-

The Financial Stability Oversight Council could determine that a broad range of mortgage companies should be subject to “heightened prudential standards,” said Andrew Olmem, a partner at Mayer Brown and a former senior economic adviser to the White House.

January 25 -

The former president and CEO of GE Capital’s restructuring and strategic ventures group was named executive vice president and chief risk officer soon after the departure of Fannie EVP Andrew Bon Salle.

January 22 -

Upcoming changes to underwriting regulations, as well as the end of the QM patch, in addition to growing home values, all add up for this market to have a good year.

January 19 -

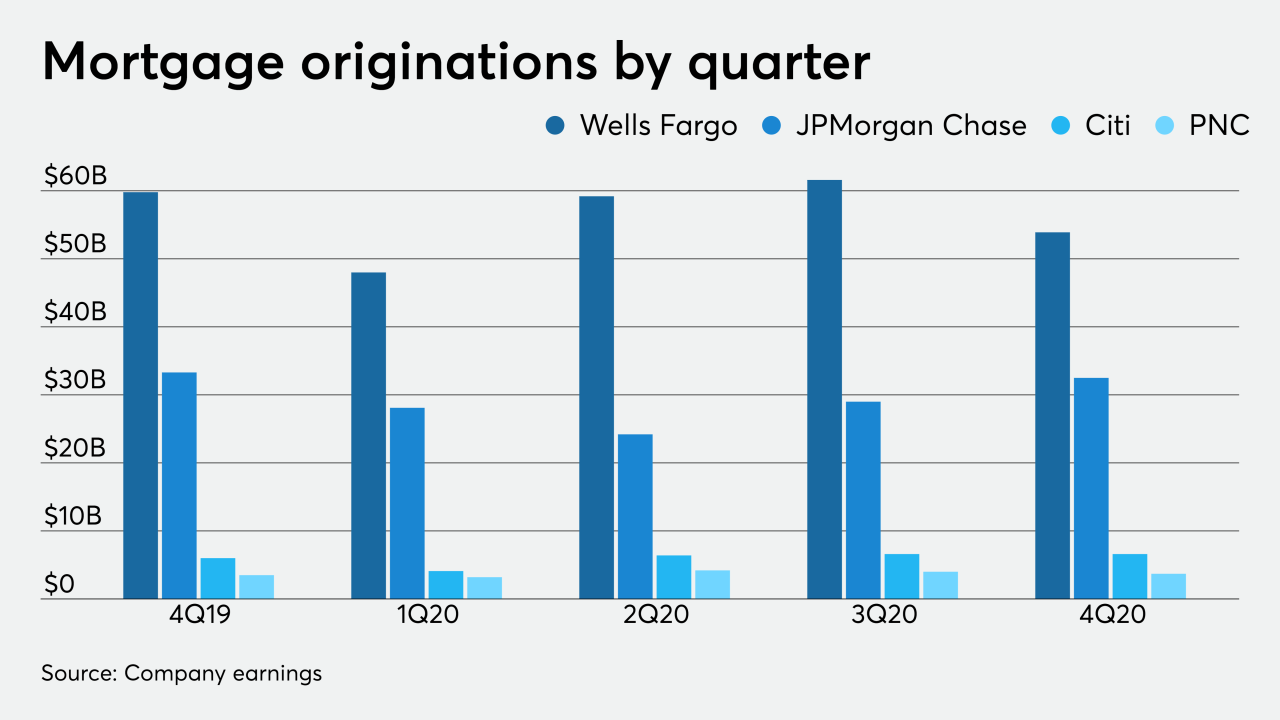

While some industry forecasts predicted origination volumes would fall 7% quarter-to-quarter in 4Q, early earnings numbers from Wells Fargo, JPMorgan Chase, Citi and PNC Bank show they were down just 3% when purchased loans are excluded.

January 15 -

After doubling its valuation in five months, Blend plans to use its latest funding to strengthen its digital lending experiences for banking and mortgages.

January 13 -

The volume of Ginnie securities issued in December marked the first time more than $80 billion has been issued in a month.

January 11 -

A new path forward for digital banks and their customers.

-

Industry watchers make their wildest guesses (more or less) about developments in real estate finance that could rock the industry in the upcoming months.

December 29 -

The availability of financing hasn’t been an issue to date, but it still could be.

December 23 -

Michael Gramins, who a jury convicted in 2017, was among more than a half-dozen traders charged by federal prosecutors in Connecticut with misrepresenting the prices of mortgage-backed securities to clients in order to increase their firm’s profits and their bonuses.

December 18