house prices are aligning closer after the second straight month of a tightened gap in perceptions of value, according to Quicken Loans.

July 10 -

A decline in refinancings led to a drop in mortgage application volume last week, even though purchase activity continues to rise, according to the Mortgage Bankers Association.

July 10 -

Lenders who employ a technology stack that tracks, collects and analyzes homebuyer behavior will have a distinct advantage as application volume rises.

July 9 NestReady

NestReady -

Mortgage rates ticked up slightly this week with opposing trends in the stock and bond markets fighting for dominance, according to Freddie Mac.

July 3 -

Mortgage application activity was virtually flat from one week earlier, down just 0.1%, although there was a huge gain in Federal Housing Administration refinance volume, according to the Mortgage Bankers Association.

July 3 -

As 30-year fixed-rate mortgages continue dipping below 4%, June had the most borrowers in position to refinance since late 2016, according to Black Knight.

July 1 -

Mortgage application fraud risk declined for the second consecutive month in May as housing market dynamics shifted towards the buyers, First American said.

June 28 -

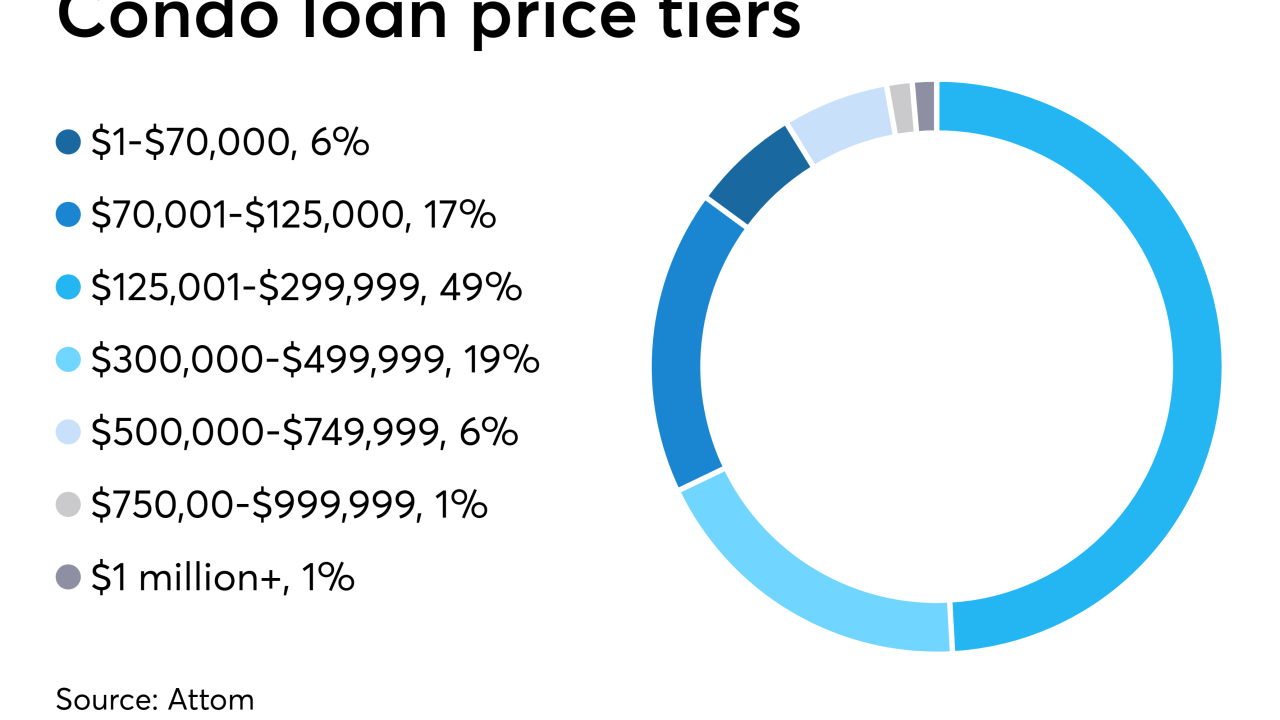

Making low-balance loans with poor economies of scale is tough in a market with slim margins, but it could have its rewards.

June 27 -

The refinance share of mortgage applications climbed to the highest level since January 2018 as the average 30-year fixed interest rate continued tumbling, according to the Mortgage Bankers Association.

June 26 -

Blackstone's real estate affiliate and property management firm SITE Centers Corp. acquired the 12 centers across seven states in 2014.

June 21 -

The number of properties in some stage of mortgage default has fallen to its lowest level in 14 years as most types of delinquencies have declined, according to Black Knight.

June 20 -

Freddie Mac fulfilled its promise to offer a single mortgage that finances the home purchase price and improvements completed after closing.

June 20 -

As mortgage rates dip lower and lower through home buying season, the rate of closing loan applications keeps climbing, according to Ellie Mae.

June 19 -

While low interest rates stimulated demand for housing in the first half of the year, affordability problems are holding back the purchase market, a First American survey of real estate professionals said.

June 19 -

Mortgage applications decreased by 3.4% this week, although refinance activity remained close to its 2019 high point, according to the Mortgage Bankers Association.

June 19 -

With mortgage rates expected to continue their recent slides over the next 18 months, in tandem with slowed economic growth, loan originations should see a jump through 2020, according to Fannie Mae.

June 17 -

Guild Mortgage is targeting Airbnb hosts with its new refinance program, allowing them to use short-term rental income to qualify for a new loan on their owner-occupied primary residence.

June 14 -

Mortgage rates remained unchanged as investors' concerns over U.S. foreign trade policy, which triggered the previous week's drop, were moderated, according to Freddie Mac.

June 13 -

With refinance activity rising to its highest level in three years, mortgage application volume increased 26.8% from one week earlier, according to the Mortgage Bankers Association.

June 12 -

Prepayment speeds for loans included in agency mortgage-backed securities were up approximately 20% both monthly and annually during May as the decline in interest rates boosted activity, according to Keefe, Bruyette & Woods.

June 11