-

Mortgage application activity decreased 3.2% from one week earlier as interest rates rose to eight-year highs and refinancings fell to an 18-year low, according to the Mortgage Bankers Association.

November 14 -

American Financial Resources, a Parsippany, N.J.-based mortgage lender, will pay any required agent fees for U.S. Department of Veterans Affairs loans for its brokers and correspondents on all AFR-related VA loan submissions starting Veterans Day.

November 12 -

Ginnie Mae officials are concerned about unusual activity with Department of Veterans Affairs cash-out refinances and are investigating the causes, as well as whether predatory lenders are taking advantage of veterans.

November 12 -

The Federal Housing Administration's life-of-loan premium discourages borrowers from refinancing into another FHA mortgage, damaging the stability of the insurance fund.

November 8 Potomac Partners

Potomac Partners -

Mortgage application activity dropped to its lowest level since December 2014 as interest rates reached an eight-year high, according to the Mortgage Bankers Association.

November 7 -

As the Federal Housing Administration prepares to release its annual actuarial report this month, the industry is questioning how the reverse mortgage program fits into the agency's future.

November 2 -

Mutual of Omaha Bank company Synergy One Lending is preparing to acquire certain assets of BBMC Mortgage, a national mortgage company and division of Bridgeview Bank, which will expand its Midwest footprint and improve its strategic direction.

November 1 -

Mortgage applications decreased 2.5% from one week earlier as purchase activity compared with 2017 fell for the first time in nearly three months, according to the Mortgage Bankers Association.

October 31 -

While all portions of mortgage credit underwriting standards have slipped since the early post-crisis period, it is the deteriorating conditions that most increases vulnerability for future loan quality, a Moody's report said.

October 29 -

All four national title insurance underwriters saw an increase in third-quarter net earnings compared with one year prior even as new orders declined because mortgage origination volume fell this year.

October 25 -

An increase in refinance activity in the period after Columbus Day drove mortgage applications 4.9% higher from one week earlier, according to the Mortgage Bankers Association.

October 24 -

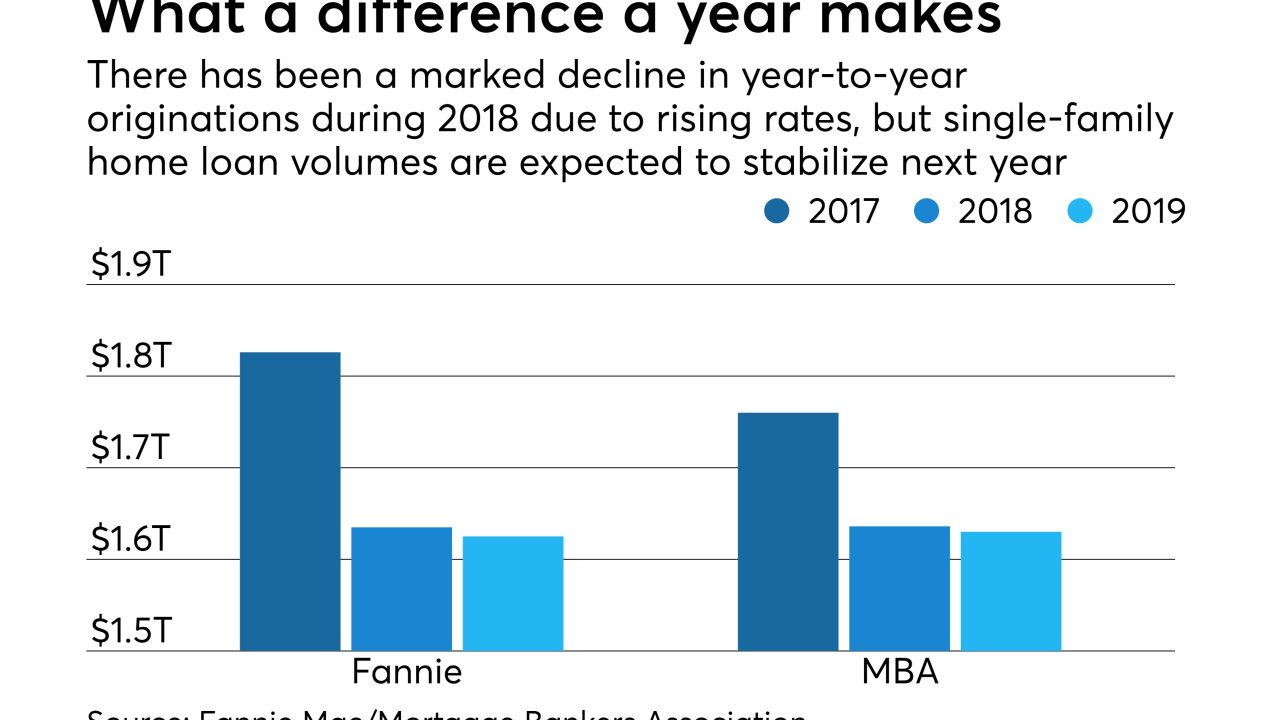

Increasing pessimism about housing is driving Fannie Mae's estimates for originations this year down a little further.

October 18 -

Mortgage applications decreased sharply from one week earlier as key interest rates stayed above 5%, although purchase volume grew from a year ago, the Mortgage Bankers Association reported.

October 17 -

While mortgage volume is expected to shrink next year, it should increase during the following two years and beyond as millennials start buying homes, the Mortgage Bankers Association forecasts.

October 16 -

Mike Cagney’s current venture, Figure Technologies, is offering consumers the ability to apply online for home equity loans and get funding in as little as five days.

October 10 -

Mortgage applications fell last week as rates for the 30-year fixed conforming loan topped 5% for the first time since 2011, the Mortgage Bankers Association reported.

October 10 -

As the housing market enters a new era, shifts in the demand for mortgages will ultimately dictate the direction of technology, staffing and GSE reform.

October 4 -

Lenders offered fewer government-guaranteed mortgage programs in September, leading to an overall decline in mortgage credit availability, according to the Mortgage Bankers Association.

October 4 -

Builder Lennar Corp.'s purchase of CalAtlantic's financial services operations boosted its mortgage segment's earnings in the third quarter as the acquisition offset declines in per-loan profits and refinancing.

October 3 -

Mortgage application activity was relatively flat compared with the previous week, as long-term interest rates held steady following the recent Fed rate hike, according to the Mortgage Bankers Association.

October 3