Community banking

Community banking

-

The lender's founder and CEO says the acquisition of Roscoe State Bank will give it new products and referral sources.

June 14 -

Less than two years after shutting down its biggest business amid fraud allegations, the Michigan company has sold branches, settled a shareholder lawsuit and returned to profitability under turnaround specialist Thomas O’Brien.

May 7 -

The Dallas company will pay nearly $54 million for a 49% stake in a lender that operates in 10 states.

April 28 -

One year after its internal merger, the fintech and fulfillment services provider’s COO Debora Aydelotte discusses the company’s support for community banks and its placement in the ranking of Best Fintechs to Work For.

April 6 -

Like the fintechs SoFi and LendingClub, DLP Real Estate Capital is acquiring a community bank largely to lower the cost of funding loans.

March 18 -

First Foundation is relocating its corporate headquarters to Dallas, where the tax burden is lighter and it sees more opportunity to beef up lending, add wealth management clients and pursue acquisitions of community banks.

February 5 -

Community banks say Vizaline’s software, which converts property descriptions into images, helps them catch errors before they close real estate loans without resorting to expensive land surveys. But traditional surveyors say the results are of questionable value.

February 3 -

The architects of two major loan deals featuring Black banks, one involving multiple lenders and a pro sports franchise and another backed by Citigroup, say more transactions like these are in the works.

December 13 -

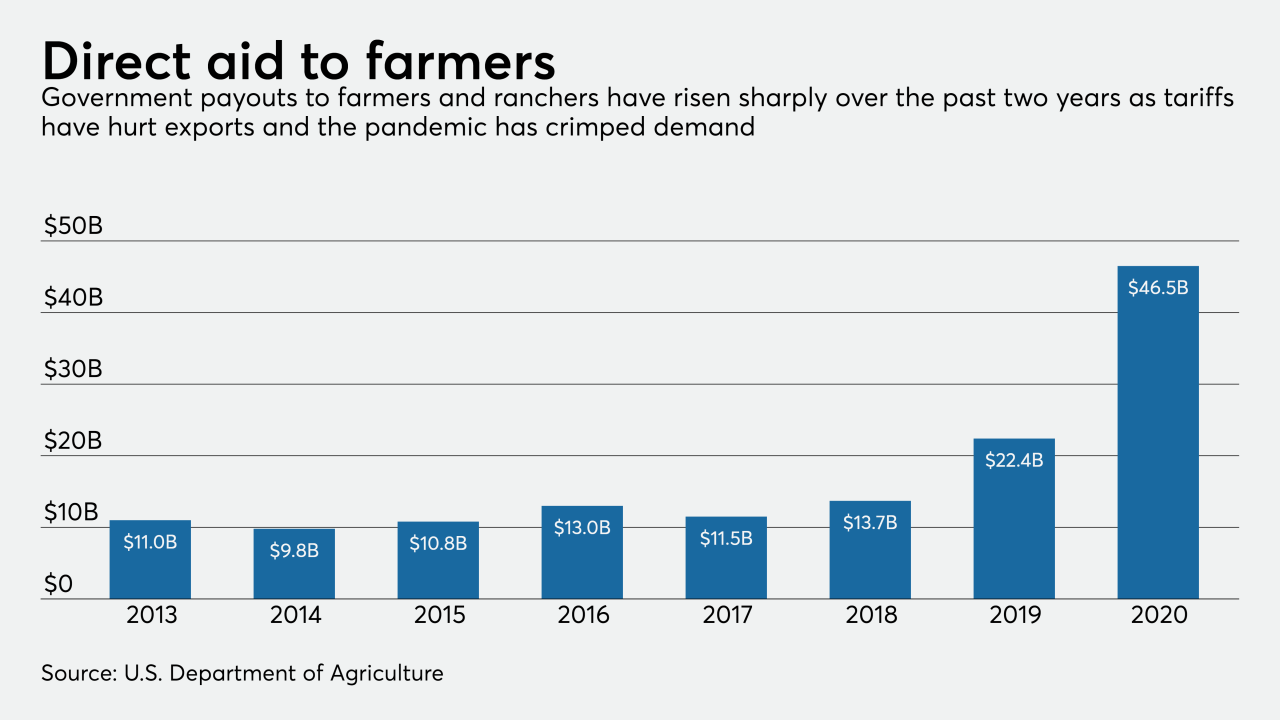

The Biden administration could curtail federal support for farmers, even with bankruptcies and requests for loan workouts on the rise. Banks are hoping that increases in crop prices and exports to China could help avert a credit crisis.

December 10 - LIBOR

The statement comes after multiple small and midsize institutions earlier this year warned the agencies that the secured overnight financing rate was ill-suited to them.

November 6 -

The company is looking to tap into a surge of homebuying tied to historically low interest rates.

November 3 -

The agency found a 40% error rate in the 2016 data submitted by the Seattle bank. In addition to the fine, the institution is required to improve its compliance systems.

October 27 -

The bank said the move will give it more flexibility for raising capital.

October 23 -

Deferrals may be hiding credit issues, leading lenders to track deposit flows, property maintenance and other factors to gauge the true health of their portfolios.

October 8 -

The company, which recently completed an audit, set aside funds to cover issues tied with a lending program it discontinued last year. The move cleared the way for Sterling to file an overdue annual report with the Securities and Exchange Commission.

October 7 -

The industry says the 2017 cut in the corporate rate helped position lenders to support the economy when the pandemic hit. But a plan proposed by Democratic nominee Joe Biden could strain banks' capital investment and hiring, observers say.

October 6 -

Low rates and intense competition might lead some banks to ease underwriting standards in 2021, when the economy may not yet have recovered.

October 5 -

The company also found a buyer for its portfolio of equipment finance loans as it tries to clean up credit and refocus on middle-market lending.

September 23 -

Congress should pass legislation that would allow Home Loan banks to backstop deposits by local governments at commercial banks and lower the cost of bond financing, two mayors argue.

September 16 -

The company said the sale will provide more consistent financial results and allow it to redeploy funds to support other businesses.

August 31