-

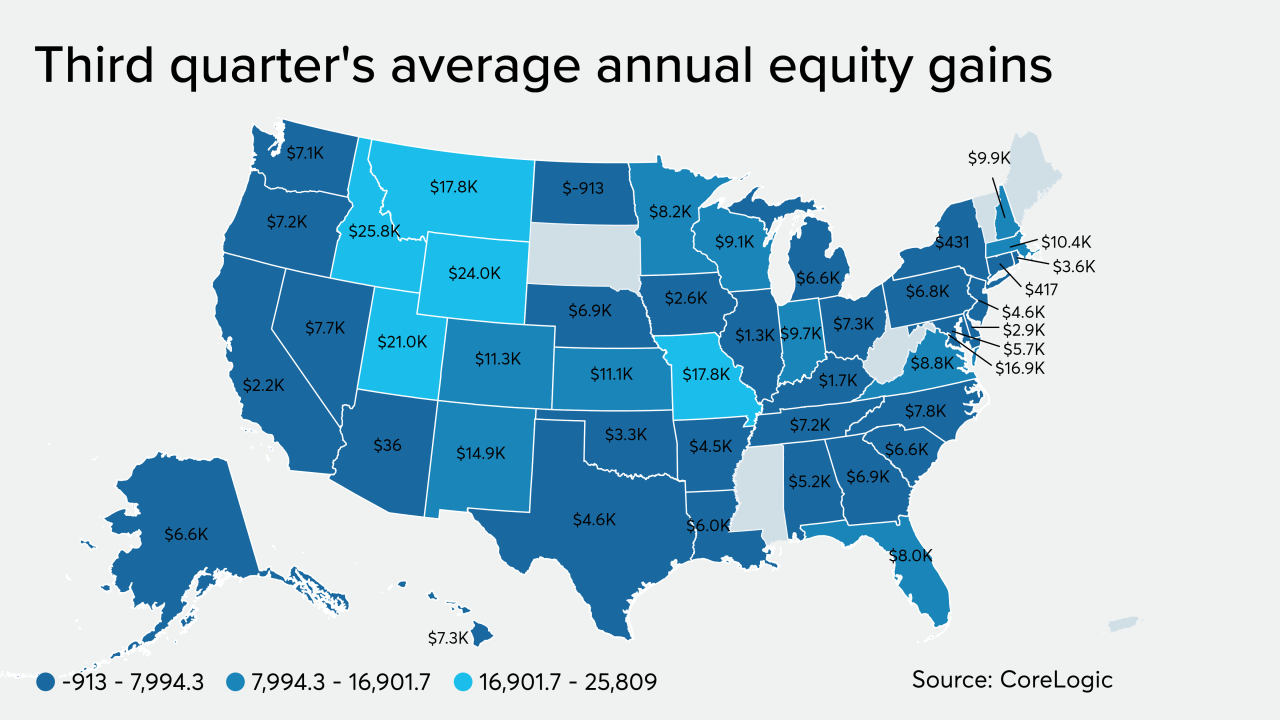

Home price gains continued during the fourth quarter and pushed the share of upside-down mortgages to the lowest level since the housing crisis, according to CoreLogic.

March 13 -

With the return of volume and profitability to mortgage lending, it is no surprise that commercial banks are coming back to the market.

March 11 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

The $400 million Toorak Mortgage Trust 2020-1 is the largest securitization to date for Toorak, which provides short-term institutional capital for individual and corporate real estate developers.

March 9 -

Mortgage lenders could benefit from the surge in refinancing due to widening market spreads, and that could help offset damage to servicing rights portfolio valuations, according to Keefe, Bruyette & Woods.

March 9 -

A rally in Treasuries that's driven 10-year yields toward record lows could have more room to run, a Goldman Sachs report said.

February 24 -

DBRS Morningstar and Moody’s Investors Service have assigned preliminary ratings to the Classic RMBS Trust, Series 2020-1 transaction sponsored by Home Trust Co.

February 24 -

Freddie Mac elevated Corley to executive vice president and head of its single-family business, putting her permanently in the role she occupied since last October.

February 20 -

As the hunt for yield intensifies, investors including Pacific Investment Management Co. see an attractive opportunity in mortgage bonds.

February 14 -

Five MBS pools of predominantly non-QM mortgages have been launched into the market by originators and loan aggregators, according to ratings agency presale reports published since Monday.

February 13 -

Default rates for prime jumbo mortgages will increase, but a strong economy and rising home prices will bail most borrowers and lenders out, Moody's said.

February 3 -

The mortgage securitization market can expect some changes, particularly in the specified pool and to-be-announced markets, alongside a continuation of trends in other areas.

January 31 Vice Capital Markets

Vice Capital Markets -

Radian Group sold Clayton Services, a due diligence company it acquired in the 2014 purchase of Clayton Holdings, to Covius Holdings.

January 22 -

Fannie Mae is sponsoring a $1.03B CRT transaction, while Caliber Homes Loans, New Residential and Onslow Bay fill the non-QM pipeline

January 14 -

Redwood Trust’s next mortgage-backed securitization consists almost entirely of older mortgages it originally sold off, but has since reacquired to assign to its first deal of the new year.

January 3 -

Fitch may use a new Structured Finance Association framework aimed at prioritizing only riskier TRID errors to assign grades to loans sold into residential mortgage-backed securities, reducing rating-related compliance burdens.

December 17 -

As home value appreciation keeps churning, the share of those upside down on their mortgage grows smaller than ever, according to CoreLogic's Home Equity Report.

December 13 -

The two deals continue a late-year surge of private-label RMBS deal volume totaling $8.37 billion priced since Oct. 1.

November 25 -

For the private-label mortgage-backed securities market to grow, regulators need to focus on collateral management in addition to changes to data disclosure rules.

November 25 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

Nationstar’s next securitization of defaulted or inactive home equity conversion mortgages will have a higher-than-average exposure to properties with steep leverage, as well as ties to judicial foreclosure states.

November 21 -

Lenders have bundled more than $18 billion worth of non-QM, private-label loans into bonds this year that they then sold to investors, a 44% increase from 2018 and the most for any year since the securities became common post-crisis.

November 18