-

Home price appreciation tapered as buyers battling tight inventory and rising housing costs pulled back from the market, according to CoreLogic.

March 5 -

Minneapolis' offering of affordable starter homes and inflated supply of below-median-priced options made it the housing market with the highest low-income ownership rate, according to Redfin.

March 5 -

Home purchaser affordability declined in the fourth quarter, which also negatively affects the amount Americans have to spend on cost-of-living expenses, a report from Zillow said.

March 5 -

Rises in the amount of low down payment loans and private mortgage insurance due to tight affordability led to the most first-time homebuyers since 2006, according to Genworth Mortgage Insurance.

March 1 -

Slower home price growth and cooled mortgage rates could bring buyers out in droves in 2019, according to NerdWallet.

February 26 -

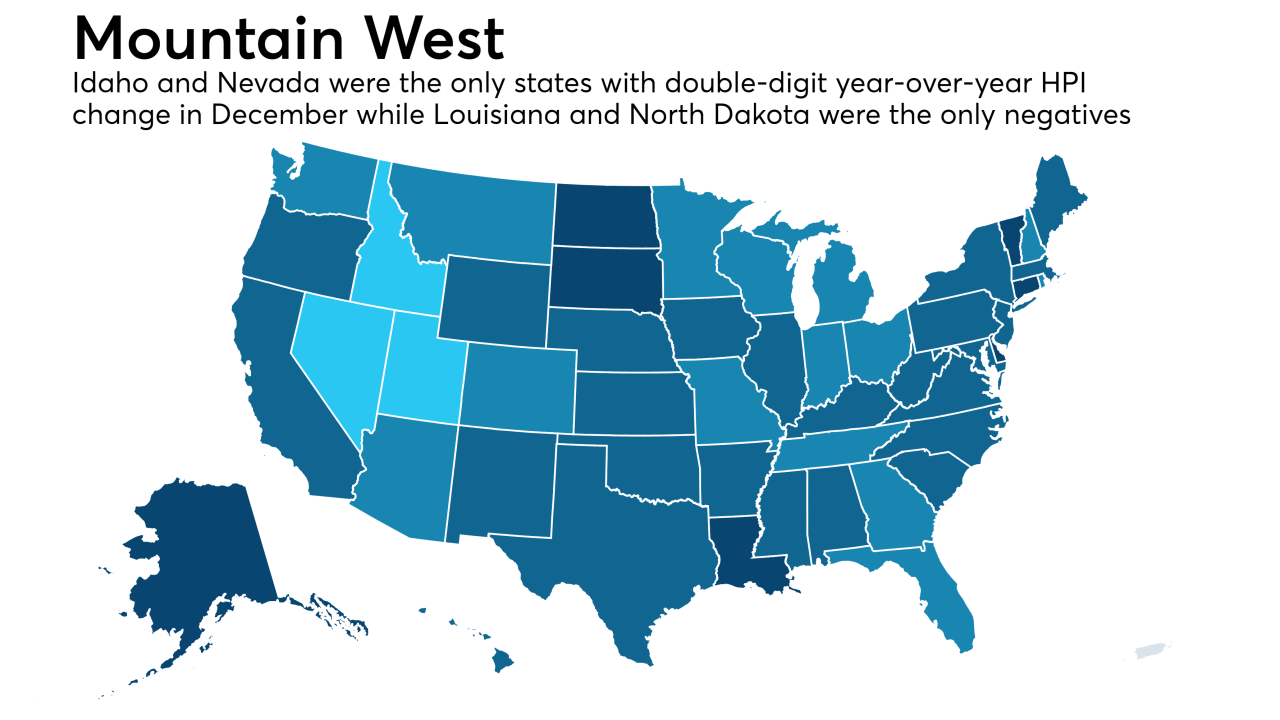

Home prices in 20 U.S. cities rose in December at the slowest pace in four years, continuing to decelerate as buyers balked at purchases amid still-elevated housing costs and a falling stock market.

February 26 -

Rising household incomes paired with December's drop in mortgage rates gave consumers their largest monthly jump in home buying power since 2013, according to First American Financial Corp.

February 25 -

While overall housing sales have suffered due to affordability, the trend is even more drastic for typically higher-priced new homes, according to Redfin.

February 22 -

Home affordability is at a 10-year low across the nation. Here's a look at the 12 cities most in danger of a housing bubble in 2019.

February 21 -

The agency's pilot program, designed to streamline mortgage insurance applications associated with the Low-Income Housing Tax Credit program, will now include applications for new construction and substantial rehabilitation.

