-

A decade after the credit crisis, investors are returning to where it all began. The mortgage sector, blamed in large part for the near-collapse of the global financial system, is now seen by many as a high-quality market forged by fire.

September 14 -

Casey Crawford, CEO of Movement Mortgage, bought First State Bank in Virginia last year. He has since injected more capital into the bank in an effort to reinvent it.

September 10 -

Caliber Home Loans’ next offering of subprime mortgage bonds includes a new product offered to borrowers with a stronger credit profile than its other programs – but also less equity in their homes.

September 10 -

The dollar volume of private-label residential mortgage-backed securities issuance this year is the highest it has been since the Great Recession, despite a decline in new originations.

September 6 -

Nearly half of July's millennial homebuyers were single, a sign that they are not waiting for certain milestones like marriage before deciding to become homeowners, according to Ellie Mae.

September 5 -

The Ohio company agreed to buy TransCounty Title Agency, which has five offices around Columbus.

September 4 -

Delinquencies for loans securing commercial mortgage-backed securities continued to decline, although they are still well above rates for other types of investors, according to the Mortgage Bankers Association.

September 4 -

A 75-year-old Florida real estate developer was sentenced to six months in prison after admitting he lied to banks to keep money flowing so he wasn't forced to scuttle an oceanfront hotel and condominium in Vero Beach.

August 29 -

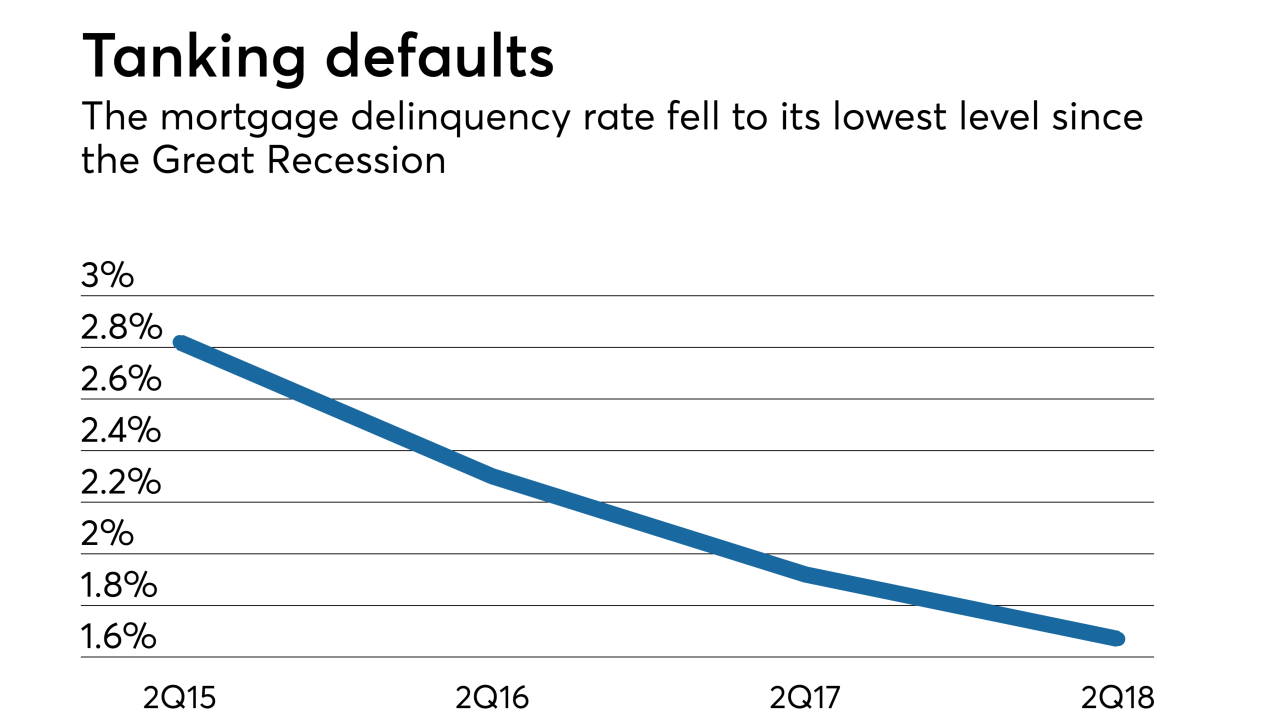

The 30-day delinquency rate dropped to a low not seen in over a decade in July, but foreclosure starts also increased to a three-month high.

August 24 -

Better consumer credit quality helped push the serious mortgage delinquency rate to its lowest level since the Great Recession, but originations remain low due to tighter underwriting standards and eroding homebuyer affordability, according to TransUnion.

August 22 -

The agency said the market for larger rental investors may not need additional liquidity from Fannie Mae and Freddie Mac.

August 21 -

Several states pledged to compensate for a slowdown in enforcement at the Consumer Financial Protection Bureau under Mick Mulvaney, but their efforts have been complicated by tight budgets and doubts over whether such initiatives are necessary.

August 20 -

A number of banks have stepped up efforts to lend to residential developers, though they are mindful of missteps made before the financial crisis.

August 20 -

New investor appetite for mortgages over $1 million is motivating more nonbank lenders to offer super jumbo loans, often with weaker credit terms than traditional banks.

August 20 -

Credit Karma is diving into the mortgage industry with a plan to acquire digital mortgage startup Approved, a provider of consumer-facing online point of sale technology.

August 17 -

The Michigan company had been operating under the supervisory agreement since 2010.

August 17 -

MountainView Financial Solutions is brokering a more than $3 billion package of Fannie Mae and government mortgage servicing rights originated primarily through third-party origination channels.

August 17 -

The investors initially won the right to sue as a group in 2015 before an appeals court reversed the ruling; the $13 billion lawsuit can now proceed as a class action.

August 15 -

The number of consumers being pursued by debt-collection agencies fell dramatically in the past year, but it's as much technicality as achievement, and bankers need to keep that in mind when reviewing the credit scores of millions of Americans.

August 14 -

Steve Calk, the head of The Federal Savings Bank, was a "co-conspirator" in an effort to defraud the Chicago bank, a prosecutor said at the trial of former Trump campaign chair Paul Manafort. Could Calk be charged with a crime?

August 13