-

Critics of recent False Claims Act enforcement argue the Justice Department is too heavy-handed toward lenders and servicers. But in an industry reputed for shoddy processes during the crisis, perhaps stringent oversight is warranted.

August 11 National Mortgage News

National Mortgage News -

Using historical patterns to predict the next financial success or crisis seems rational. But beware the human psyche’s tendency to concoct order out of randomness.

August 8 IBM Global Business Services

IBM Global Business Services -

Old Republic International Corp. is again making noise about bringing its mortgage insurance subsidiary back to active status, while separating it out from the holding company.

July 31 -

CoreLogic will fully integrate its 4506-T income verification product in August with Fannie Mae's Desktop Underwriter platform to provide Day 1 Certainty service.

July 31 -

The government-sponsored enterprises transferred $5.5 billion of credit risk on $174 billion of mortgages in their portfolios during the first quarter.

July 26 -

Borrowers with variable-rate debt affected by Federal Reserve rate hikes showed they could handle December's 25-basis-point increase, but that could be changing as short-term rates continue to rise.

July 20 -

The Office of the Comptroller of the Currency told a somewhat familiar story Friday about the industry's risk environment.

July 7 -

If HSBC reaches an agreement with the government, it could give an early indication of how the Trump administration will levy financial penalties.

July 5 -

Canadian officials are working to slow a rapid rise in home prices that's being attributed to tight inventory levels in the country's largest cities and is threatening to create a housing bubble.

June 23 -

The House Financial Services Committee approved several bills Thursday designed to boost the private flood insurance market.

June 21 -

From vendor choice to valuations, here's a look at the key differences between Fannie and Freddie's upfront rep and warrant relief strategies.

June 21 -

Managing portfolios for an influx of servicing rights investors helps mortgage companies augment revenue and keep rising costs and compliance risks in check.

June 19 -

New entrants in mortgage servicing are rethinking how business is done, creating more division between holders of mortgage servicing rights and the entities that actually manage loans.

June 13 -

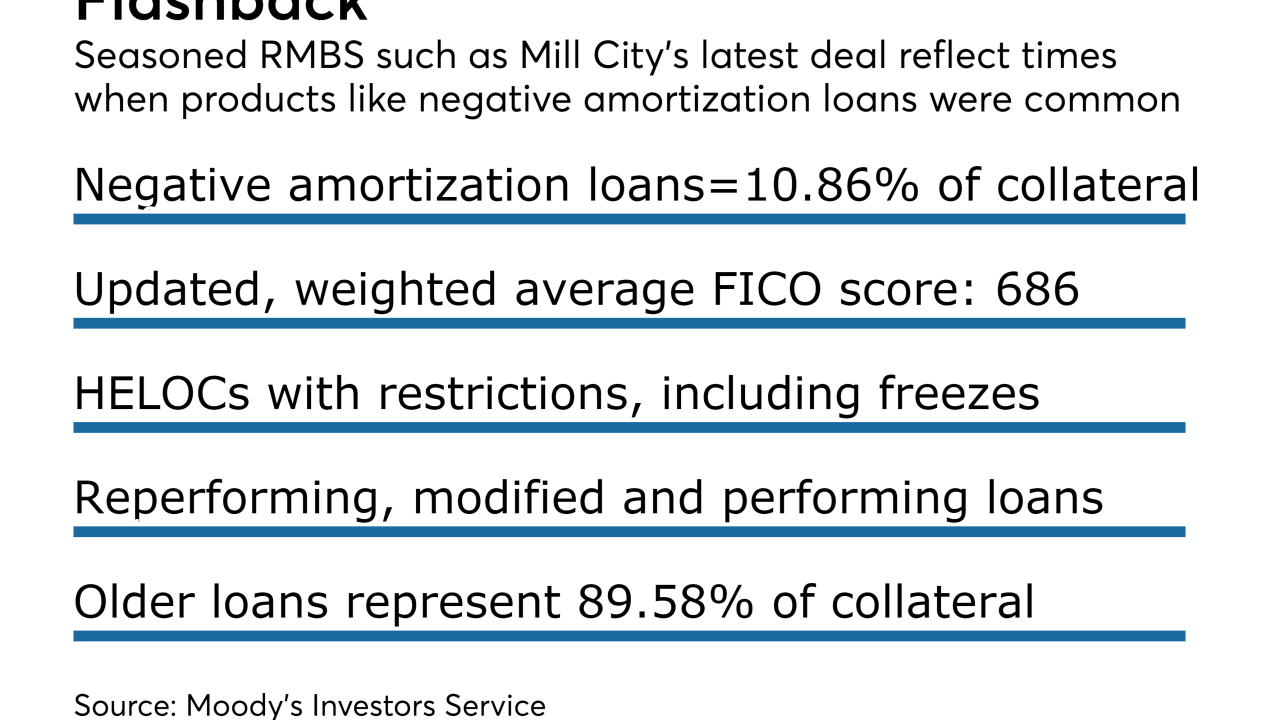

A loan securitization launched by Mill City has the largest concentration of seasoned negative-amortization loans seen in a residential mortgage-backed securities deal since the financial crisis.

June 12 -

The share of mortgaged properties underwater is inching down toward 6% but in certain areas like Las Vegas the percentage is more than twice as high, according to CoreLogic.

June 9 -

Not only is the uninsured sector growing, but the Bank of Canada is seeing some riskier mortgages within that area as it studies recent disruptions in the market.

June 8 -

Celebrated by cable TV shows and touted by get-rich-quick gurus, home flipping is coming back with a vengeance across the U.S.

June 8 -

Kroll Bond Rating Agency reports rapidly rising losses on loans secured by commercial properties in Texas and in Houston, driven locally by high vacancy in the office market.

June 6 -

From pockets of growth in a shrinking refi market to the possibility of REITs buying agency risk-sharing securities, here's a look at recent market shifts that major industry players are focused on right now.

June 5