-

In her first policy speech since being confirmed as the agency's director, Kathy Kraninger promised less focus on enforcement actions and more emphasis on consumer education.

April 17 -

General Electric Co. finalized an agreement to pay $1.5 billion to settle a U.S. investigation into the manufacturer's defunct subprime mortgage business.

April 12 -

Freddie Mac's latest nonperforming mortgage auction will include one pool targeted to smaller investors like nonprofit organizations.

April 12 -

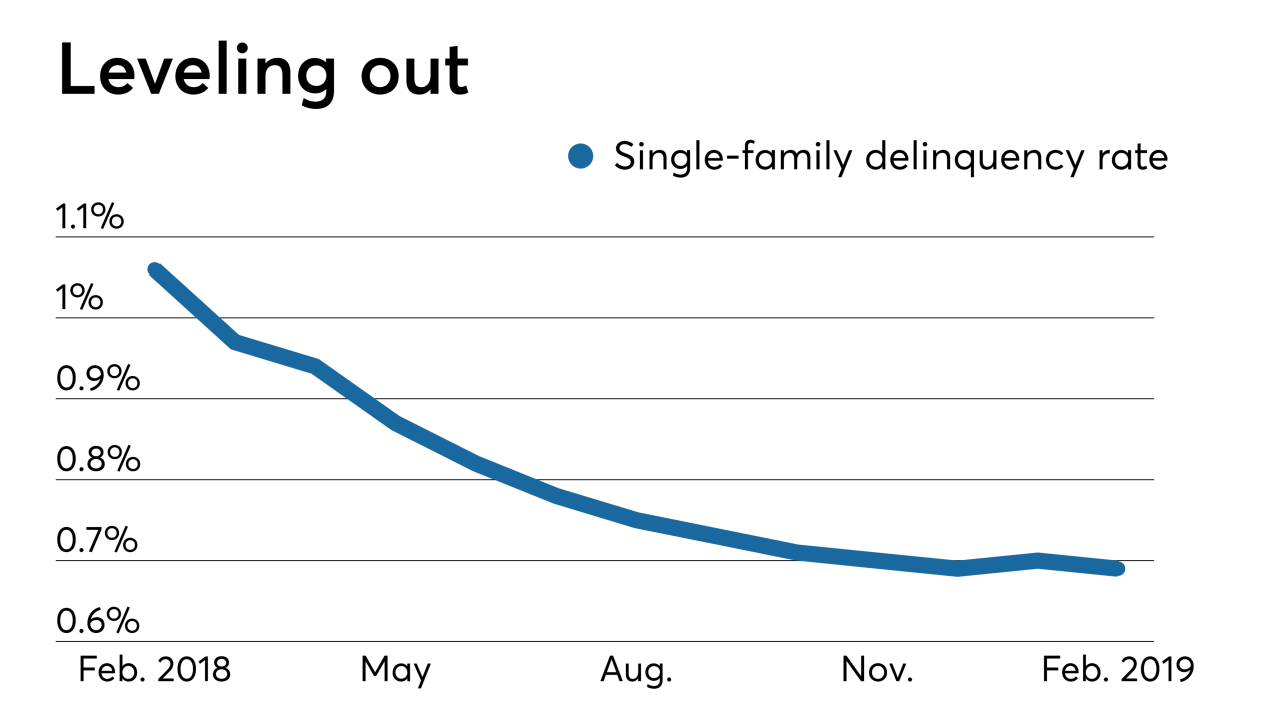

Late payments on single-family home mortgages changed direction and started falling again in Freddie Mac's latest monthly report.

March 26 -

In a unanimous ruling, the court placed new limits on the ability of consumers to sue law firms that handle foreclosures on behalf of mortgage servicers.

March 20 -

Servicers that fail to give borrowers access to digital collection methods are missing out on a chance to improve delinquency rates and lower costs.

March 19 Visa Inc.

Visa Inc. -

Recent remarks from top officials at the FDIC and Fed suggest the agencies' recent impasse over reforming the Community Reinvestment Act may be ending.

March 18 -

In the face of tough questioning from House members, CFPB Director Kathy Kraninger appeared mostly unfazed and tried to strike a balance between heeding concerns about the agency’s power and supporting its mission to help consumers.

March 7 -

The legislation comes a day before CFPB Director Kathy Kraninger is set to testify to Congress.

