-

Over half of mortgage industry executives anticipate first-time home buyer growth in 2018, estimating that market will grow at a faster pace than the overall housing market, according to Genworth Financial.

November 17 -

The Consumer Financial Protection Bureau is seeking more information about consumers' experience with free access to credit scores.

November 13 -

Calls for less reliance on credit bureaus and Social Security numbers for verification are leading many to envision a future of identity on a distributed ledger.

October 30 -

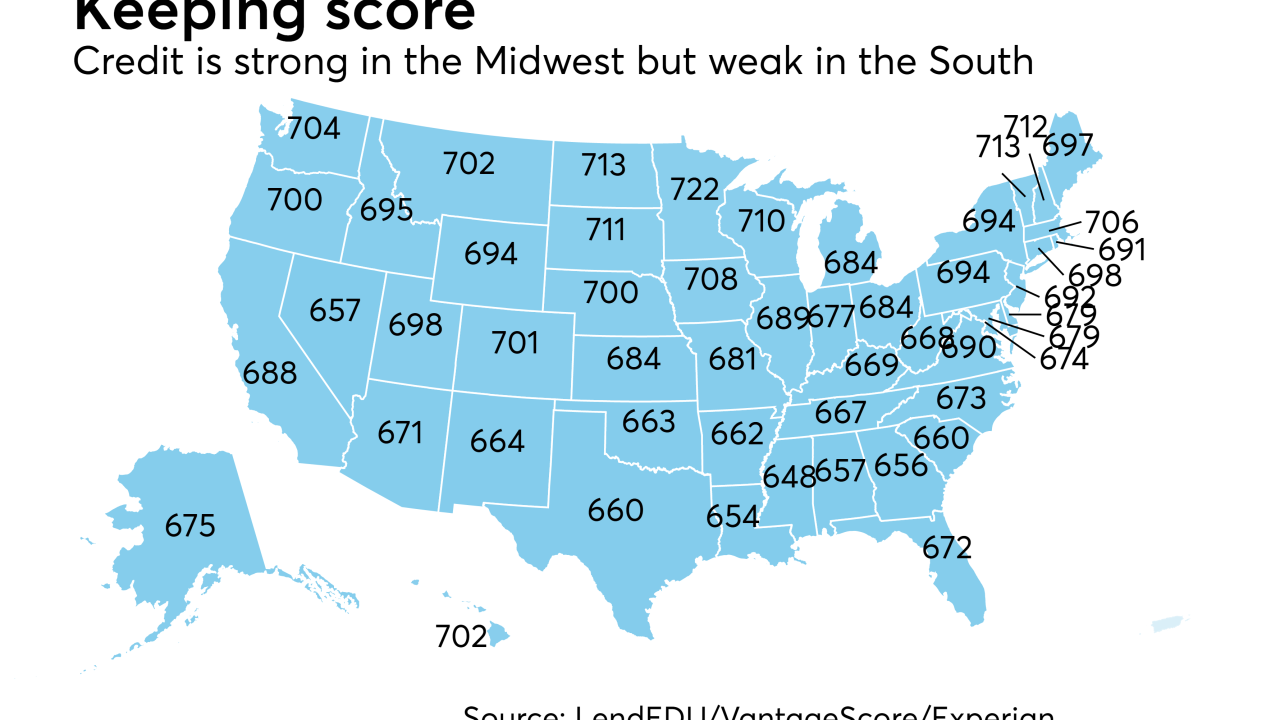

Consumer credit varies nationally due to regional variations in income and the cost of living. To get a sense of where it's strongest and weakest, here's a look at the five best and worst states for consumer credit scores.

October 23 -

The percentage of refinance loans rose in September as interest rates dipped to a 2017 low, according to Ellie Mae.

October 18 -

Cybersecurity and breach notification procedures have caught the most public attention following the massive hack at Equifax, but lawmakers are also interested in the accuracy of credit reports.

October 17 -

Mortgage defaults keep rising and are getting much nearer to where they were in 2016 as damage from natural disasters continues to add to slight upward pressure on credit.

October 17 -

CFPB Director Richard Cordray is using the Equifax breach to suggest the CFPB be given power to examine credit reporting agencies for potential cybersecurity lapses.

October 10 -

Congress may soon try to limit the personal identifiable information that companies and the government can collect on consumers based on their reaction to the massive data breach at Equifax.

October 4 -

Richard Smith came to Capitol Hill this week to speak about the massive breach at Equifax, but it was clear Tuesday that he will be defending the entire credit reporting industry.

October 3 -

Competition in other areas of consumer lending has driven both VantageScore and FICO to build credit scoring models that are more accurate and more consumer-friendly. Permitting that competition in the mortgage market can increase certainty for lenders and transparency for investors.

October 2 VantageScore Solutions

VantageScore Solutions -

Tim Welsh has spent his first two months on the job thinking about how to make U.S. Bank as central to consumers’ lives as Amazon, develop new personal financial management services, and expand into new cities.

September 29 -

Mortgage lenders took on more risk in the second quarter as the share of loans to real estate investors and condominium owners increased, according to CoreLogic.

September 29 -

Rep. Patrick McHenry, R-N.C., plans to reintroduce legislation requiring the IRS to fast-track income verification, which proponents say could reduce the financial industry's dependence on credit bureaus.

September 28 -

Equifax observed an increasingly well-worn ritual of scandal-ridden firms by jettisoning CEO Richard Smith: apologize, promise to do better in the future, and sacrifice your top executive in the hopes it will ward off action by Congress and regulators.

September 26 -

Inevitably, Equifax’s CEO Richard Smith has left his post. For the credit bureau's sake, let's hope it has a long-term plan that's better than promoting from within.

September 26 -

The share of lenders easing credit for government-sponsored enterprise-eligible loans is at a high not seen since Fannie Mae started a survey to track it.

September 25 -

The hearings before the Senate Banking Committee have high stakes for both companies, as lawmakers are expected to ask the CEOs whether they should be fired.

September 21 -

Despite an uptick in interest rates, refinance loans held steady in August and closing rates reached a new 2017 high.

September 21 -

Default rates for first-lien mortgages rose slightly higher in August and remain lower year-over-year, but recent hurricanes could intensify loan performance concerns.

September 20