-

Late payments on office loans have trended upward recently, but longer lease periods may mitigate the potential for distress in that sector, the Mortgage Bankers Association said.

August 5 -

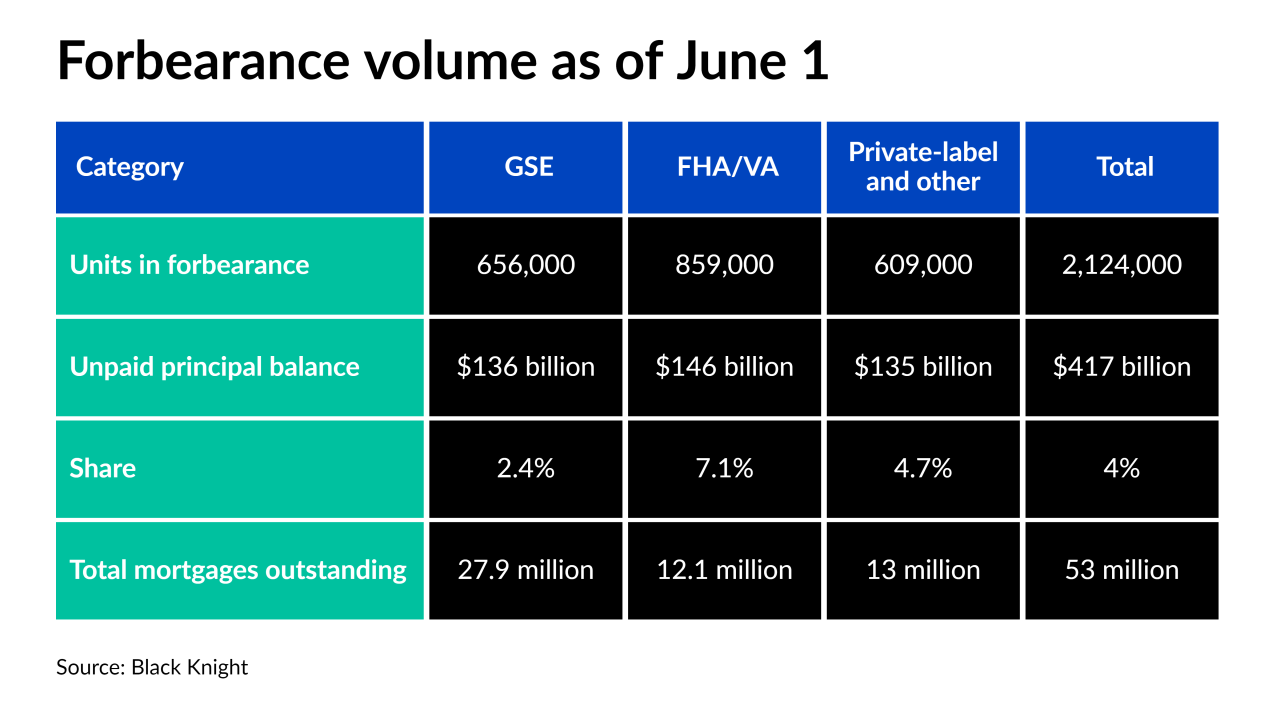

The relatively low share of borrowers who were distressed in June adds to signs that the offramp from government relief measures may not lead to an overwhelming wave of foreclosures.

July 22 -

Consumers are booking rooms at levels not seen since early 2020 and loan delinquencies have fallen sharply as a result. Still, business travel remains sluggish and new COVID variants are spreading, threatening the hotel industry’s recovery.

July 19 -

Identifying where payment stress is concentrated could help mortgage servicers and federal policymakers prepare for the broader range of loan workouts that will resume this summer.

July 8 -

It will be several years before business and group travel return to normal levels, according to an estimate from the American Hotel & Lodging Association.

July 7 -

Rebounding employment brought total forborne mortgages under 2 million, according to the Mortgage Bankers Association.

July 6 -

Private mortgage insurers can continue to hold less capital for forborne delinquent loans, which helps them potentially upstream payments to parent companies in the third and fourth quarters.

July 1 -

The numbers, which include payments suspended for pandemic-related hardships, could be a consideration in the possible further extension of moratoria federal regulators are close to making a call on.

June 23 -

The strength of the housing market helped to increase forbearance exits while minimizing new requests, according to the Mortgage Bankers Association.

June 22 -

About 20% of the pandemic-related delinquent borrowers are up for review by the end of June, which could lead to vast improvement or deeper financial strife, according to Black Knight.

June 18 -

Meanwhile, National MI has been increasing its new insurance written by slightly widening its credit standards.

June 11 -

But March's overall late payment rate was 1.3 percentage points higher than one year ago, while the 90-day-plus rate was 2.3 percentage points higher.

June 8 -

The sooner troubled loans can be put on a more proactive servicing path, the more likely the distressed homeowners will be able to avoid foreclosure, writes the vice president of market economics at Auction.com.

June 4 Auction.com

Auction.com -

The four-week high in forbearance exits also helped drive the considerable drop in plans, according to Black Knight.

June 4 -

Mortgage forbearances rose for only the second week in the past three months but big drops in numbers could be on the horizon, according to Black Knight.

May 21 -

For the first time since the pandemic began, the share of borrowers who are 30 days or more late on their payment is below 5%, Black Knight found.

May 20 -

The total number of loans in this category dropped 11 basis points from week to week according to the Mortgage Bankers Association. Meanwhile, the amount of unpaid balance in forbearance dropped almost 23% since the start of the year, a separate report from Black Knight found.

May 10 -

The agreement, which is extended for five years, also expands upon the delinquent mortgages services Altisource will provide to Ocwen.

May 6 -

An economic rebound, stimulus payments and COVID-19 vaccinations contributed to new delinquencies dropping to an all-time monthly low with more recovery ahead, according to Black Knight.

May 3 -

The mortgage insurance business had adjusted operating income of $126 million in the first quarter, down from $148 million one year ago.

April 30