-

The federal banking agencies will not hold a hearing on a proposal to reduce the number of residential real estate transactions that require an appraisal.

February 22 -

From Romeo, Colo., to Valentines, Va., here's a look at closing costs in some of the country's romantically-named cities this Valentine's Day.

February 14 -

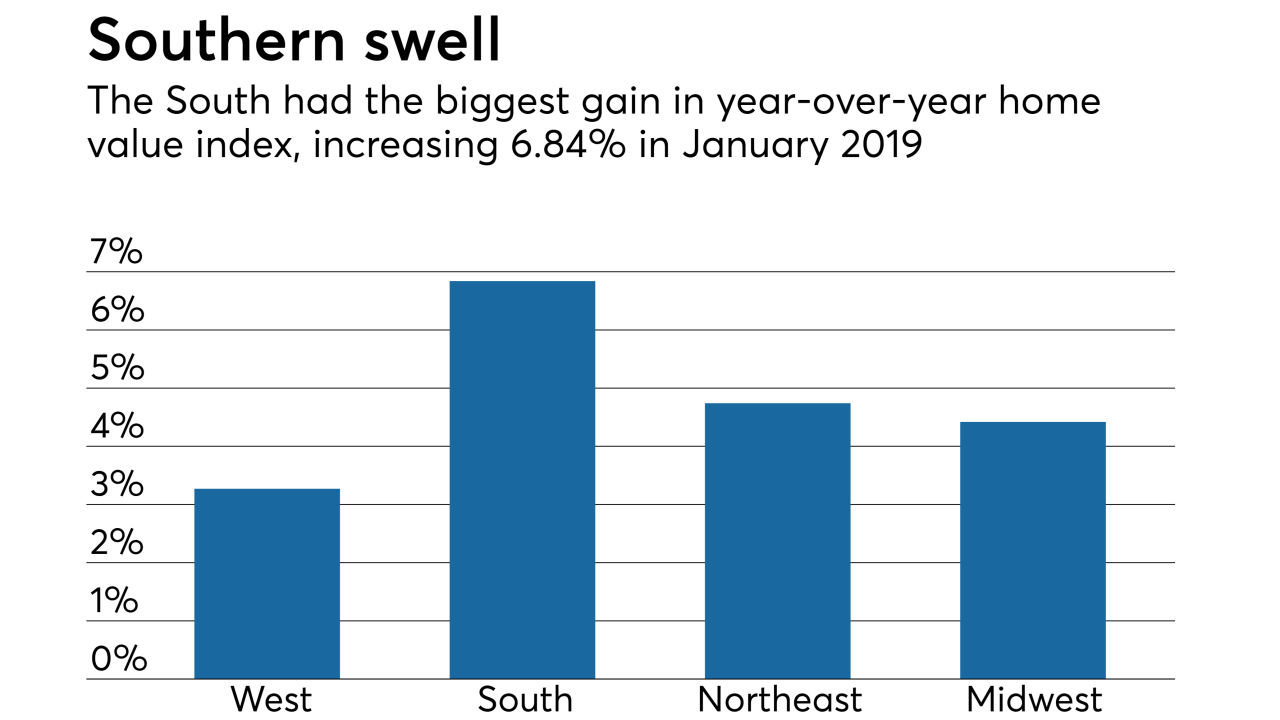

While home price appreciation showed steady growth in January, it's a lower rate than years past and consumer appraisal perception lags reality, according to Quicken Loans.

February 13 -

Radian Group has acquired Five Bridges Advisors, further cementing the new focus of its mortgage and title services business.

January 16 -

The Lancaster County, Neb., assessor has reassessed home values a year early to keep up with the rapidly rising home prices.

January 15 -

The agencies are weighing a plan to reduce the scope of residential real estate transactions requiring an appraisal, but appraisers have warned that the proposal could have consequences.

January 3 -

Mortgage technology is rapidly advancing, with incumbents and new entrants scrambling to take advantage of developments in artificial intelligence and automation. The goal? Beat the customer expectations set by Amazon and Uber, not just other lenders, says KPMG Managing Director Teresa Blake.

December 28 -

CoreLogic is exiting its loan origination software and default management operations over the next 24 months and instead accelerated plans to transform its appraisal management company unit.

December 21 -

Class Valuation, a Troy, Mich.-based appraisal management company, acquired Landmark Network, which specializes in providing valuation services for reverse mortgages.

December 18 -

A proposal allowing more lenders to skip outside appraisals could remove a hurdle to quick closings, but appraisers say they could be collateral damage.

