-

In a move designed to improve access to financial products for consumers with low credit scores and short credit histories, Experian, FICO and Finicity are developing an "UltraFICO" score that lets individuals share checking and savings account data and help lenders better assess risk.

October 22 -

A decade after the credit crisis, investors are returning to where it all began. The mortgage sector, blamed in large part for the near-collapse of the global financial system, is now seen by many as a high-quality market forged by fire.

September 14 -

Caliber Home Loans’ next offering of subprime mortgage bonds includes a new product offered to borrowers with a stronger credit profile than its other programs – but also less equity in their homes.

September 10 -

New investor appetite for mortgages over $1 million is motivating more nonbank lenders to offer super jumbo loans, often with weaker credit terms than traditional banks.

August 20 -

The investors initially won the right to sue as a group in 2015 before an appeals court reversed the ruling; the $13 billion lawsuit can now proceed as a class action.

August 15 -

Lauren Hedvat, Angel Oak's managing director of capital markets, said that the rising non-qualified mortgage volume in the market has expanded the number of third-party origination loan packages for purchase.

June 27 -

The borrowers behind the $401.6 million COLT 2018-2 have weighted average liquid reserves of $426,633, or nearly twice the level of borrowers backing a deal completed in January.

May 29 -

The post-recession boom in auto loans and credit cards for borrowers with marred credit histories has been winding down in recent months.

May 17 -

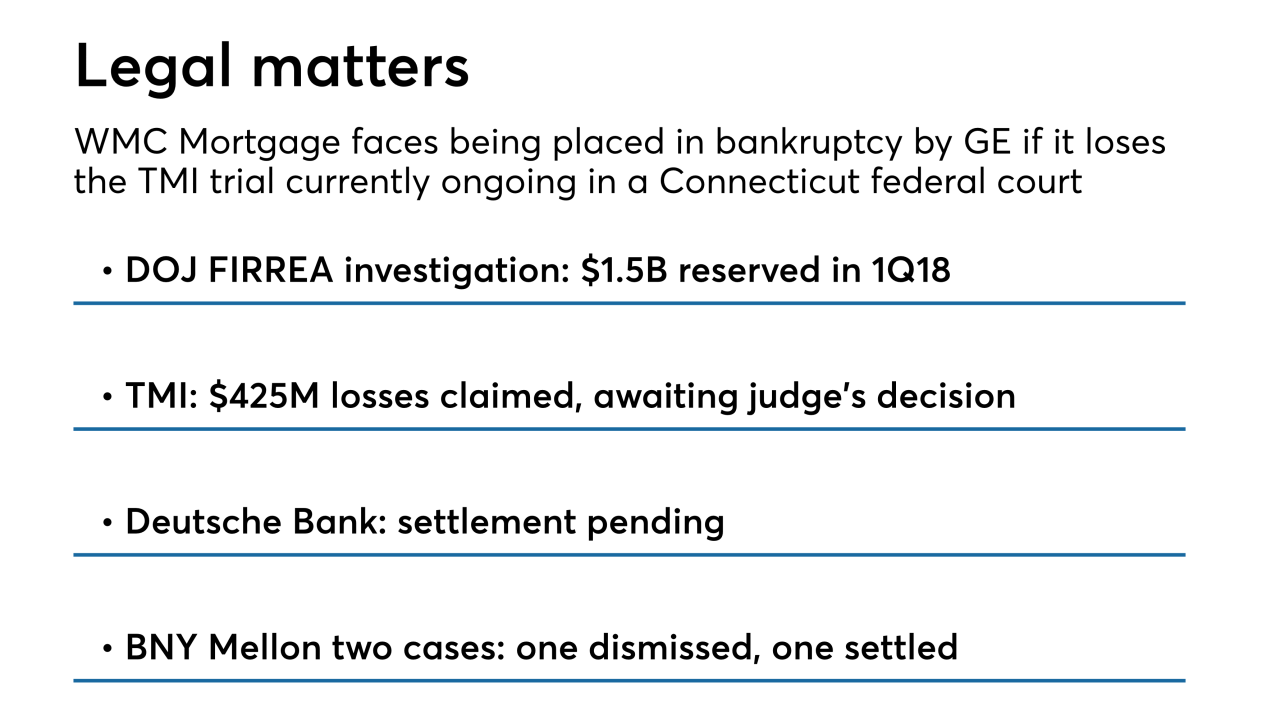

WMC Mortgage, a leading subprime originator during the boom era, could file for bankruptcy by parent company General Electric if it loses a legal proceeding regarding indemnifications on mortgage-backed securities.

May 3 -

Mortgage credit availability tightened during March to its lowest level in over a year, adding another headwind to a market challenged by rising interest rates and a shortage of homes for sale.

April 5 -

Carrington Mortgage Services' decision to offer subprime mortgage loans was a natural progression from its decision four years ago to concentrate on borrowers with credit scores under 640.

April 3 -

The deal, known as Bayview Opportunity Master Fund IVb Trust 2017-RT6, pools 2,745 current loans, of which nearly 58% have been clean for at least two years, and 55.2% have been modified.

October 26 -

In a new book, Mehrsa Baradaran argues that the same forces of poverty that African-American banks were supposed to alleviate are now holding them back.

September 25 -

Investor demand for mortgage bonds is strong; the only limiting factors are consumer awareness of the product and loan officers' willingness to offer them.

September 19 -

The $426.2 million COLT 2017-2 is backed entirely by loans originated by Caliber, an affiliate of private equity firm Lone Star Funds. There are no loans originated by Sterling Bank & Trust, which accounted for 22% of the collateral for the prior deal.

September 8 -

Auto, personal and credit card originations have fallen as delinquencies have risen, but researchers called the slowdown a temporary rebalancing by lenders.

August 16 -

Ocwen Financial finalized the deal to sell its interests in $110 billion of nonagency mortgage servicing rights to New Residential Investment Corp. for total consideration of $400 million.

July 24 -

The credit characteristics of the collateral are broadly similar to the sponsor's inaugural deal, completed in February, but the capital structure has been tweaked.

July 19 -

Morgan Stanley received credit for $30 million of consumer relief, completing 85% of the obligations required by its February 2016 settlement with New York State.

July 3 -

Wells Fargo & Co. surprised investors this week by withholding more than $90 million due to buyers of pre-crisis residential mortgage-backed securities.

June 30