-

Gentrification and rapid home price growth have intensified the loss of wealth the African-American community experienced post-crisis, widening the chasm between what white and black borrowers can afford, Redfin found.

October 17 -

Millennial homeownership rates declined between 2009 and 2016 before picking up in 2017, even as the number of households under the age of 35 dropped by over 1 million, a ValuePenguin study found.

October 10 -

From Texas to Ohio, here's a look at the top 15 housing markets providing the shortest timelines for renters to buy a home, according to SmartAsset.

October 8 -

With housing affordability still a prominent hurdle to homeownership, prospective buyers — especially millennials — now get creative in order to find suitable homes, according to Chase and the Property Brothers.

October 4 -

Millennial homeowners and renters are more likely to stay in their home for a shorter period of time than similar aged people of previous generations, according to Zillow.

October 4 -

The majority of first-time homebuyers participating in a recent survey preferred online or phone interactions when receiving counseling that is a prerequisite for some loan programs.

October 3 -

Millennials took advantage of mortgage rates falling to near three-year lows in August, increasing their refinance share to the highest percentage since December 2015, according to Ellie Mae.

October 2 -

Millennials — now more than ever — dictate the direction the housing market is moving in, and with the deceleration of starter home prices, more should become homeowners soon, according to CoreLogic.

October 1 -

Charles Scharf’s most immediate priorities will be mending fences with regulators and getting the bank out from under a Fed-imposed asset cap. But he also must come up with strategies for spurring revenue growth and reining in expenses.

September 27 -

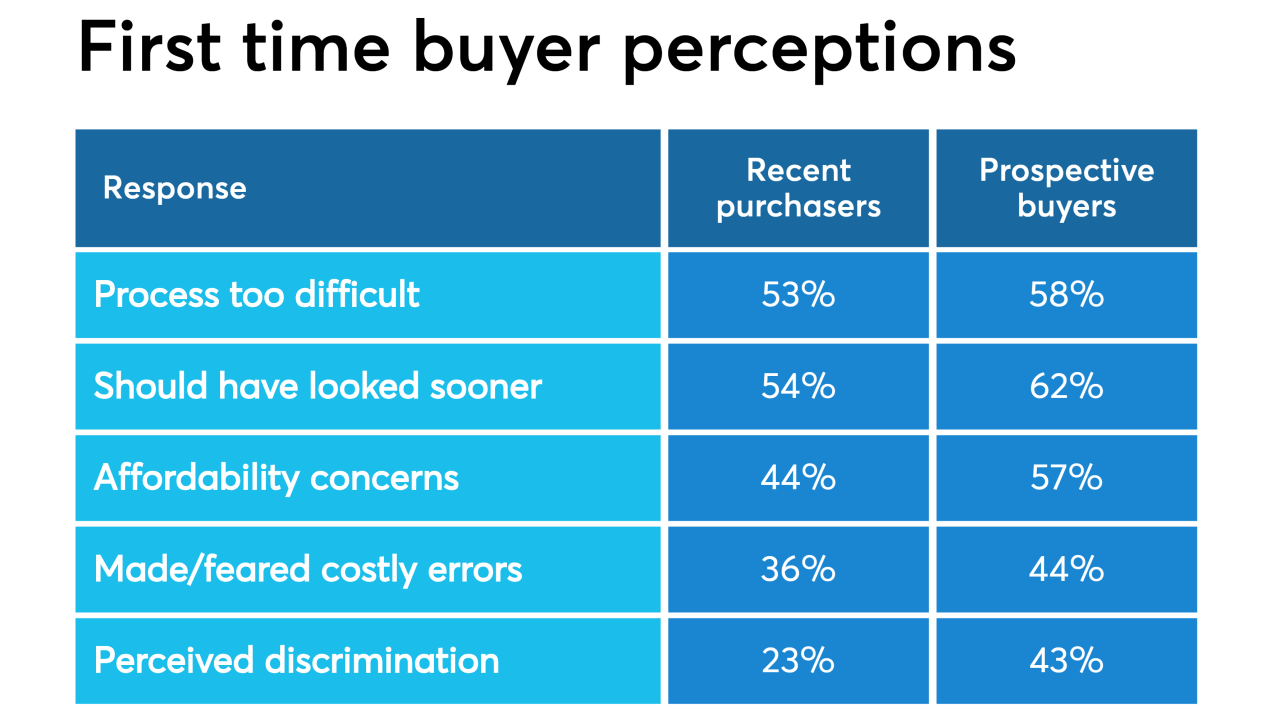

More than half of recent, as well as prospective, first-time homebuyers said purchasing a house was more difficult than it should be, according to a survey for Framework.

September 25 -

With the qualified mortgage patch expiring and a recession likely, wealth inequities that have hurt black and millennial homeownership could worsen, according to the National Association of Real Estate Brokers.

September 16 -

While millennials took advantage of mortgage rates falling to two-year lows, increasing their refinance share, teaching them about low down payment loan products would help grow homeownership for this group, according to Ellie Mae.

September 4 -

Strong home purchase activity — especially by millennials — pushed up annual price appreciation in July after a disappointing June, according to CoreLogic.

September 3 -

New Home Mortgage Disclosure Act data shows debt-to-income ratios have risen but also have been frequently cited among reasons for denials, suggesting lenders are becoming more cautious about this underwriting metric.

September 3 -

Mortgage debt climbed to a new peak of $9.4 trillion in the second quarter and the distribution across the U.S. varies greatly.

August 29 -

Here's a look at five perspectives from potential homebuyers, from their plans to purchase to how they view the current real estate market.

August 28 -

Digitizing the lending experience can go a long way toward boosting mortgage applications even as interest rates continue to fluctuate.

August 26 Fincity

Fincity -

Millennial mortgage debt is on pace to reach levels higher than any other generation, according to Experian.

August 23 -

The majority of young adults and consumers in coastal housing markets claim climate change will affect their homes or communities, which could influence where they consider buying a house, according to Zillow.

August 15 -

Mortgage activity fell at the start of the year, but lower mortgage rates are boosting refinance volume, and Generation Z is starting to creep into the housing market, according to TransUnion.

August 14