-

Under a new policy, a company subject to a civil investigative demand will learn from the agency about what conduct the probe is targeting and what legal provisions the firm may have violated.

April 23 -

General Electric Co. finalized an agreement to pay $1.5 billion to settle a U.S. investigation into the manufacturer's defunct subprime mortgage business.

April 12 -

A newer set of issues and opportunities presents itself for those embracing technology, involving everything from business strategy to cybersecurity.

March 22 -

Revised legislation would exclude credit unions from Community Reinvestment Act requirements, but could make the National Credit Union Administration the de facto enforcer of how CUs meet the needs of underserved markets.

March 18 -

Mortgage brokers need to consider bringing their business into new locations to overcome limitations like competition and a finite number of possible customers.

March 15 JW Surety Bonds

JW Surety Bonds -

Ginnie Mae could limit how much servicing income mortgage lenders can sell off through a transaction if they don't establish a minimum 25-basis-point spread at the portfolio level by next year.

March 8 -

Residential mortgage-backed securities servicers are better able to weather a downturn and the resulting loan defaults today versus before the crisis because of their investments in technology and regulatory compliance, Fitch Ratings said.

February 1 -

Ginnie Mae has restricted loanDepot's ability to securitize Veterans Affairs mortgages because of apparent churning of recent originations.

January 30 -

The same TILA-RESPA integrated disclosure errors continue to plague mortgage lenders, though those documents have been required for over three years, a report from MetaSource said.

January 29 -

New York State is providing additional funding to municipalities that will boost efforts regarding mortgage servicer compliance with the state and local vacant property laws.

January 28 -

1st Alliance Lending CEO John DiIorio explains why the mortgage lender turned down a consent order with the Connecticut Department of Banking and the high cost of fighting what he sees as an overreach of regulators' enforcement power.

January 17 1st Alliance Lending

1st Alliance Lending -

Fintechs must be held to the same standards as regulated financial institutions, a letter from the National Association of Federally-Insured Credit Unions stated that used Zillow's entrance into the mortgage business as an example.

January 9 -

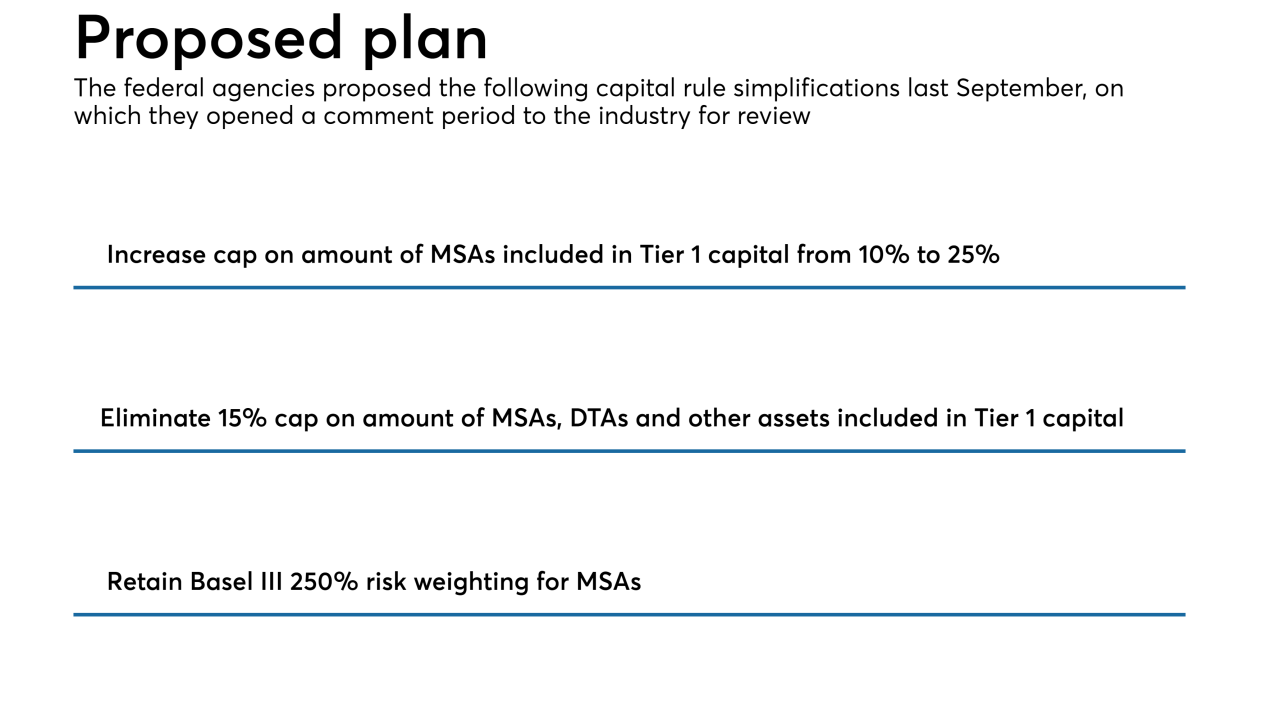

A proposal issued over a year ago by federal banking agencies to simplify risk-based capital rules and ease compliance burdens for community banks has still not been finalized, and mortgage brokers and bankers are calling on them to do just that.