February 21 -

As expected economic growth remains at 2.2% — down from 2018's 3.1% — 2019 should only be accompanied by a solitary rate hike from the Federal Reserve, according to Fannie Mae.

February 21 -

Despite a healthier economy supporting wage and income growth, the narrative that homebuyers are struggling to afford homes for sale hasn't changed much. House values are still on the rise, meaning shoppers are struggling with how much house they can afford.

February 19 -

Women have lower incomes than men, limiting their options when buying a house. But in some of the more pricey housing markets, single female homeowners outpace single male homeowners, which could suggest some tightening in the home value gap, according to Attom Data Solutions.

February 14 -

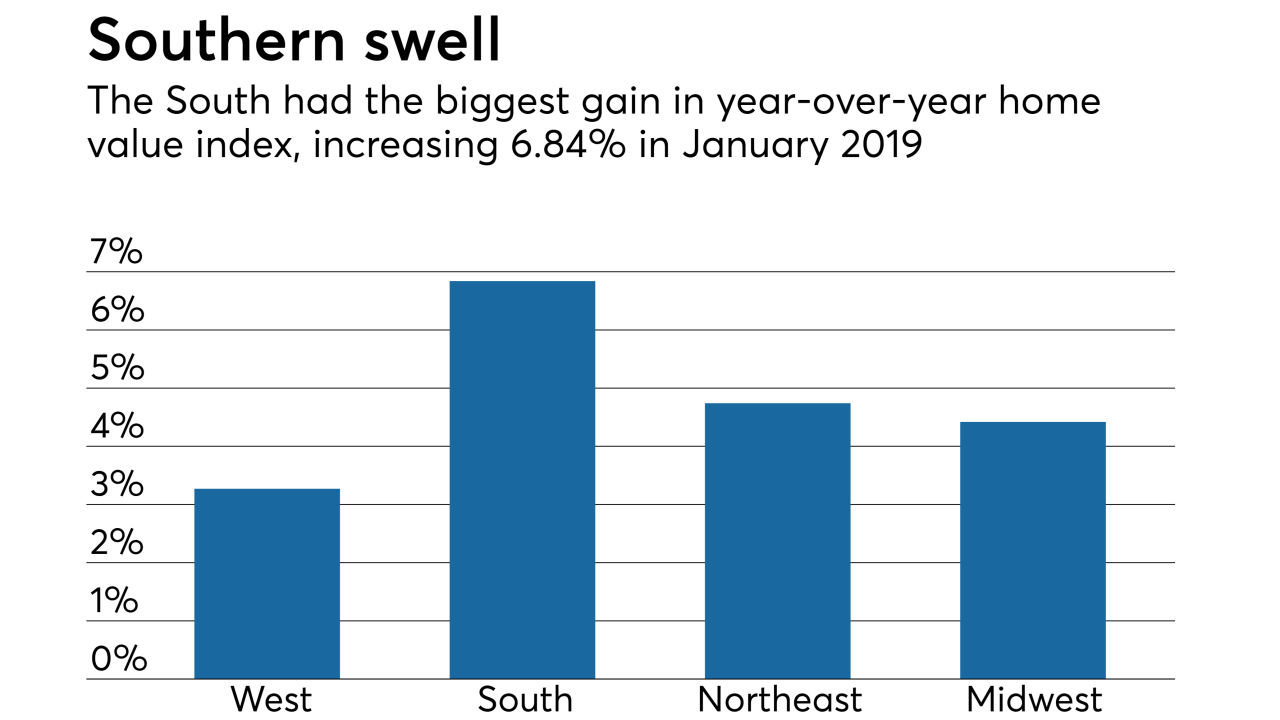

While property values continued rising in most markets, they grew at a healthier pace for homebuyers, according to the National Association of Realtors.

February 13 -

While home price appreciation showed steady growth in January, it's a lower rate than years past and consumer appraisal perception lags reality, according to Quicken Loans.

February 13 -

From the gateway to the West to just below the Mason-Dixon Line, here's a look at the 12 housing markets with the highest percentage of homes affordable to millennial purchasers with median incomes.

February 12 -

Inventory deficiency and affordability issues kept sales down and hampered home price growth, according to CoreLogic.

February 5 -

Nearly a quarter of Denver-area residents looking for a home on Redfin.com are conducting their searches outside the metro area, and Seattle continues to provoke the most yearning.

February 5 -

Affordability remains a challenge for homebuyers, but barely any mortgage lenders attribute last year's sluggish home sales to insufficient consumer income or lack of loan products for new buyers, according to Fannie Mae.

January 31 -

Bay Area adjacency without the exorbitant home prices make Sacramento, Calif., an attractive option for consumers, according to Redfin's migration report.

January 30