-

The average price of a single-family home increased 1.7% from last year to $426,800 in the third quarter.

November 6 -

Federal Reserve Gov. Christopher Waller said there was a popular "misunderstanding" Thursday regarding who can qualify for a "skinny" master account, noting that only firms with a bank charter would qualify for approval.

November 6 -

New guidelines should provide homeownership opportunities for certain consumer segments with thin credit files and open up product options, lenders said.

November 6 -

A new research report this week found AI could 'unlock' $370 billion in profits for banks, though they're not yet ready to capture it. But big-bank executives say they are already seeing measurable results from their generative and traditional AI investments.

November 6 -

Michael Barr said he believes artificial intelligence will have a positive long-term impact on the economy, though it may cause job losses in the short term.

November 6 -

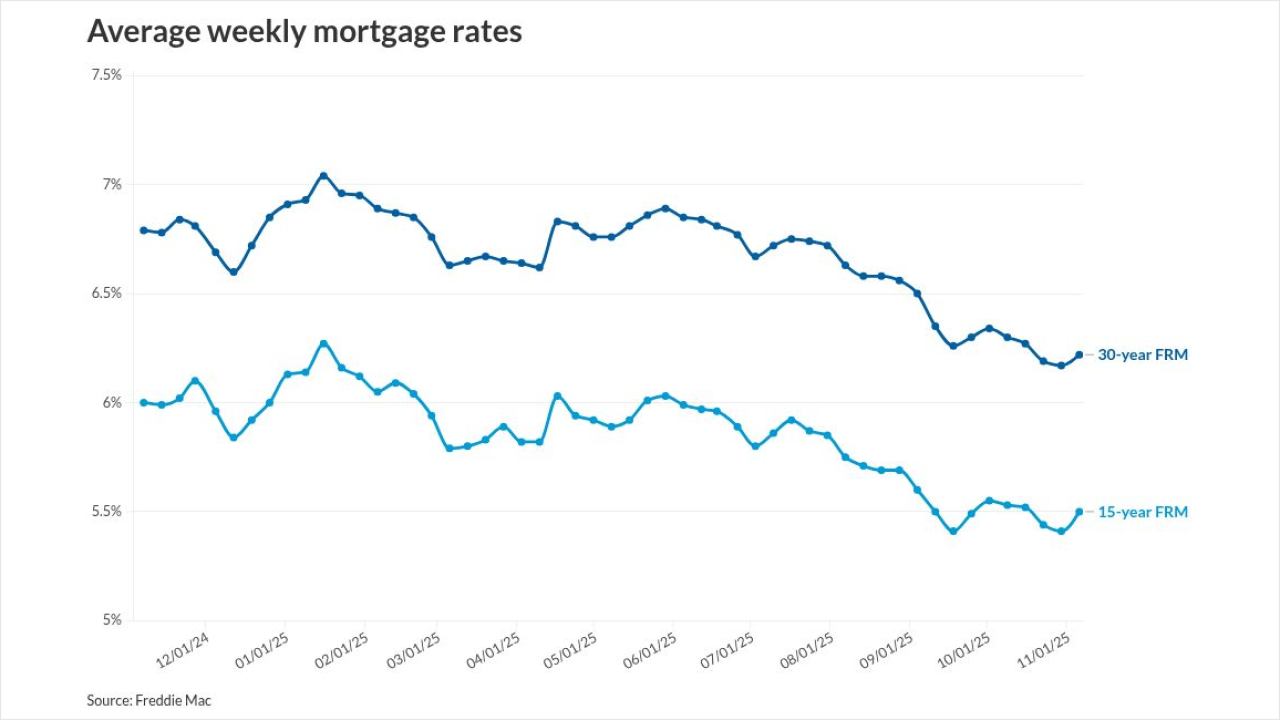

The 30-year fixed-rate mortgage rose five basis points from last week to 6.22%, while the 15-year rate increased nine basis points to 5.50%

November 6 -

UWM Holdings set a single-day record for rate locks in September at $4.8 billion, taking advantage of the window of opportunity leading up to the FOMC meeting.

November 6 -

The Federal Reserve Board finalized changes to its supervisory rating framework, allowing large bank holding companies to be considered "well managed," even with one deficient rating.

November 6 -

The company posted its best quarter for funded loan volume and shared other green shoots including greater margins on less reverse mortgage business.

November 6 -

In markets across the US, homebuilders sitting on unsold inventory are subsidizing mortgage rates so heavily they sometimes match the record lows last seen during the Covid-19 pandemic.

November 6 -

Industry professionals shared stories of homeowners looking to get out and investors pausing deals, while others cautioned a wait-and-see approach.

November 6 -

The Consumer Financial Protection Bureau is considering a proposal to reduce its oversight of auto finance lenders, saying the benefits of supervision may not justify the "increased compliance burdens."

November 6 -

The lender reported $33.3 million in net income in the third quarter this year, up from the second quarter and same period a year earlier.

November 5 -

Previously, Kim was a managing director in J.P. Morgan Chase & Co.'s strategic investments group, where she managed a diverse portfolio of fintech investments.

November 5 -

At its first investor day in a decade and a half, the nation's second-largest bank pegged its guidance for return on tangible common equity at a slightly higher level than what it reported last quarter. Not all investors were impressed.

November 5 -

The latest sale consists of close to 1,200 HECMs secured by vacant residential units found in 46 states, according to data provided by the government agency.

November 5 -

What makes the situation alarming is the government attack on the fair lending enforcement infrastructure, said Lisa Rice of the National Fair Housing Alliance.

November 5 -

Private-sector payrolls increased by 42,000 after a revised 29,000 decline a month earlier, according to ADP Research data released Wednesday.

November 5 -

Treasuries fell after the US government signaled that larger auction sizes are on the horizon, while signs of economic resilience hurt the odds a Federal Reserve interest-rate cut in December.

November 5 -

Built launched Draw Agent Tuesday, which can process thousands of construction loan draws monthly.

November 5