-

The inevitable cancellation of the takeover transaction by China Oceanwide means Genworth will be spinning out a portion of its U.S. mortgage insurance business.

April 6 -

Banks can mitigate damage from slowing origination activity by putting excess cash to work, Keefe, Bruyette & Woods said.

April 6 -

Horizon Land Co. is securitizing a $488 million single-asset, single-borrower loan that will fund its purchase of 93 rent-site communities in the Midwest and Southwest regions.

April 5 -

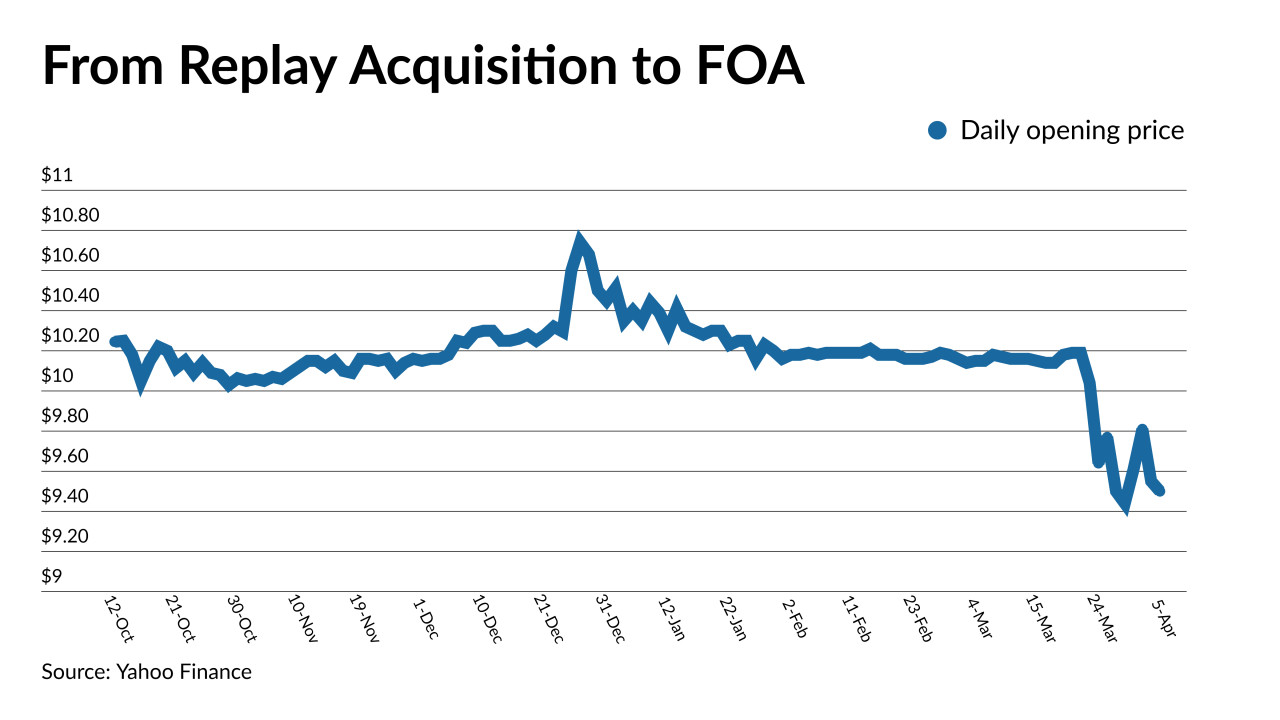

The forward and reverse mortgage lender completed its merger with blank check company Replay Acquisition Corp. on April 1.

April 5 -

“Federal Housing Finance Authority Director Mark Calabria’s decisions to date are conservative and imply a slow death for the GSEs and IMBs operating in the conventional market,” analyst Chris Whalen writes.

April 5 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

Securitization is a sound delivery model for any lender when combined with adequate research and preparation and it offers unique benefits, too — especially in terms of greater control and efficiencies, writes Black Knight’s managing director of pipeline analytics, James Baublitz.

April 1 Black Knight

Black Knight -

But private mortgage insurers should not see significant impact on business if a 25 basis point reduction were to occur sometime after 2021, according to BTIG.

March 31 - LIBOR

A white paper released Monday by the Alternative Reference Rates Committee outlined how issuers could (and perhaps should) model new floating-rate transactions using a compounded version of the interbank overnight rate instead of Libor.

March 30 -

The lasting effects of work-from-home practices driven by the COVID-19 pandemic could slash some office property values to less than half of their original value – and lead to rating downgrades on affected CMBS transactions, according to Fitch Ratings.

March 30 -

As the U.S. economy swings from pandemic lows to a vaccine- and stimulus-induced rebound, the window of opportunity for discounted deals is closing before it ever really opened.

March 29