-

Investor demand for mortgage bonds is strong; the only limiting factors are consumer awareness of the product and loan officers' willingness to offer them.

September 19 -

Efforts to persuade regulators to allow Fannie Mae and Freddie Mac to use alternative credit scores would stifle competition between the credit bureaus and FICO and do little to expand access to credit, according to industry analyst Chris Whalen.

September 18 -

Senate Democrats' legislative bid to reform the credit reporting industry is tempered and balanced, according to analysts, which could help it gain traction in the GOP-controlled Congress.

September 15 -

The online lender has accelerated its search for a permanent CEO and is said to be seeking someone with a history of success in banking.

September 15 -

The bill would create a federal obligation for credit reporting agencies to offer free credit freezes and prevent them from selling consumer information while a freeze is in place.

September 15 -

Banks could be busy supplying credit to manufacturers, hotels, multifamily developers and other businesses that will be helping residents get their lives back on track after two fierce storms.

September 14 -

The U.S. subsidiary of Japanese-owned Orix Corp. is adding another housing finance firm in the commercial and multifamily space to its stable of companies with its purchase of Lancaster Pollard.

September 13 -

Mike Cagney’s eventual successor will have to decide whether to continue his focus on rapid growth. Also on the table are strategic decisions about when to go public and whether to pursue a bank charter.

September 12 -

A new documentary that aired Tuesday on PBS raises questions about why prosecutors targeted a small bank after the financial crisis and left bigger institutions untouched.

September 12 -

Lima One Capital is expanding its single-family investor financing business by acquiring the residential debt business of the marketplace lender RealtyShares.

September 12 -

Banks should not point blame at the credit bureau but rather should step up and demonstrate their commitment to their customers. If you punt the problem to Equifax, it suggests you don’t really care.

September 12

-

Senate Finance Committee leaders sent a letter to Equifax CEO Richard Smith scrutinizing the scope of the company's data breach and its response.

September 11 -

The hurricane was expected by many to deliver catastrophe. Instead, bankers are largely looking to restore power and confirm the status of employees.

September 11 -

Lawmakers signaled Monday that Congress will likely have a swift and powerful response to revelations that the credit reporting company Equifax was hacked, exposing 143 million people to identity theft.

September 11 -

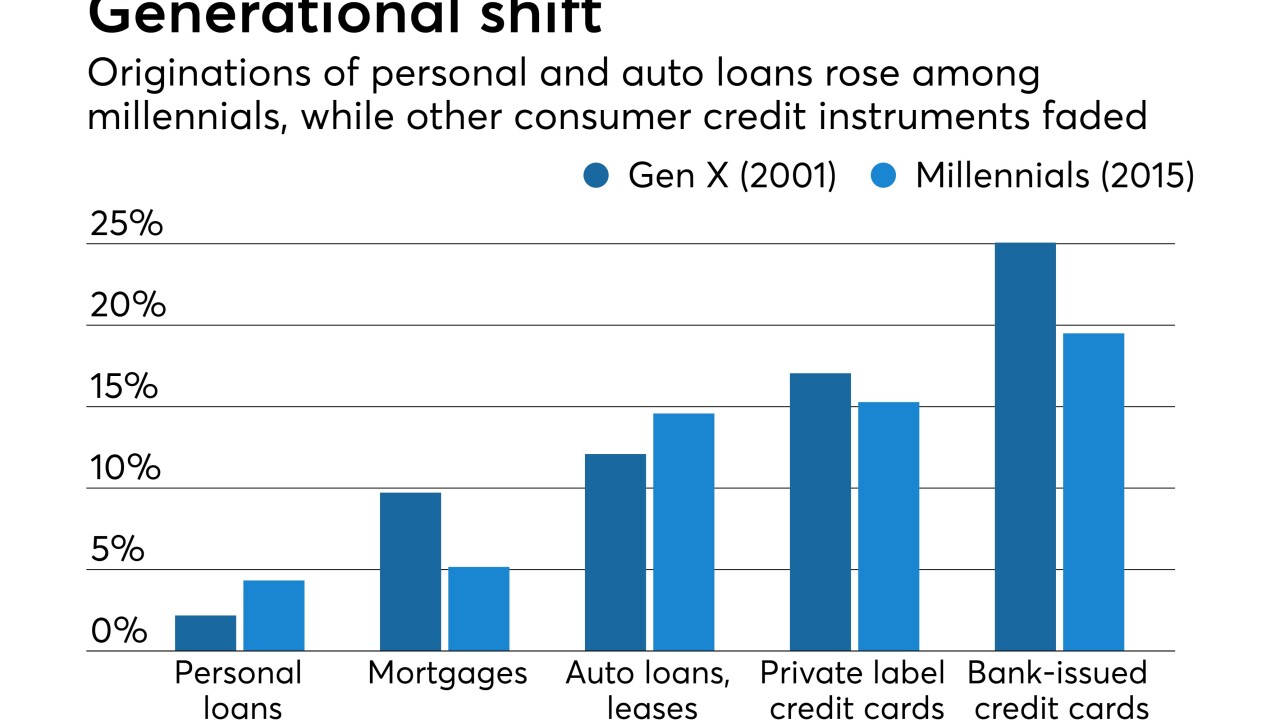

Millennials — many of whom joined credit unions in recent years as the movement's membership expanded — are relying more heavily on personal loans than their Gen X predecessors while paring back on credit cards and mortgages.

September 11 -

Overall mortgage lending increased by 20% in the second quarter but was still down from a year earlier, according to Black Knight Financial Services.

September 11 -

One lawsuit has already been filed against Equifax in the wake of its massive security failure. But that’s the just beginning of the consequences for the credit bureau and the banks that use it.

September 8 -

Over one-quarter of all mortgages in the areas affected by Hurricane Harvey are likely to become delinquent because of the storm, according to an analysis from Black Knight.

September 8 -

The $426.2 million COLT 2017-2 is backed entirely by loans originated by Caliber, an affiliate of private equity firm Lone Star Funds. There are no loans originated by Sterling Bank & Trust, which accounted for 22% of the collateral for the prior deal.

September 8 -

One year after it paid $190 million in fines and restitution for opening millions of unauthorized accounts, Wells Fargo remains mired in scandal. Why hasn't it been able to recover?

September 7