-

Fitch Ratings is considering making adjustments to property valuations used in sizing up private residential mortgage securitizations to better account for possible exposure to uninsured, catastrophic risks.

June 6 -

Mortgage prepayment speeds may rise with the strong U.S. rate rally, and that may be cause for alarm for mortgage investors.

May 29 - LIBOR

The development of a replacement index for the London interbank offered rate brought back memories for one secondary market participant of the technology disaster worries many had at the turn of the century.

May 22 -

With prospects for government-sponsored enterprise reform improving, players in the private residential mortgage-backed securities market are starting to think about how they could better compete against the GSEs while awaiting change.

May 20 -

The shift to nonbank lenders will put the breaks on non-qualified mortgage and home equity line of credit origination growth.

May 20 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

PIMCO Mortgage Income Trust tabled plans to launch an initial public offering this week following a steep stock market decline Monday.

May 15 -

After issuing five RMBS deals of prime jumbo loans in 2019, JPMorgan has gathered a pool of 919 investor-only properties for its next mortgage securitization.

May 14 -

While prepayment speeds on agency mortgage-backed securities rose in April, that increase should be short-lived as further significant interest drops are not expected, said a report from Keefe, Bruyette & Woods.

May 13 -

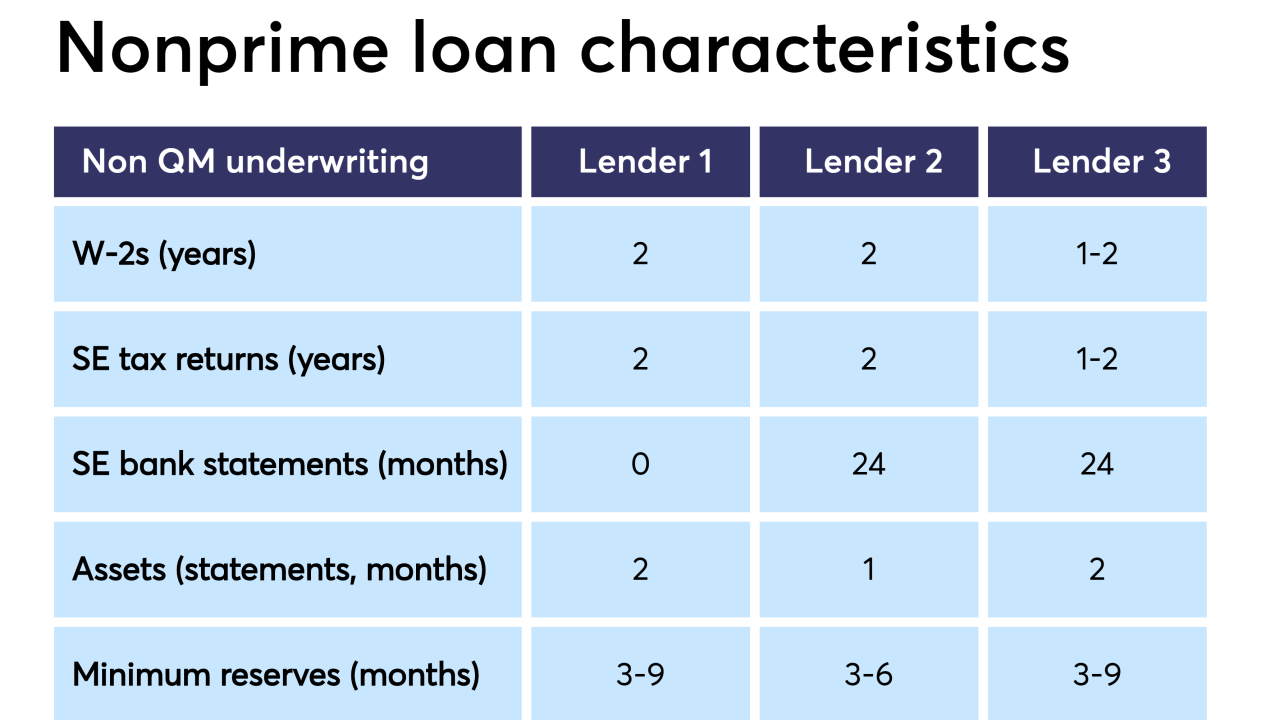

Securitized loans originated outside the Qualified-Mortgage rule's parameters have looser underwriting guidelines than mainstream loans do today, but are more tightly underwritten than past subprime or alternative-A products, according to DBRS.

May 6 -

Private-label mortgage securitizations with variable servicing fee arrangements could become more common going forward as issuers look to increase investor cash flow while reducing the loan servicer's economic exposure, Fitch said.