December 18 -

While the foreclosure crisis is over and federal regulators are being less assertive on enforcement actions, mortgage servicers must remain vigilant about compliance, as state agencies are stepping up their own oversight, according to Standard & Poor's.

November 6 -

New York's Department of Housing Preservation and Development has released a "Speculation Watch List" of rent-regulated homes sold that the agency said could potentially put tenants at risk.

November 1 -

Under the Federal Housing Finance Agency's plan, small Home Loan banks would face a new housing benchmark and a volume threshold for meeting the goals would be eliminated.

October 29 -

Lennar's mortgage banking unit agreed to settle False Claims Act allegations for $13.2 million, a smaller amount than other lenders paid to the government prior to the end of fiscal year 2017.

October 22 -

The Office of the Comptroller of the Currency lowered the $14 billion-asset thrift in Cleveland to “needs to improve” from "satisfactory."

October 3 -

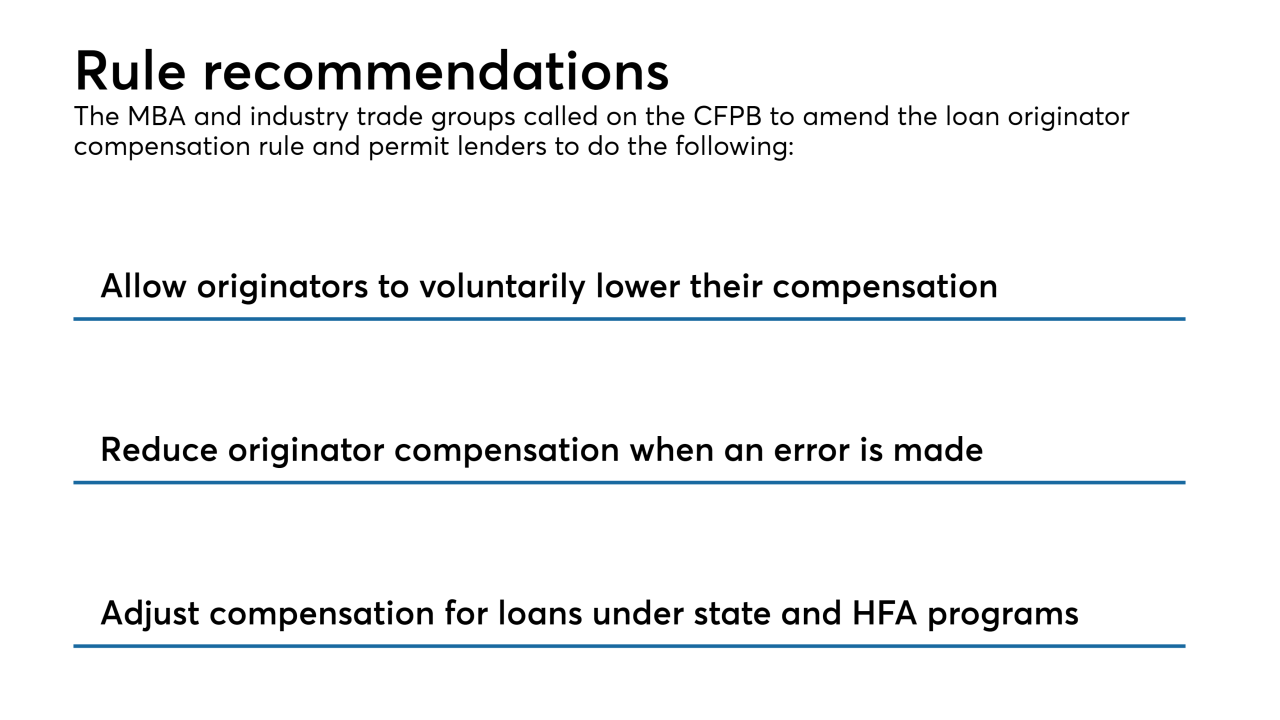

The mortgage industry is calling on the Consumer Financial Protection Bureau to revise its Loan Originator Compensation rule in favor of better protection for consumers and lesser regulatory burdens for lenders.

October 1 -

Gov. Jerry Brown signed a bill Sunday to streamline housing development around BART stations and ease the Bay Area's epic affordable housing problem at the expense of local officials' decision-making powers over land use.

October 1