-

CoreLogic's second-quarter net income increased 2% over the previous year on higher operating income from improvements in productivity.

July 26 -

LendingTree has added property valuation data to its My LendingTree site, showing consumers how much equity in their home they can tap.

June 14 -

CoreLogic is acquiring appraisal technology company Mercury Network from Serent Capital just two years after the San Francisco-based private equity firm purchased it.

June 6 -

Real estate site Zillow is launching a $1 million competition among data scientists to improve its "Zestimate" home valuations, but said the crowdsourcing initiative is unrelated to recent lawsuits filed in Chicago against the company.

May 26 -

The time needed to close a mortgage improved nine days since the start of the year as the market has shifted to doing more purchase loans.

May 18 -

By replicating human tasks, robotic process automation technology is driving scale and efficiency in loan manufacturing.

April 11 -

loanDepot has invested $80 million in a three-part digital lending platform called mello and is opening a 65,000-square-foot technology campus in Irvine, Calif.

March 31 -

Lenders can track the effectiveness of product pricing changes on a real-time basis using a new market share analytics tool from Optimal Blue.

March 30 -

The reduction in refinance activity as the mortgage industry pivots toward purchase transactions amid higher interest rates has caused loan defect and fraud risk to rise, according to First American Financial Corp.

February 24 -

CoreLogic has released a new platform that provides information on lien and equity positions for whole loan traders and servicers.

February 24 -

The monthly prepayment rate declined in January, an indication of the effects of higher interest rates.

February 23 -

Nationstar Mortgage Holdings reported significantly higher net income for the fourth quarter, due to improved revenue in its servicing segment.

February 22 -

International Document Services has updated its idsDoc technology to support upcoming changes to Home Mortgage Disclosure Act reporting.

February 17 -

Black Knight Financial Services has launched a new tool that identifies potential liabilities to reduce title insurers' claims.

February 15 -

Fannie Mae and Freddie Mac have released the final specification update regarding the Uniform Closing Dataset, the digital file format for the TRID Closing Disclosure form.

February 1 -

CoreLogic has released a new mobile application that provides access to property data and analytics.

January 24 -

The Mortgage Industry Standards Maintenance Organization has extended the comment period on its proposed standard regarding the maintenance and sharing of commercial and multifamily rent-roll information.

January 24 -

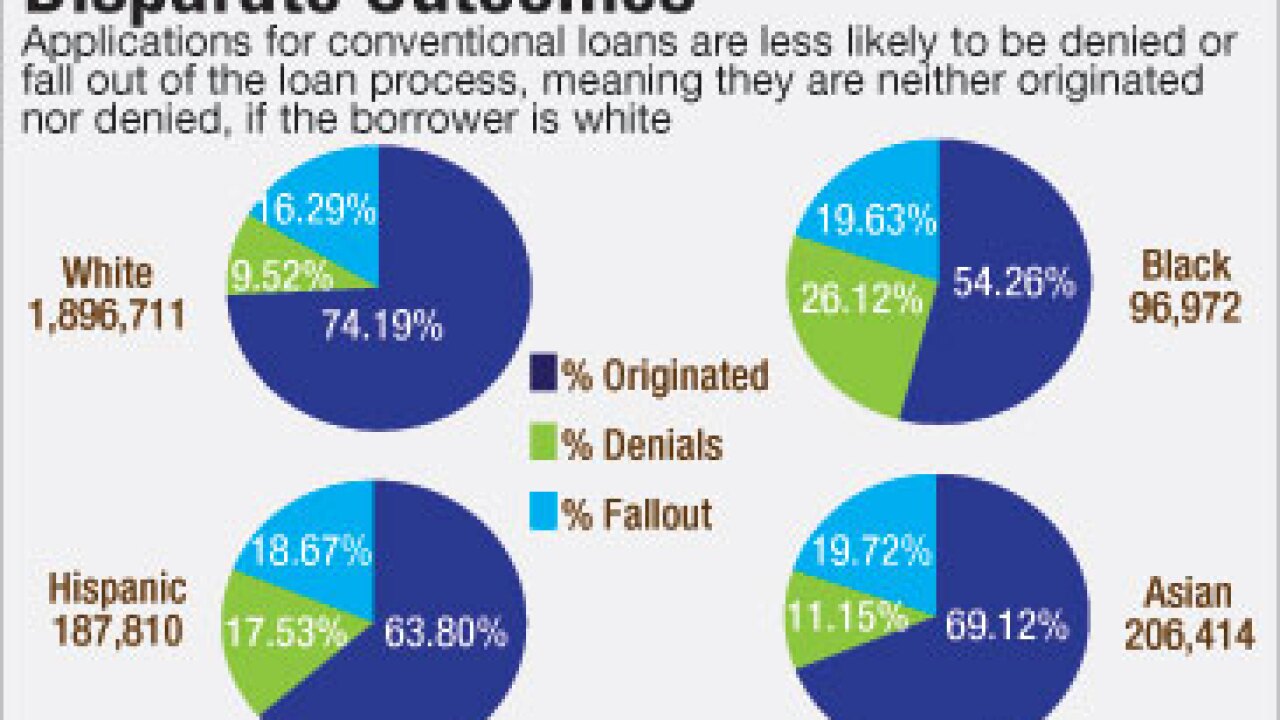

Initiatives aimed at a more inclusive credit box have long relied on costly approaches that are difficult to scale. Now, demographic shifts are intensifying industry demand for a more automated and efficient solution.

January 6 -

Demographics are shifting, creating more prospective minority homebuyers than ever before. But predominant underwriting processes and these would-be borrowers' financial backgrounds are holding them back.

January 5 -

Fannie Mae's Day 1 Certainty initiative and automated verification tools at Freddie Mac are set to improve mortgage loan application defect and misrepresentation risk in 2017, according to a report from First American Financial Corp.

December 28