-

The U.S. Trustee overseeing the bankruptcy filing by Ditech is objecting to certain fees and expenses sought by Weil, Gotshal & Manges, among others.

December 9 -

IndiSoft will continue to support the distressed-borrower assistance platform formerly known as Hope LoanPort after the nonprofit that runs it winds down operations at the end of this year.

November 11 -

Flagstar Bank expects to recover $1 million of its loan to defunct reverse mortgage lender Live Well Financial following the sale of the collateral that secured it.

September 19 -

Stearns Lending canceled plans for an auction after almost two-thirds of its noteholders approved a bankruptcy reorganization proposal that would solidify Blackstone's ownership of the company.

September 11 -

Bankrupt mortgage servicer Ditech Holding Corp. cleared the way for the $1.8 billion sales of its businesses by agreeing to preserve some homeowner claims like the right to fix mistakes on their loans.

September 11 -

When the former vice president and Massachusetts senator appear together in Houston, they could present two contrasting visions of financial policy within the presidential field.

September 9 -

Live Well Financial CEO Michael Hild has been charged with misrepresenting the value of a bond portfolio in parallel actions by the U.S. Attorney's Office and the Securities and Exchange Commission.

August 30 -

Bankrupt mortgage servicer Ditech Holding Corp. saw its reorganization plan rejected on Wednesday after a federal judge ruled the company couldn't sell its mortgage-servicing rights and reverse-mortgage business free and clear of consumer claims.

August 29 -

New York Attorney General Letitia James is monitoring how the bankrupt Ditech Holding Corp. handles borrower-sensitive issues like foreclosure proceedings, and is backing the involvement of a consumer creditors' committee.

July 23 -

Stearns Holdings and certain subsidiaries have filed for Chapter 11 bankruptcy as part of a restructuring agreement that could reduce debt, increase Blackstone's stake in the company and preserve jobs.

July 9 -

Live Well Financial's creditors are seeking a court-supervised bankruptcy, but the mortgage lender is opposing the move, saying it can get more for certain assets if it sells them before filing.

June 19 -

Ditech Holding Corp. has entered into purchase agreements with New Residential Investment Corp. and Mortgage Assets Management, in which each would acquire certain assets in the company's Chapter 11 bankruptcy.

June 18 -

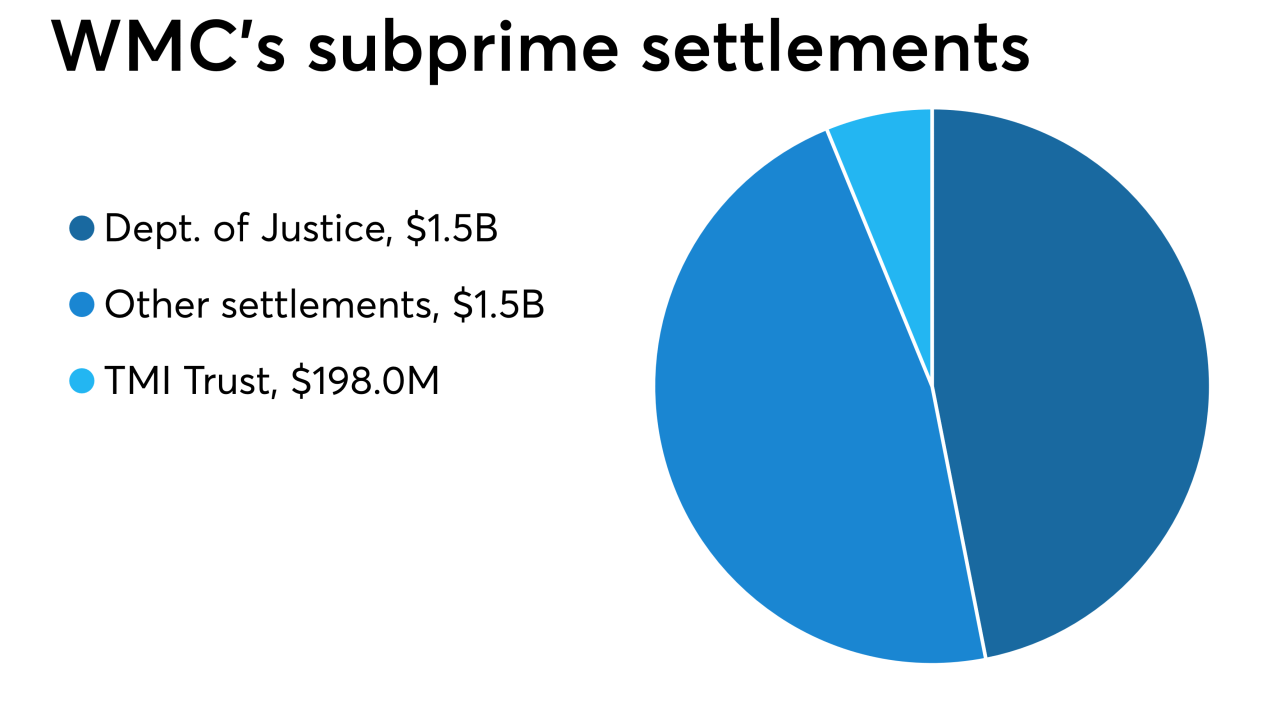

General Electric placed its WMC Mortgage unit into Chapter 11 bankruptcy protection as it has nearly $1.7 billion in legal settlements agreed to or pending.