March 6 -

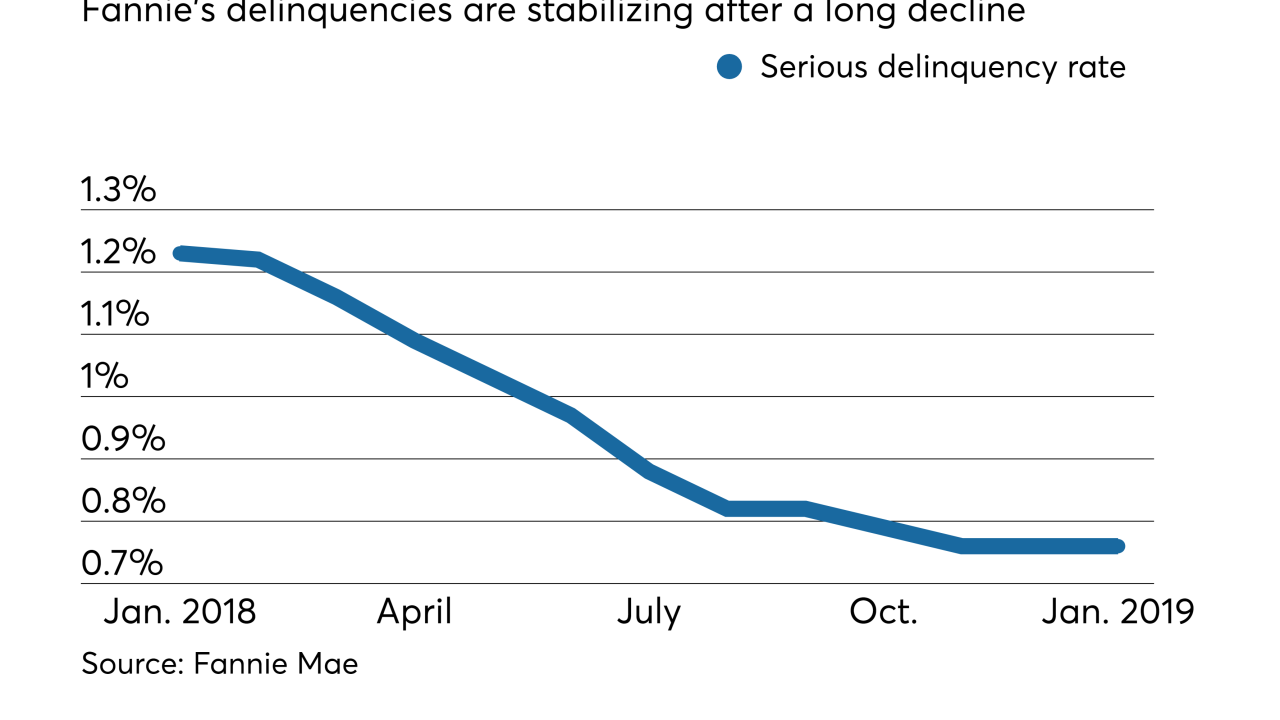

Fannie Mae's serious delinquency rate stood firm for the third month running, adding to evidence that it has hit a floor after dropping for most of the past year.

March 1 -

The agency has required restitution in just one of six settlements under its new director, raising questions about whether the pattern will continue.

February 20 -

While student, auto and credit card balances are at or near record levels, housing debt is shrinking, credit quality is weakening a bit and lending standards, at least in some sectors, are tightening.

February 19 -

Recent data from the Federal Reserve suggests lenders are growing pessimistic about the credit environment. But is that a sign of trouble ahead, or just sound risk management?

February 18 -

Refinance volume slipped following growth in mortgage rates, and loans refinanced through the Home Affordable Housing Program barely made a dent in overall volume, according to the Federal Housing Finance Agency.

February 15 -

Mortgage delinquencies in the fourth quarter were at their lowest level in nearly 19 years, helped by wage growth, low household debt and low unemployment, the Mortgage Bankers Association said.

February 15 -

The government-sponsored enterprises are going through a transition period. From proposals for rebuilding their capital cushions to tackling shortages in affordable housing, Fannie Mae and Freddie Mac face a number of key challenges with wide-ranging consequences this year.

February 14 -

Late payments on loans backing commercial mortgage bonds continued falling at the start of the year, due to strong new issuance volume and continued resolutions for precrisis loans by special servicers, according to Fitch Ratings.

February 11 -

Better credit quality and the influx of refinancing during the low interest rates of the last few years pushed mortgage performance to the highest levels since the turn of the century, according to Black Knight.

February 4 -

Risk aversion, economic momentum and the multidecade nadir of unemployment rates helped push delinquencies to the lowest year-end measure of the 21st century, according to Black Knight.

January 23 -

Loans grew 6% at JPMorgan Chase, but the bank is "not going to be stupid" and assume that will last forever, its CEO says. Here are some precautionary steps it's taking.

January 15