-

In Philadelphia, there is no limit to the amount by which assessments — the value used to calculate property tax bills — can increase in one year.

December 13 -

While home values rose over 5% in November, air is getting let out of the home price balloon, as the growth rate remains low compared to the past few years, according to Quicken Loans.

December 11 -

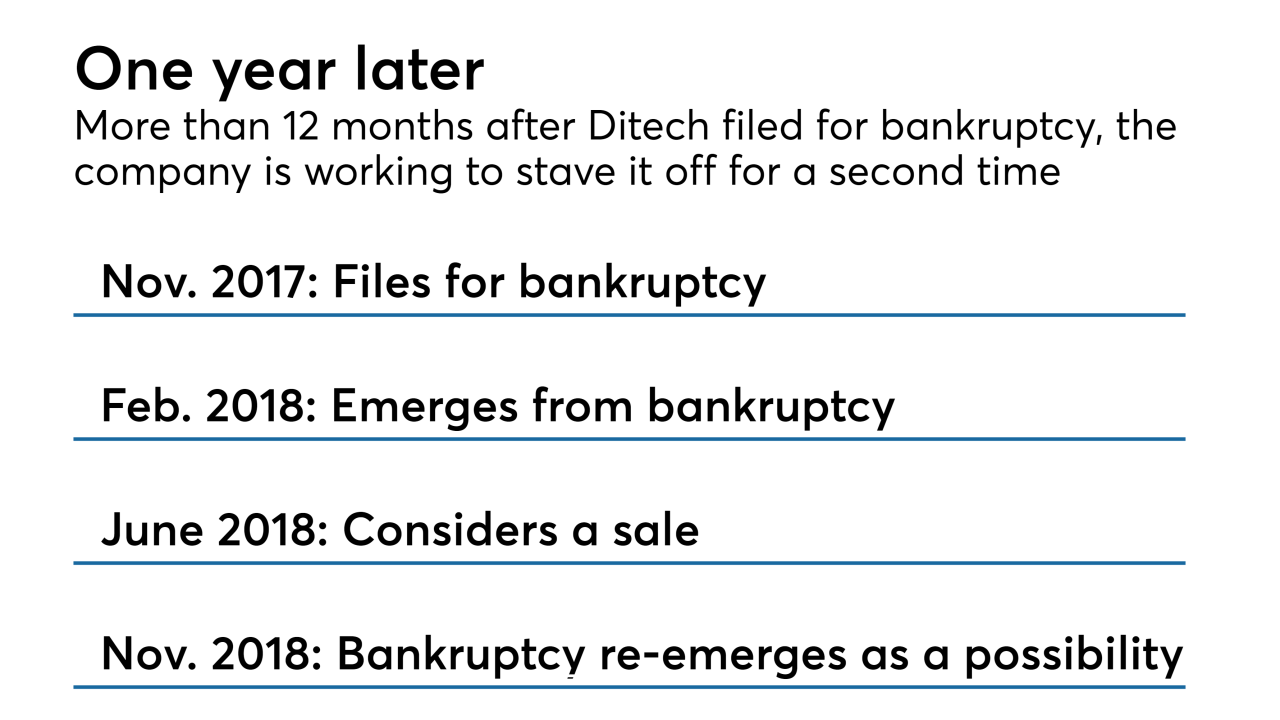

Ditech Holding Corp. is proposing to pay $257,000 and improve governance to settle a stockholder lawsuit alleging that a lack of oversight allowed improprieties to occur in several mortgage-related business lines.

December 10 -

As home value appreciation slowed, gains in home equity for the third quarter fell to the lowest level in two years, according to CoreLogic's homeowner equity report.

December 6 -

No surprise for potential North Texas homebuyers, but a new report ranks Dallas-Fort Worth as one of the U.S. markets that's seen the most home price growth.

December 4 -

The effort to raise the threshold for transactions excused from appraisal requirements responds to concerns that the current threshold is outpaced by real estate prices.

November 20 -

Freddie Mac is expanding its Home Possible loan program to allow borrowers in rural locations to use "sweat equity" for down payments and closing expenses.

November 20 -

The decelerating pace of home price growth in October is helping offset the rise in mortgage rates, according to Quicken Loans.

November 14 -

Amrock is calling for a new trial in its dispute with HouseCanary following a judge's denial of its motion to reverse an earlier decision in HouseCanary's favor.

November 1 -

Home price appreciation is continuing to decelerate due to affordability concerns that are unlikely to let up even though recent market developments have put some downward pressure on mortgage rates.

October 25 -

Mortgage technology company SharperLending is tapping mobile devices to offer a quicker and more efficient loan process for lenders in instances that don’t require full appraisals.

October 23 -

ReverseVision and Stratmor Group are building a benchmark for Home Equity Conversion Mortgages that could help determine how well these Federal Housing Administration loans serve seniors.

October 17 -

Federal regulators have issued answers to frequently asked questions on appraisal regulations.

October 16 -

Hurricane Michael is putting mortgage transactions with a combined value of over $400 million in jeopardy, according to ClosingCorp estimates.

October 11 -

While September had a steady yearly rise in home prices, the month-to-month growth is slowing down, according to Quicken Loans.

October 10 -

Technology will help compile and assess property data so that the future of real estate appraisers is that they won’t exist, says Matt Rider, chief information officer at Franklin American Mortgage.

October 2 -

The Federal Housing Administration is mandating that lenders originating new reverse mortgages offer a second property appraisal in certain cases.

September 28 -

The House of Representatives passed two bills that would tie appraisal waivers for Small Business Administration loans to bank rules for commercial real estate loans, despite objections from the Appraisal Institute about its members being cut out of transactions.

September 26 -

Fannie Mae will add an appraisal waiver option for mortgages in regions that its Duty to Serve program designates as high-needs rural areas, but only if home inspections are completed instead.

September 24 -

The typical homeowner spends 17.5% of their income on monthly mortgage payments, according to Zillow's second quarter affordability report.

September 6