-

The six bills championed by Democrats aim to reduce consumer burdens and provide opportunities for borrowers to rehabilitate their credit, but the legislation garnered no Republican support.

January 29 -

The largest bank in Puerto Rico said hundreds of millions of dollars of its mortgages and consumer loans are tied to the parts of the island hit by the recent quake or still recovering from two hurricanes.

January 28 -

FICO plans to release a new suite of scores that could reduce defaults on newly originated mortgages by 17%, but home lenders may not use it unless the government-sponsored enterprises do.

January 23 -

Under terms of the settlement approved by a Georgia court Monday, Equifax may also have to pay an additional $125 million if the initial amount doesn't cover all the claims.

January 16 -

Susan Riel succeeded Ronald Paul as CEO of the Maryland bank shortly before questions surfaced about credit quality and lending practices.

December 31 -

The percentage of recent mortgage borrowers with subprime credit scores still resides in the single digits, but nearly doubled what is was in 2013, according to TransUnion.

November 13 -

Such credits, which reflect borrowers with financial challenges, increased significantly during the third quarter.

November 13 -

Shares in the lender fell after it reported lower third-quarter profits, said nonperforming assets rose and cautioned that it had lost multifamily loan deals to competitors offering easier terms.

October 30 -

VantageScore totaled 12.3 billion scores across consumer credit loan categories over a 12-month period between 2018 and 2019 with minimal mortgage volume, leaving potential for a major ramp up.

October 29 -

Regulators have long warned the credit bureaus about deceptive marketing that causes consumers to sign up unwittingly for paid monitoring services. But the practice has persisted, according to complaint data.

October 20 -

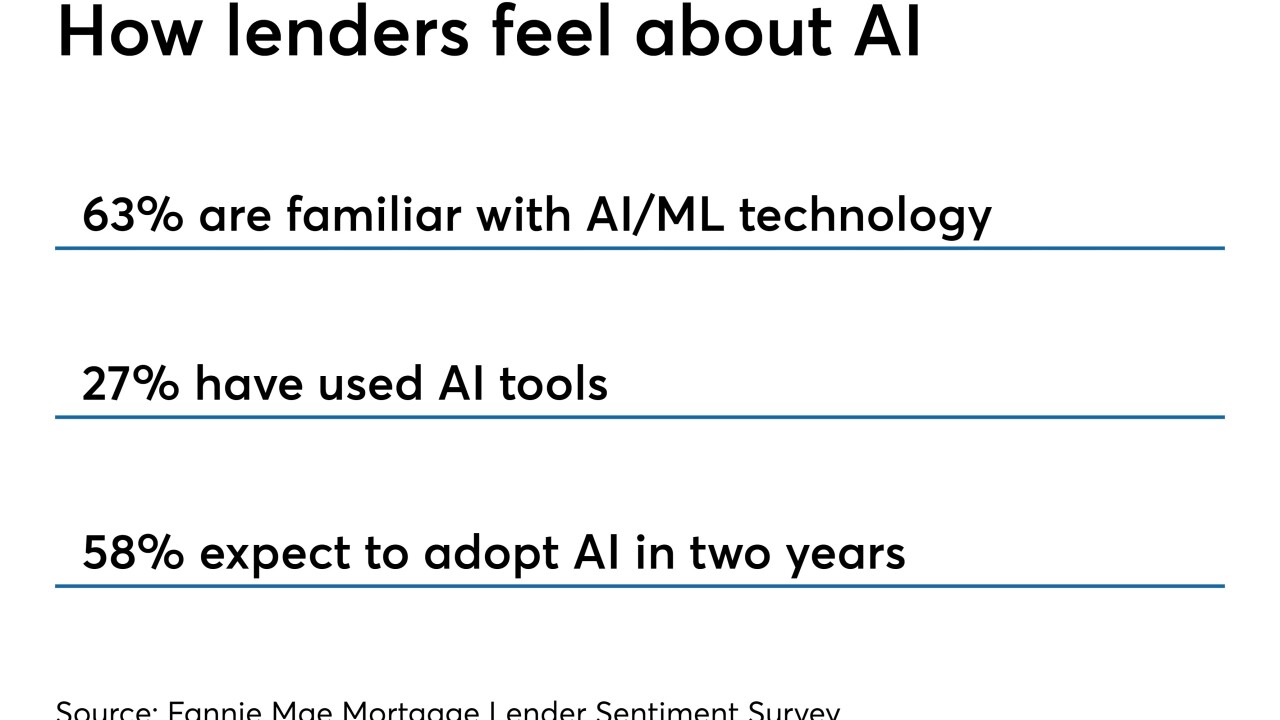

Freddie Mac's test of artificial intelligence to make lending decisions could be a significant turning point in broadening the use of the technology.

October 2 -

Caught in the middle of a credit-subsidy debate, the program would have shut down on Tuesday without congressional action.

September 27 -

The House Financial Services Committee passed a bill that would exclude adverse credit information for consumers impacted by a government shutdown.

September 20 -

The popular program could go idle next month for the second time in less than a year if lawmakers are unable to approve a $99 million credit subsidy.

September 17 -

Borrowers recovering from foreclosure might not be in as much hot water as perceived, with many maintaining healthy credit scores within a year, according to LendingTree.

September 10 -

A year after the major credit bureaus agreed to strip tax liens and civil judgments from consumers' credit files, a new study says it is hampering lenders' credit decisions. But proponents of the move insist it was the right call.

September 3 -

Kristy Kim was an immigrant success story with a degree from Berkeley and a lucrative job — except her lack of credit history precluded her from getting a car loan. She started TomoCredit to help the many young folks who struggle to qualify for a credit card.

August 29 -

Millennial mortgage debt is on pace to reach levels higher than any other generation, according to Experian.

August 23 -

Refinances jumped in July in response to a considerable mortgage rate decline from the month prior as homeowners set to lock in lower costs, according to Ellie Mae.

August 22 -

Mortgage debt hit an all-time high, but the share of homeowners with financing has fallen to a low not seen in 13 years, according to the Urban Institute.

August 21