-

Rising mortgage rates will only be "a mild deterrent" to home purchase activity during 2019 as other indicators like price and demand will cancel that out, according to Standard & Poor's.

January 23 -

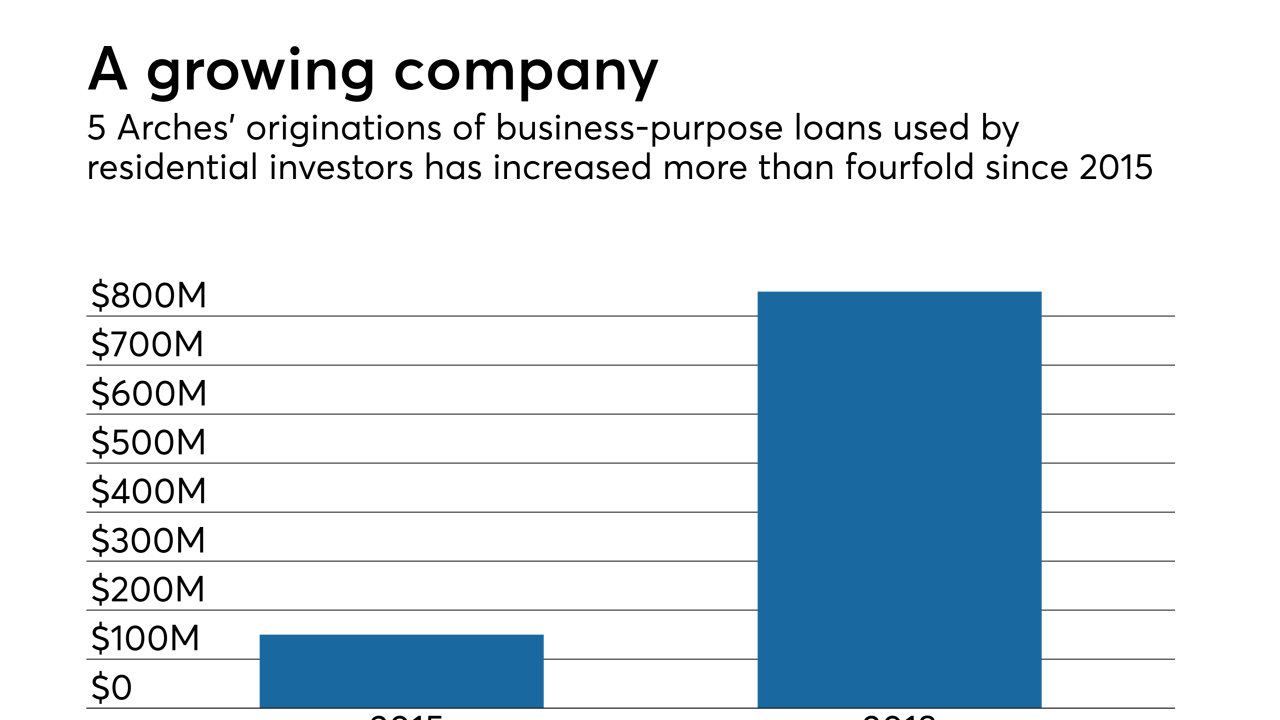

Redwood Trust has exercised its option to expand its minority stake in 5 Arches to 100%, increasing Redwood's exposure to loans used for house flipping and other types of residential investment.

January 23 -

At Ginnie Mae, Michael Bright worked closely with Congress to fight churn in VA mortgages; he plans to bring the same collaborative approach to the Structured Finance Industry Group.

January 10 -

Michael Bright is resigning as acting president of Ginnie Mae to run the Structured Finance Industry Group, a trade association that's been without a CEO since Richard Johns resigned in July amid a reported split with the group's board.

January 10 -

Due diligence firm American Mortgage Consultants has purchased Meridian Asset Services as part of its continuing efforts to expand through acquisition or organic growth.

January 10 -

Acting Ginnie Mae President Michael Bright will leave his post on Jan. 16 and will no longer seek confirmation to be the permanent head of the mortgage secondary market agency.

January 9 -

Cascade Financial Services has become the only manufactured housing loan-focused servicer currently rated by Fitch, adding signs of a rebound in factory-built home financing that could lead to new private securitization.

January 9 -

The expected decline in conventional mortgage volume may open the door for more non-qualified mortgage lending as secondary market investors seek new opportunities to deploy capital, says Tom Millon, CEO of Capital Markets Cooperative.

December 28 -

Liquidity, products and pricing are the main concerns for the secondary mortgage market in 2019.

December 26 -

Next year is unlikely to offer relief from higher rates or housing supply shortages, according to the consensus forecast from 24 of the Securities Industry and Financial Markets Association's member firms.

December 14 -

As home value appreciation slowed, gains in home equity for the third quarter fell to the lowest level in two years, according to CoreLogic's homeowner equity report.

December 6 -

Private-label residential mortgage-backed securitization is approaching a post-crisis high, according to Kroll Bond Rating Agency.

December 3 -

A National Fair Housing Alliance-led group plans to amend and refile a recently dismissed complaint against Deutsche Bank, Ocwen Financial Corp. and Altisource Portfolio Solutions alleging racial discrimination in property preservation.

November 21 -

Subprime originations are climbing in multiple consumer loan categories, including mortgages, but the increase is much smaller in the home loan sector than it is in other markets, according to TransUnion.

November 19 -

Accessory dwelling units are gaining attention as a way to boost the supply of rental housing; dedicated financing could help those who need it the most.

November 16 -

Ginnie Mae officials are concerned about unusual activity with Department of Veterans Affairs cash-out refinances and are investigating the causes, as well as whether predatory lenders are taking advantage of veterans.

November 12 -

UBS Group sold tens of billions of dollars' worth of residential mortgage-backed securities by "knowingly and repeatedly" making false and fraudulent statements to investors about the loans backing those trusts, the U.S. Justice Department said in a civil suit filed Thursday.

November 8 -

Continued diversification of its business lines and better margins in its securitization activities helped Redwood Trust overcome steep mortgage origination declines and post nearly 14% annual growth in net income during the third quarter.

November 8 -

While the foreclosure crisis is over and federal regulators are being less assertive on enforcement actions, mortgage servicers must remain vigilant about compliance, as state agencies are stepping up their own oversight, according to Standard & Poor's.

November 6 -

Although forecasts anticipate a continuing drop in overall originations, private-label residential mortgage-backed securitizations backed by newer loans are expected to keep increasing through next year, according to Bank of America.

November 5