May 6 -

With nearly $90 million added in the past two months, Goldman Sachs marched closer to its $1.8 billion consumer-relief mortgage settlement with the U.S. Department of Justice.

May 2 -

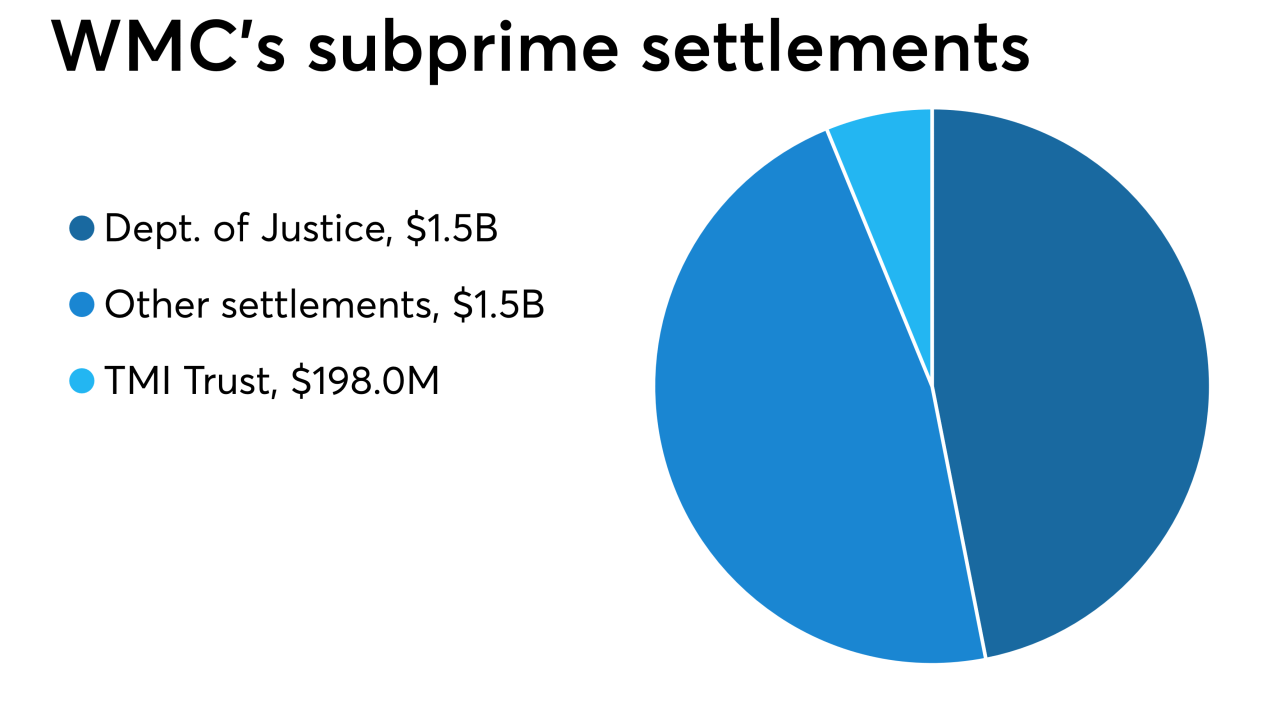

General Electric placed its WMC Mortgage unit into Chapter 11 bankruptcy protection as it has nearly $1.7 billion in legal settlements agreed to or pending.

April 24 -

An industry working group might seek legislation to eliminate the need for investor consent in the shift to a new benchmark interest rate. But any legislative fix is almost certain to be challenged because choosing an alternative to Libor will inevitably favor one party in a transaction over another.

April 21 -

General Electric Co. finalized an agreement to pay $1.5 billion to settle a U.S. investigation into the manufacturer's defunct subprime mortgage business.

April 12 -

Non-qualified mortgage-backed securities record issuance in the first quarter puts it on pace to top full-year volume predictions, according to Keefe, Bruyette & Woods.

April 9 -

The bank agreed to modify loans to struggling U.S. borrowers as part of a 2017 settlement. Instead, it’s receiving credit for financing new mortgages that likely would have been made anyway.

April 8 -

The Structured Finance Industry Group wants Treasury and the IRS to issue a notice that a change from Libor to an alternative index would not be treated as a taxable exchange.

March 31 -

While reinsurers are becoming more comfortable with the risk it is offloading, the GSE wants to maintain control of the workout process for loans that go bad.

March 27 -

Depending on market conditions and demand from whole loan buyers, it could fund 25% to 35% of fix-and-flip loans through deals like the $219 million one it just completed.

March 26 -

At $230 million, GSMBST 2019-PJ1 is notably smaller than recent transactions from JPMorgan and Redwood Trust; borrowers also have less equity in their homes.

March 25