-

Businesses are investing more, people are finding jobs, and inflation is picking up, meaning higher interest rates for homebuyers.

April 26 -

There is now less fraud risk associated with adjustable-rate mortgage applications and this will offset some of the higher hazard associated with a purchase market.

April 2 -

Refinance mortgages accounted for 45% of mortgage volume, the highest share in a year, according to Ellie Mae.

February 21 -

MountainView is brokering a nonrecourse $3.5 billion package of Fannie Mae and Freddie Mac mortgage servicing rights on behalf of an unnamed seller.

January 5 -

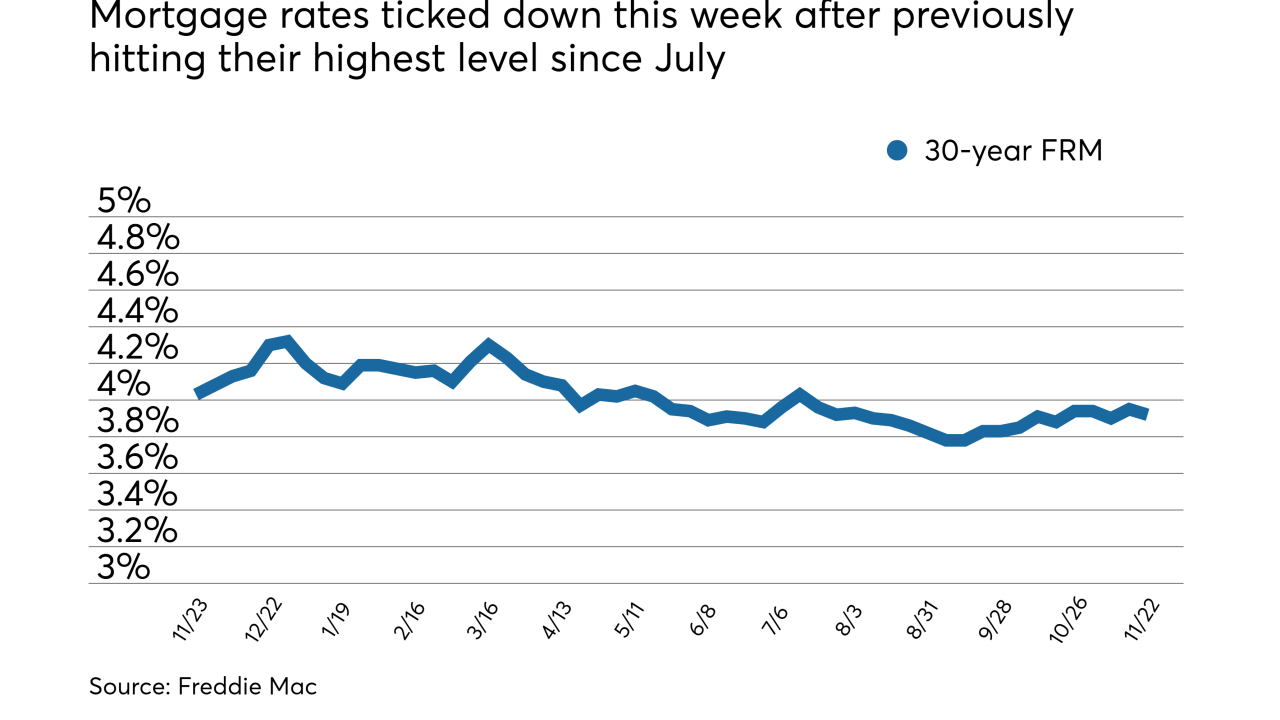

Mortgage rates ticked down this week after previously hitting their highest level since July, according to Freddie Mac.

November 22 -

A slight decrease in the number of jumbo investor offerings contributed to lower consecutive-month credit availability in October, according to the Mortgage Bankers Association.

November 8 -

Slightly looser underwriting outside the government sector is primarily responsible for the latest increase in credit availability.

October 10 -

Looser underwriting standards for agency-eligible adjustable-rate mortgages helped increase credit availability in August to its highest level since April, according to the Mortgage Bankers Association.

