-

Meanwhile, National MI has been increasing its new insurance written by slightly widening its credit standards.

June 11 -

But March's overall late payment rate was 1.3 percentage points higher than one year ago, while the 90-day-plus rate was 2.3 percentage points higher.

June 8 -

The sooner troubled loans can be put on a more proactive servicing path, the more likely the distressed homeowners will be able to avoid foreclosure, writes the vice president of market economics at Auction.com.

June 4 Auction.com

Auction.com -

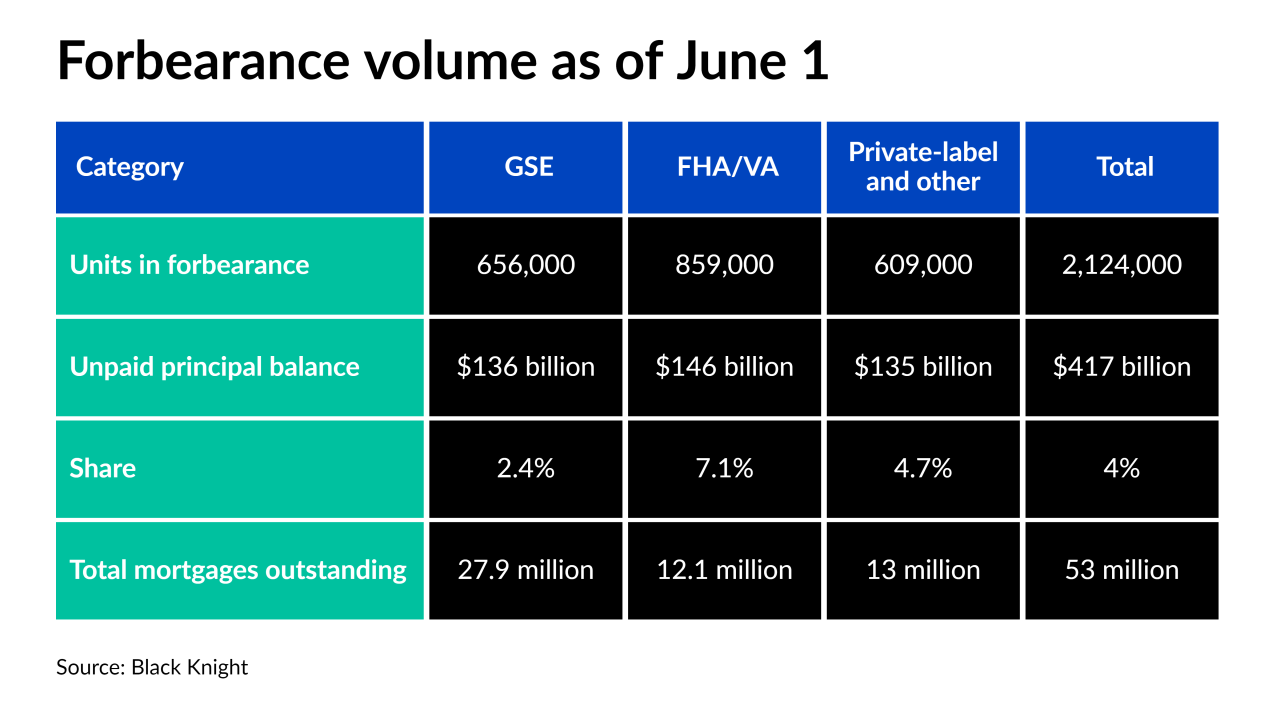

The four-week high in forbearance exits also helped drive the considerable drop in plans, according to Black Knight.

June 4 -

Mortgage forbearances rose for only the second week in the past three months but big drops in numbers could be on the horizon, according to Black Knight.

May 21 -

For the first time since the pandemic began, the share of borrowers who are 30 days or more late on their payment is below 5%, Black Knight found.

May 20 -

The total number of loans in this category dropped 11 basis points from week to week according to the Mortgage Bankers Association. Meanwhile, the amount of unpaid balance in forbearance dropped almost 23% since the start of the year, a separate report from Black Knight found.

May 10 -

The agreement, which is extended for five years, also expands upon the delinquent mortgages services Altisource will provide to Ocwen.

May 6 -

An economic rebound, stimulus payments and COVID-19 vaccinations contributed to new delinquencies dropping to an all-time monthly low with more recovery ahead, according to Black Knight.

May 3 -

The mortgage insurance business had adjusted operating income of $126 million in the first quarter, down from $148 million one year ago.

April 30 -

The persistently slow reduction in the number of borrowers at risk of default indicates that while loan performance overall is improving, a substantial pool of mortgages will need workouts when forbearance ends.

April 22 -

COVID-19 quickly altered the hierarchy of borrower debt, with home financing payments taking precedence over credit cards and auto loans, according to TransUnion.

April 14 -

While the overall delinquency rate decreased for the fifth straight month, states with unemployment rates that were double and triple the national average had the most overdue loans, a CoreLogic report found.

April 13 -

The stabilizing economy drove one of the biggest mortgage recoveries on record, according to the Mortgage Bankers Association.

April 12 -

However, the number of borrowers who failed to remit payment but were not yet 30 days overdue increased.

April 1 -

But private mortgage insurers should not see significant impact on business if a 25 basis point reduction were to occur sometime after 2021, according to BTIG.

March 31 -

As an improving job market aided financial stability for borrowers, 2020 ended with drops in delinquent home loans, a CoreLogic report found.

March 9 -

Servicers could be dealing with approximately 1.8 million distressed properties when the latest forbearance extension ends in June, Black Knight said.

February 24 -

Independent mortgage banker recovery drove the weekly decrease in forbearance share, according to the Mortgage Bankers Association.

February 22 -

Moratorium extensions helped drive a weekly increase in forbearances, according to Black Knight.

February 19