April 24 -

Homeowners in Chicago cheated by a mortgage fraud scheme are seeking to form a committee to protect their interests in the bankruptcy of Ditech Holding Corp., the company that owns their loans.

April 23 -

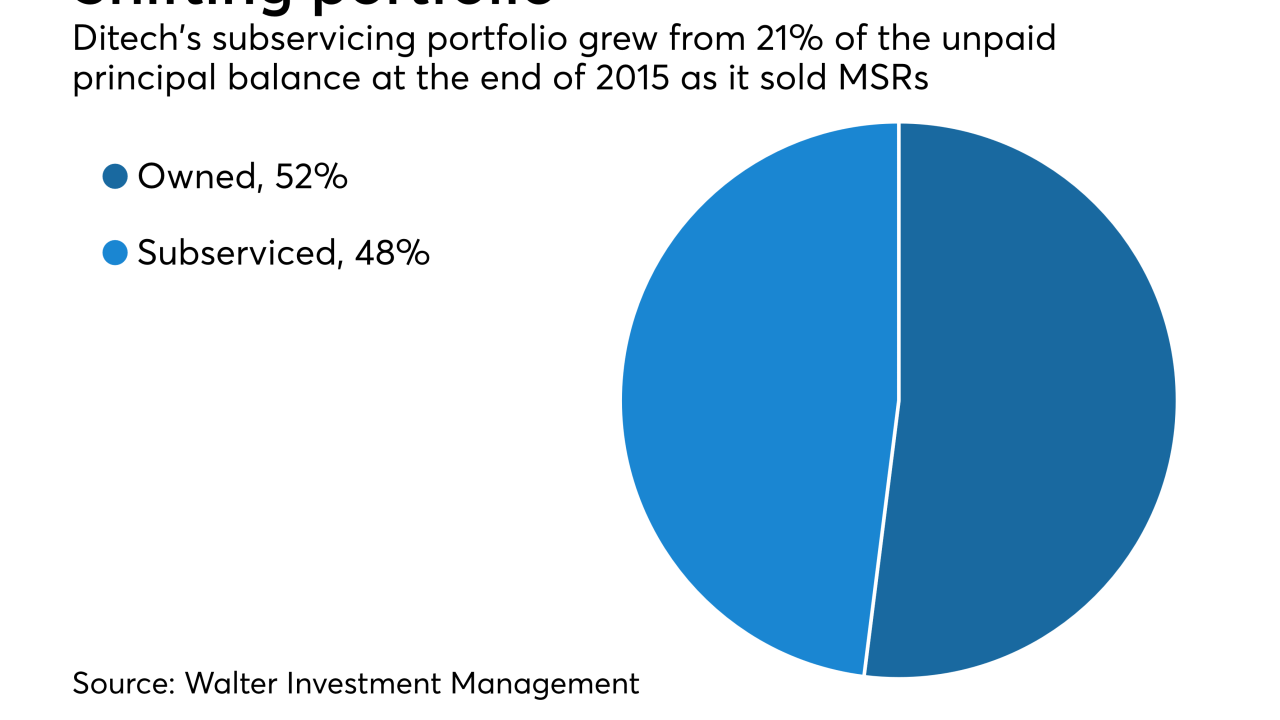

Ditech Holding Corp. is refiling for bankruptcy almost a year after emerging from it in order to facilitate a restructuring agreement with lenders holding more than 75% of its term loans.

February 11 -

The Consumer Financial Protection Bureau finalized a rule on Thursday that gives mortgage servicers more latitude in sending periodic statements to borrowers in bankruptcy.

March 8 -

Ditech Holding Corp. promoted Jeffrey Baker to interim CEO of the company, replacing Anthony Renzi who left the company.

February 21 -

Walter Investment Management Corp. plans to emerge from Chapter 11 bankruptcy and start trading again under a new name in a matter of days.

February 8 -

Anthony Renzi, the former Freddie Mac executive brought in to try and right the ship at Walter Investment Management Corp., will be leaving the company once a replacement is found.

February 2 -

Walter Investment Management Corp. pushed back the date it would emerge from bankruptcy to no earlier than Feb. 2 from the originally planned Jan. 31.

January 31