September 11 -

Loan application defects were unchanged for July compared with June, the first time in eight months there has not been an increase, according to First American Financial Corp.

August 31 -

A Fed committee studying Libor’s replacement has dwelled heavily on the potential impact to the derivatives market. Loans may become a bigger part of the conversation later this year, but the panel plans to leave a lot of the specifics up to lenders.

August 17 -

Picking a new benchmark for adjustable-rate mortgages is the easy part. Industrywide implementation is where things get tricky.

August 10 -

Low-down-payment purchases are on the rise, but not necessarily with the same pre-crisis practices and risk factors.

August 8 -

U.K. regulators’ decision to abandon the Libor benchmark by the end of 2021 threatens to sow confusion in the market as the industry races to replace the scandal-plagued rate that underpins more than $350 trillion of financial products.

July 27 -

Borrowers with variable-rate debt affected by Federal Reserve rate hikes showed they could handle December's 25-basis-point increase, but that could be changing as short-term rates continue to rise.

July 20 -

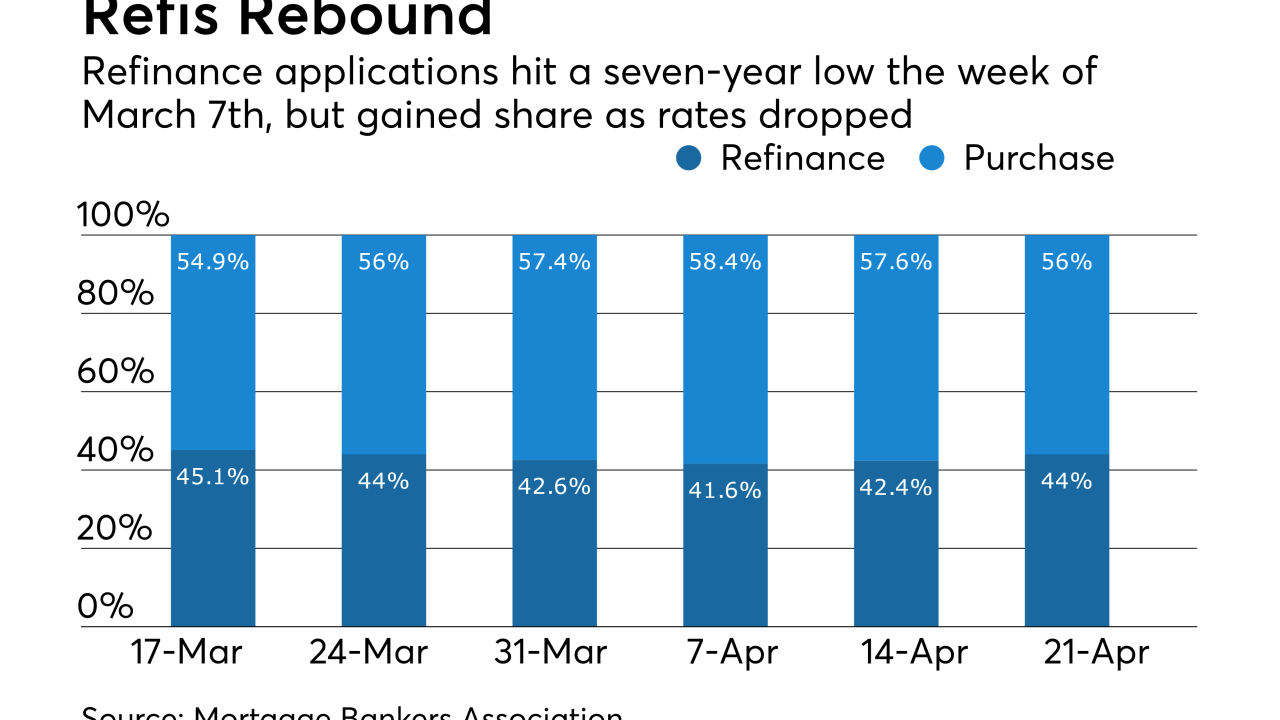

Mortgage application volume increased 2.7% for the week of April 21 as more consumers applied for refinance loans.

April 26 -

Mortgage application activity increased by 5.8% during the week of Feb. 24.

March 1