Thought leaders

The mortgage industry is at the same place the music industry was at the dawn of MP3s and file-sharing platforms like Napster, Lopez said, and warned that lenders and servicers can't ignore technology's role in delivering loans.

Bots are hot

For example, Union Bank is using RPA to transfer and compare mortgage data and documents across systems to find exceptions and compile loan files. And the digital labor force may soon supplant offshore outsourcing as a source of reliable, cheap labor for low-skill tasks.

Mortgage blockchains

You gotta spend money to save money

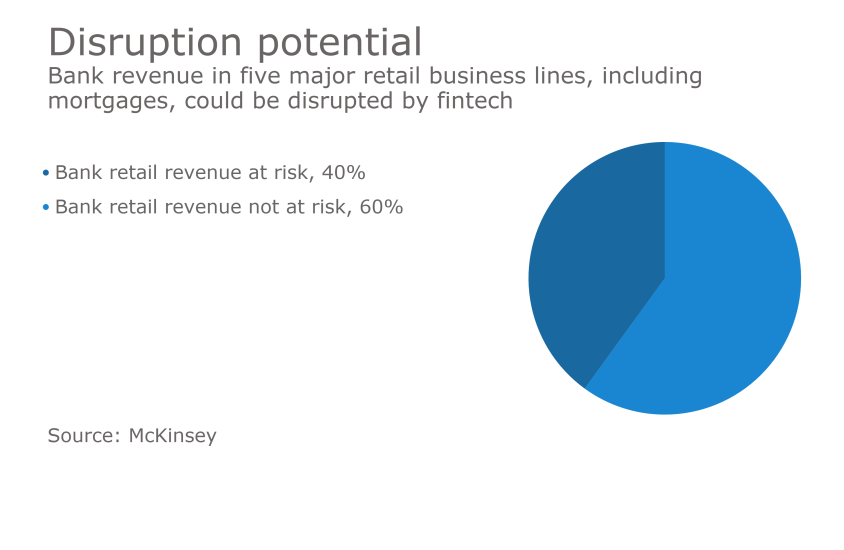

Digital disruption

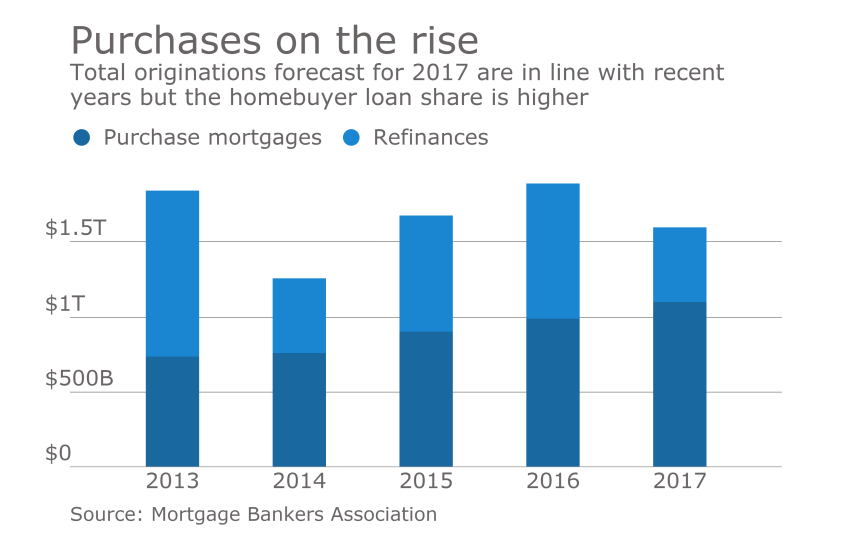

Demand for consumer-direct spurs startup frenzy

Subject-matter expertise