-

The amount of commercial and multifamily mortgage debt outstanding ticked up from April through June, yet the balance of loans in commercial mortgage-backed securities continued its decline.

September 27 -

In a business populated by extroverts, Diana Reid views herself as an introvert. The head of PNC Real Estate at PNC Financial Services Group says it's an attribute that she's made an asset as she looks to build consensus and drive business growth.

September 25 -

Armada Analytics, a commercial real estate underwriting and asset management services provider, acquired Anabranch Flood, a provider of flood risk assessment services.

September 5 -

Laurance H. Freed, a Chicago developer, has been sentenced to three years in prison and ordered to pay $825,000 in fines and restitution in connection with a double-pledging scheme.

August 23 -

Insurers are seeing modest gains in market share as banks, facing increased scrutiny from regulators, lightly tap the brakes.

August 1 -

Colony American Finance has been rebranded as Corvest American Lender in the wake of equity and asset acquisitions by funds affiliated with Fortress Investment Group.

July 19 -

The Pennsylvania bank's mortgage performance contributed to stronger loan growth, fee income and profits.

July 18 -

The Pine Tree Plaza in Sterling, Ill., will be auctioned online after a string of tenant departures put the property in foreclosure.

June 29 -

Goldman Sachs is marketing nearly $1 billion of commercial mortgage bonds backed primarily by office and retail properties.

May 16 -

The Property Assessed Clean Energy program entails a priority lien that critics dislike, but one lender ran the numbers and liked them enough to take out a PACE loan itself.

May 11 -

ExactBid has released new automation that allows exchanges of information between its lender appraisal-workflow technology and its appraiser reporting system.

May 8 -

Analysts at Goldman Sachs Group say it's not too late to bet against commercial mortgage bonds, even if parts of the trade have become crowded this year.

April 11 -

Global Index Group has developed a new product based on the NCREIF Property Index, which measures the performance of some $525 billion of CRE held on behalf of tax-exempt institutions.

April 11 -

Agency mortgage-backed securities issuance increased in 2016, rising to $1.6 trillion from $1.3 trillion, while nonagency mortgage securitization issuance decreased.

April 7 -

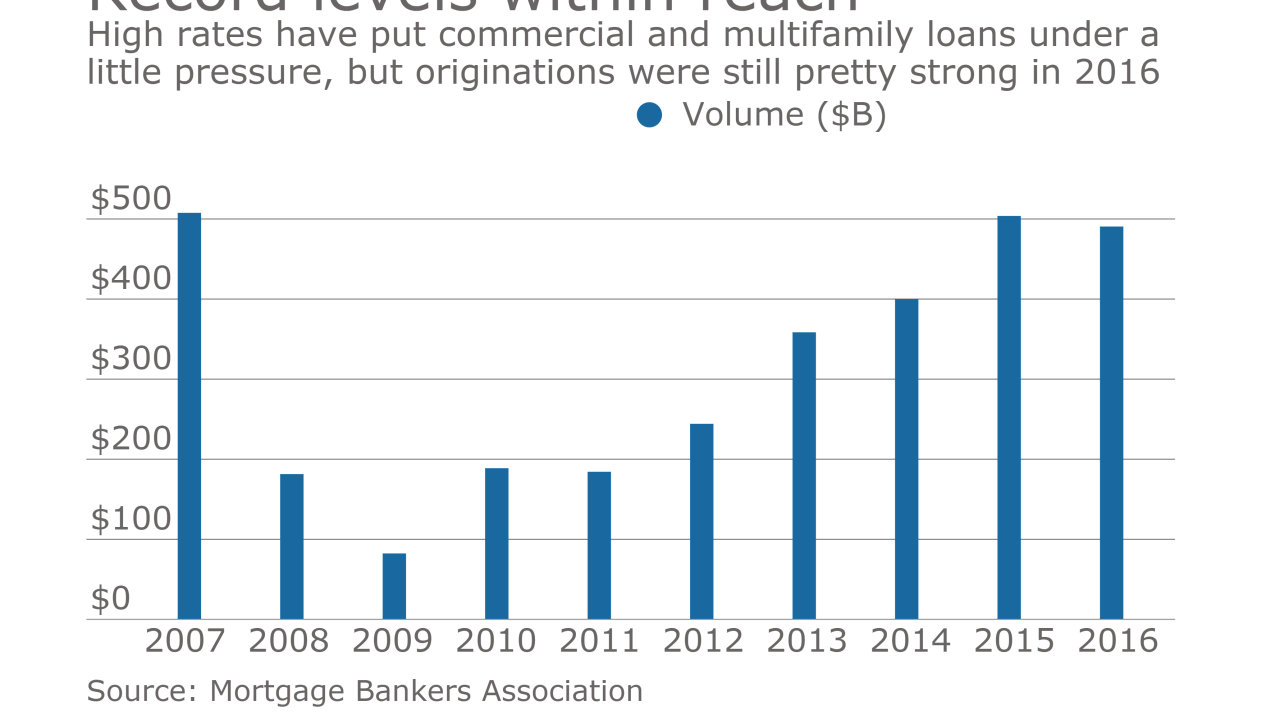

Commercial and multifamily mortgage bankers originated $490.6 billion closed loans in 2016, making it the third strongest year on record despite the pressure higher rates have put on volume.

April 6 -

U.S. bank regulators have tentatively agreed to ease an appraisal requirement that could help commercial real estate borrowers.

March 20 -

Mortgage industry hiring and new job appointments for the week ending March 17.

March 17 -

Goldman Sachs is selling $1.02 billion of bonds refinancing the Blackstone Group's acquisition of the Willis Tower, formerly known as the Sears Tower.

March 14 -

Wall Street speculators are zeroing in on the next U.S. credit crisis: the mall.

March 13 -

Late payments on securitized commercial mortgages resumed climbing in February, after an unexpected pause the previous month, according to Trepp.

March 2