-

A new credit score that includes consumers' cash flow alongside their credit score is winning praise for its potential to help expand access to credit, but some worry it gives the credit bureaus even more data that could be compromised.

October 23 -

In a move designed to improve access to financial products for consumers with low credit scores and short credit histories, Experian, FICO and Finicity are developing an "UltraFICO" score that lets individuals share checking and savings account data and help lenders better assess risk.

October 22 -

Millennials are targeting homeownership within the next few years, but many are buying into certain house-purchasing myths, according to Bank of America.

October 10 -

August's share of conventional mortgages closed by millennials reached a three-year high as lenders added products to meet their lifestyle, Ellie Mae said.

October 3 -

When it comes to attracting millennials, mortgages could be the key to capturing this demographic for the long haul – provided CUs are willing to put in the work.

September 26 -

Nearly half of July's millennial homebuyers were single, a sign that they are not waiting for certain milestones like marriage before deciding to become homeowners, according to Ellie Mae.

September 5 -

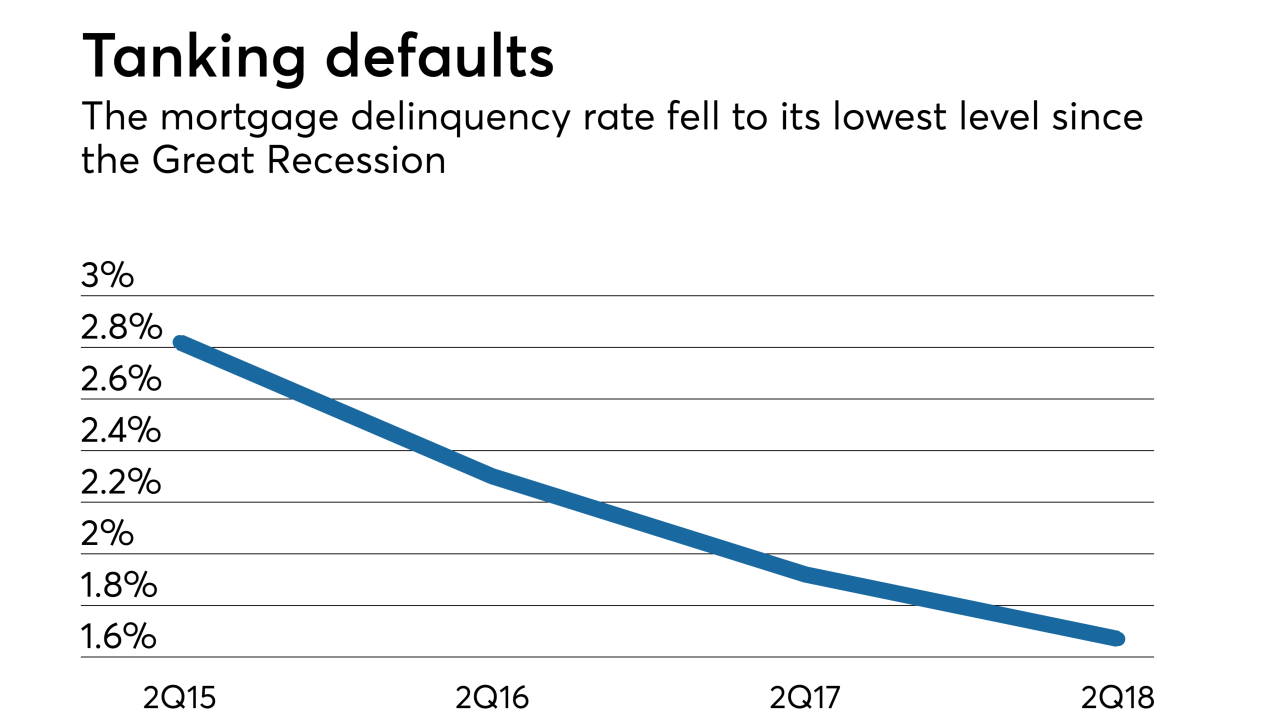

Better consumer credit quality helped push the serious mortgage delinquency rate to its lowest level since the Great Recession, but originations remain low due to tighter underwriting standards and eroding homebuyer affordability, according to TransUnion.

August 22 -

Credit Karma is diving into the mortgage industry with a plan to acquire digital mortgage startup Approved, a provider of consumer-facing online point of sale technology.

August 17 -

The number of consumers being pursued by debt-collection agencies fell dramatically in the past year, but it's as much technicality as achievement, and bankers need to keep that in mind when reviewing the credit scores of millions of Americans.

August 14 -

An increase in millennials making home purchases is a call to the mortgage industry for a quicker, more efficient digital process.

August 1 -

American Mortgage Consultants has acquired the right to hire 50 employees from The Barrent Group and will add 150 more in response to increased private-label securitization.

July 24 -

The Federal Housing Finance Agency is suspending its ongoing review of new credit scoring models and will instead move forward with creating a regulatory framework for providers of alternative credit scores to apply and be evaluated for use by Fannie Mae and Freddie Mac.

July 23 -

Senators at a hearing Thursday discussed a bill establishing an online portal for consumers to monitor their credit reports free of cost.

July 12 -

The average millennial borrower credit score remained unchanged in May, but values by city painted very different pictures, according to Ellie Mae.

July 11 -

Credit reporting firms with significant operations in New York will face new cybersecurity and registration requirements to stave off concerns related to a breach of Equifax's systems last year.

June 25 -

Higher interest rates on home mortgages drove the share of loans used to purchase houses rather than refinance to new heights in May.

June 20 -

As mortgage lenders continue seeking ways get more trustworthy consumers into the housing market, a majority of them are utilizing alternative credit as a means of assessing borrower risk, according to Experian.

May 25 -

As the mortgage industry moves farther past the housing crisis, access to credit remains tight, especially for first-time homebuyers.

May 23 -

The company has also hit its goal of having half of total loans tied to customers around Atlanta.

May 21 -

The post-recession boom in auto loans and credit cards for borrowers with marred credit histories has been winding down in recent months.

May 17