-

The bureau issued an interpretive rule clarifying that consumers under certain conditions can modify or waive waiting periods required by the Truth in Lending Act and Real Estate Settlement Procedures Act.

April 29 -

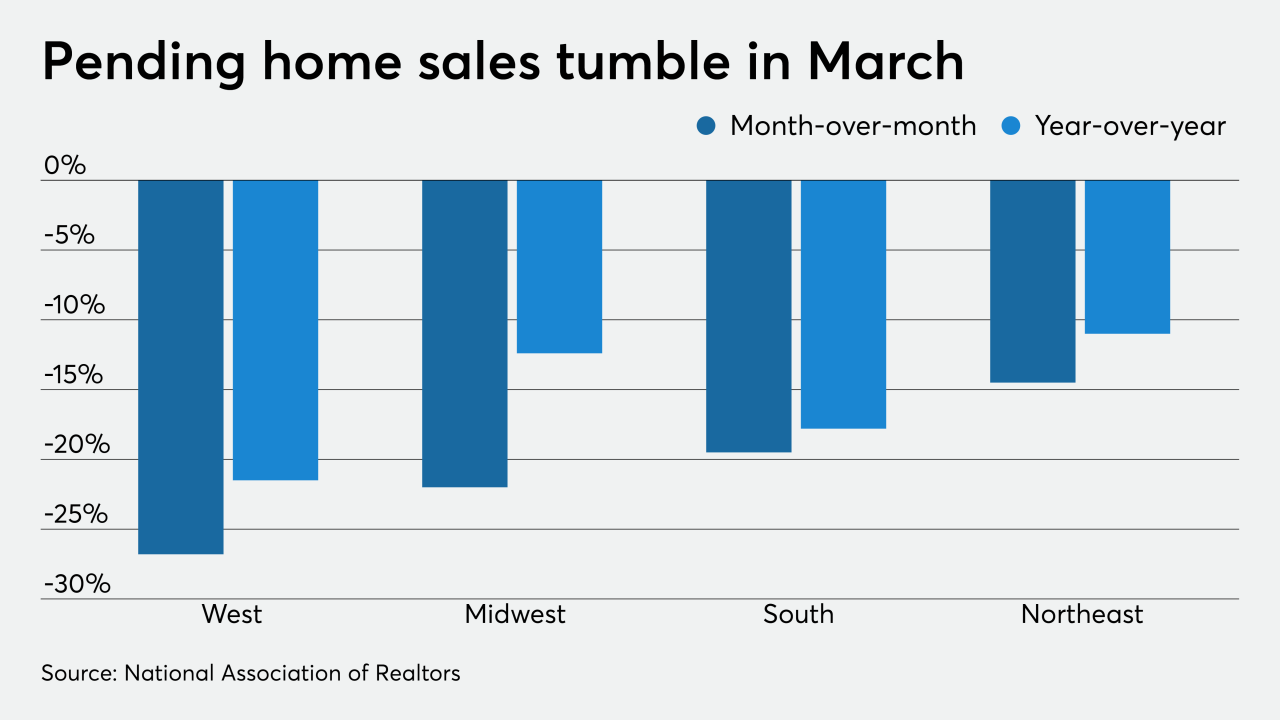

The coronavirus disruption caused March's pending home sales to fall and the losses will reverberate through the rest of 2020, according to the National Association of Realtors.

April 29 -

It's now definitive: Before coronavirus hit, the Seattle area's home market was hotter than almost anywhere else in the country.

April 29 -

Contracts to buy existing homes plunged in March by the most since 2010 as the coronavirus forced people to stay home and the economy spiraled down.

