-

Mortgage activity plunged before the start of the year, but subprime originations dropped the least, according to TransUnion. Despite dwindling volume, borrower delinquency rates hit historic lows in the first quarter.

May 16 -

Mortgage rates descended through the onset of spring's home buying season, pushing up the share of refinance loans and volume of new-home purchase applications, according to Ellie Mae and the MBA.

May 16 -

Meridian Corp. may have breached sales agreements after originating nearly $100 million in loans in a state where it lacked a license.

May 16 -

The Michigan company said the loan — made to a borrower that plans to shut down its reverse mortgage business — has collateral.

May 13 -

New legislation in Iowa that allows banks and credit unions to utilize electronic notaries could help local lenders compete with online competitors.

May 13 -

The Consumer Financial Protection Bureau received over a quarter-million complaints in 2018, according to analysis by an advocacy group that urged the agency to maintain public access to its database.

May 12 -

Housing advocates and Democratic lawmakers want to create more protections for tenants of rent-controlled apartments, but they are facing stiff opposition from property owners and the banks that lend to them.

May 10 -

Whether online or advertised on a sign, very few consumers will qualify for that incredible low-rate deal. Here's why.

May 9 -

Mortgage lending credit standards loosened a bit last month as investors displayed more interest in non-qualified mortgage and nonagency jumbo loans to stay competitive, according to the Mortgage Bankers Association.

May 9 -

Angelo Mozilo had a front-row seat during the collapse in housing prices a decade ago. Now the former chief executive officer of Countrywide Financial Corp. is predicting another drop, and for some homeowners it may be even worse.

May 9 -

Payoffs of maturing office loans in securitizations may be delayed more often in the next few years if increasing inventory constrains occupancy and rent growth, according to Morningstar.

May 8 -

Bank 34 will no longer sell mortgages in the secondary market as it looks to reduce its reliance on volatile revenue streams.

May 7 -

The long-awaited proposal includes safe harbors to protect collectors from getting sued, but would restrict phone collection attempts and allow borrowers to opt out of receiving other communications.

May 7 -

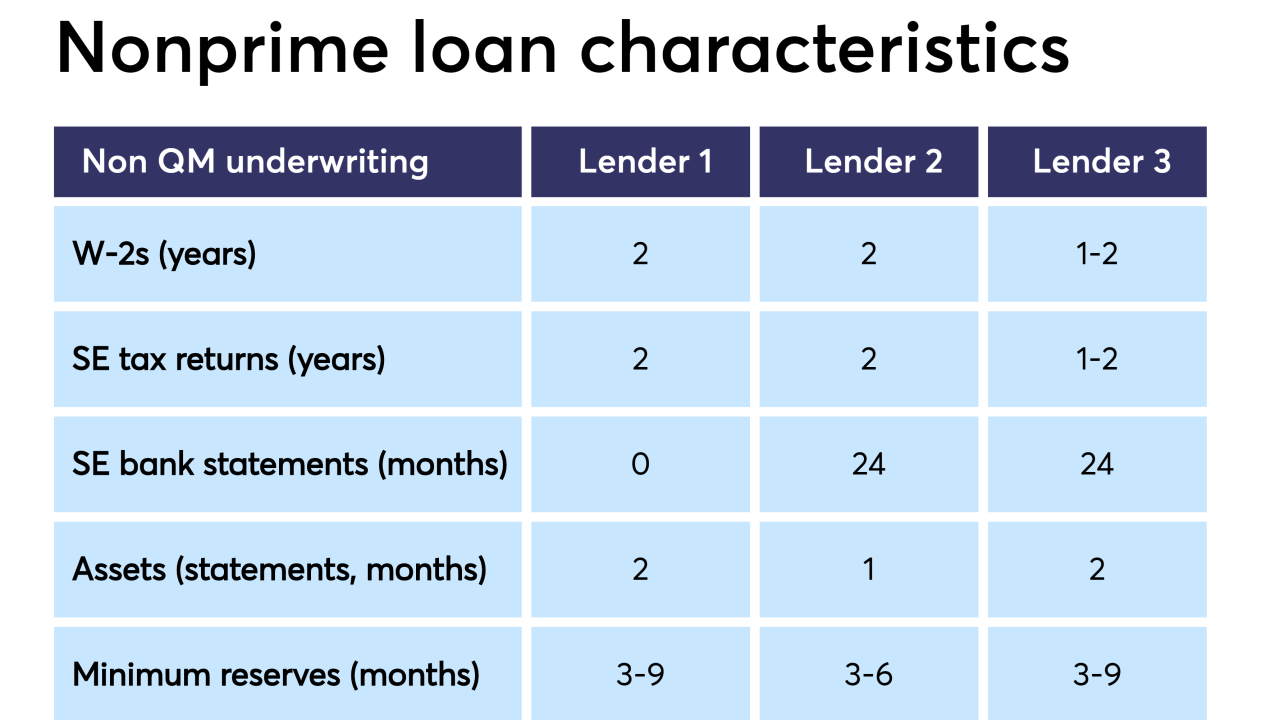

Securitized loans originated outside the Qualified-Mortgage rule's parameters have looser underwriting guidelines than mainstream loans do today, but are more tightly underwritten than past subprime or alternative-A products, according to DBRS.

May 6 -

The Consumer Financial Protection Bureau proposed steps to ease Home Mortgage Disclosure Act requirements, just days after announcing it was retiring a platform to let users analyze raw mortgage data.

May 2 -

As the CFPB moves closer to updating its debt collection regulations, revising restrictions on phone calls and other communications with consumers must be a priority.

May 1

-

Having poor credit doesn't necessarily keep someone looking to become a mortgage broker from obtaining a surety bond, but it can complicate matters.

May 1 JW Surety Bonds

JW Surety Bonds -

The Boston company gained the mortgage platform when it bought First Choice in 2017.

April 30 -

The debt collection proposal is expected to address how debt collectors can use text messages and emails to track down debtors.

April 29 -

Commercial mortgages placed into special servicing grew last year, but default and foreclosure dollar volume fell as legacy loan resolutions outpaced newly distressed loans, according to Fitch Ratings.

April 29