Slower home price growth and cooled mortgage rates could bring buyers out in droves in 2019, according to NerdWallet.

The personal finance company and data provider's 2019 Home Buyer Report showed 36% of consumers plan to buy a home within the next five years, a year-over-year increase from 32%. Of those planning to make a purchase, 24% said

"Homebuyers have been on a dizzying, twisty journey," Holden Lewis, NerdWallet's home expert, said in a press release. "A year ago at this time, mortgage interest rates were low and competition for homes was fierce. Rates moved higher in much of the fall, reducing affordability and knocking some buyers out of the market. Now rates have dropped again. Because so much of the home buying experience depends on timing and location, it's not surprising to see a wide array of sentiments across recent and prospective buyers."

While it's not a buyer's market yet,

"Home prices are still going up, but at the slowest pace in two years. Affordability is still a struggle, but looking for a home is an act of hope. The combo of slower price increases and low interest rates should bring out more shoppers this home buying season than in years past. Buyers of moderately priced homes will still face strong competition in most markets. First-timers should expect to make multiple offers before landing a home," Lewis said.

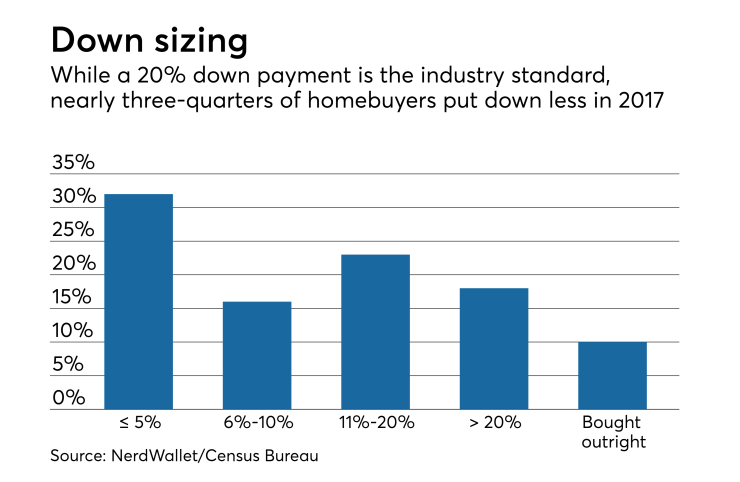

First-time buyers are also