April 29 -

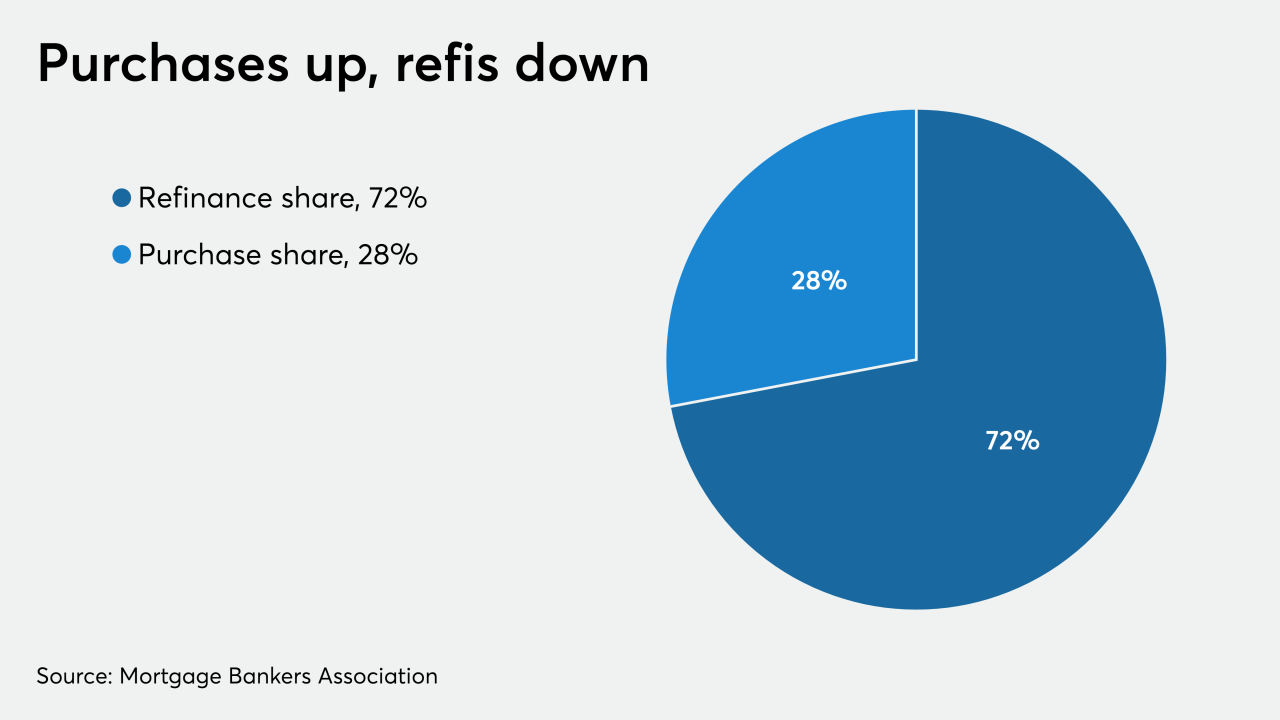

Even though mortgage application volume decreased from one week earlier, lenders had their best week for purchase business since the coronavirus shutdown began, according to the Mortgage Bankers Association.

April 29 -

The Southern California housing market was on track for record-setting prices and increased sales before the coronavirus outbreak hit, new numbers show.

April 28 -

The government-sponsored enterprises are focusing on how loans can be repaid after the federal forbearance period ends, and projections for loan modification volumes suggest the larger industry should, too.

April 28 -

Fannie Mae and Freddie Mac are now able to buy loans in forbearance to alleviate pressure on the sector, but the fees charged by the mortgage giants to assume more risk could turn away some originators.

April 28 -

Refinancing drove a 75% year-over-year increase in mortgage banking revenue during the first quarter at Flagstar Bancorp as it shored up its operations to avoid other negative repercussions from the coronavirus.

April 28 -

Manhattan homebuyers were already calling the shots in deals before the coronavirus hit. Now they're more in control than ever.

April 28 -

Mass layoffs and furloughs due to COVID-19 disproportionately affected Asian, black and Latino workers, and, in turn, will impact their housing security the most, according to Zillow.

April 28 -

Dallas-area home prices were up just 2.5% in the latest national comparison, but the small year-over-year increase came in February before the COVID-19 pandemic significantly impacted the market.

April 28 -

The Greater Capital Association of Realtors released market numbers, showing pending sales in March were down 21% from March of last year, and closed sales dropped by 10% compared to March 2019 as the impact of COVID-19 spreads through the local real estate market.

April 28 -

Is JPMorgan Chase an outlier or the canary in the coal mine when it comes to home equity lending during the coronavirus spread?

April 28 -

The number of loans in forbearance increased by a full percentage point over the past week, according to the Mortgage Bankers Association.

April 27 -

Pre-pandemic, home-buying power was high, but few are likely to buy a home today given a host of uncertainties regarding coronavirus, First American said.

April 27 -

As lenders scale up on their remote capabilities in response to the pandemic, the software companies that service them see exponential growth.

April 27 -

The FHFA's director said the announcement is meant to “combat ongoing misinformation” about efforts to let homeowners skip mortgage payments due to the coronavirus pandemic.

April 27 -

The Missouri real estate market was expected to have a promising year, but it's since been hobbled by the COVID-19 pandemic, and the disruption may stretch into the fall according to the Missouri Realtors Association.

April 27 -

The Bakersfield, Calif., home market was on track to finally retake the peak it achieved during the housing bubble.

April 26