December 17 -

In Philadelphia, there is no limit to the amount by which assessments — the value used to calculate property tax bills — can increase in one year.

December 13 -

While home values rose over 5% in November, air is getting let out of the home price balloon, as the growth rate remains low compared to the past few years, according to Quicken Loans.

December 11 -

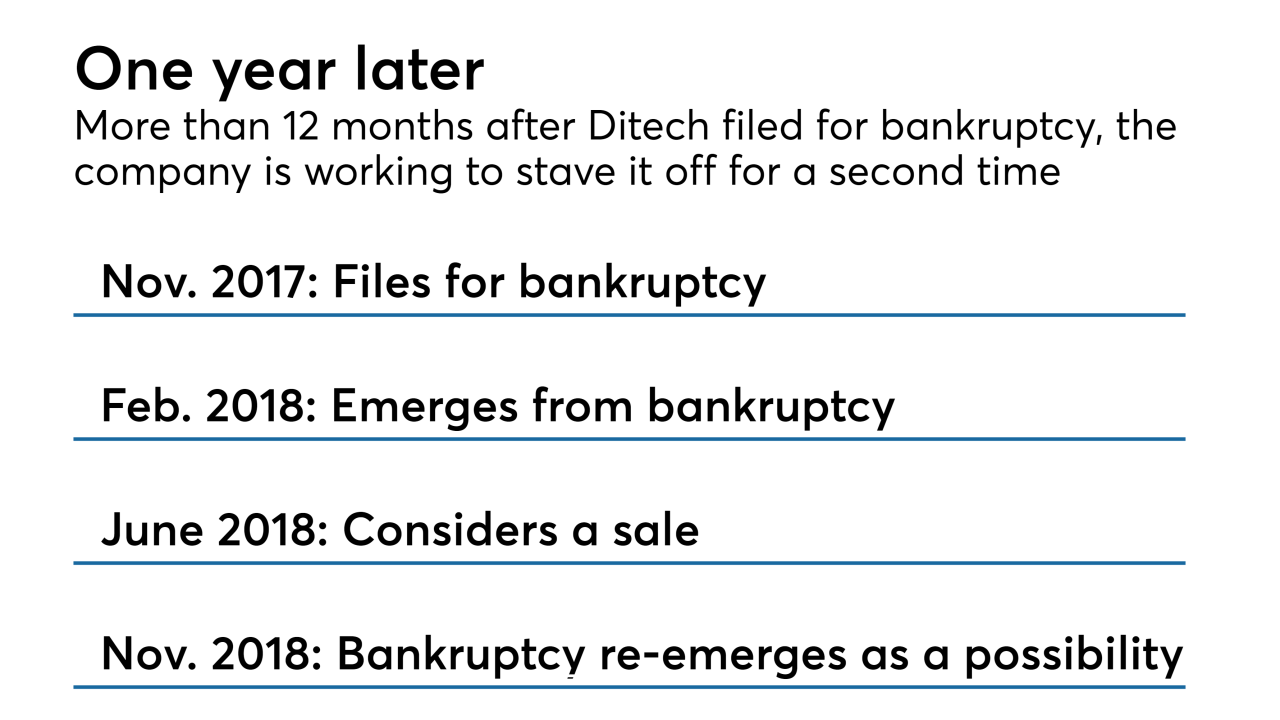

Ditech Holding Corp. is proposing to pay $257,000 and improve governance to settle a stockholder lawsuit alleging that a lack of oversight allowed improprieties to occur in several mortgage-related business lines.

December 10 -

As home value appreciation slowed, gains in home equity for the third quarter fell to the lowest level in two years, according to CoreLogic's homeowner equity report.

December 6 -

No surprise for potential North Texas homebuyers, but a new report ranks Dallas-Fort Worth as one of the U.S. markets that's seen the most home price growth.

December 4 -

The effort to raise the threshold for transactions excused from appraisal requirements responds to concerns that the current threshold is outpaced by real estate prices.

November 20 -

Freddie Mac is expanding its Home Possible loan program to allow borrowers in rural locations to use "sweat equity" for down payments and closing expenses.

November 20 -

The decelerating pace of home price growth in October is helping offset the rise in mortgage rates, according to Quicken Loans.

November 14 -

Amrock is calling for a new trial in its dispute with HouseCanary following a judge's denial of its motion to reverse an earlier decision in HouseCanary's favor.

November 1 -

Home price appreciation is continuing to decelerate due to affordability concerns that are unlikely to let up even though recent market developments have put some downward pressure on mortgage rates.

October 25