-

From Ohio to Utah, here's a look at the 12 housing markets with the highest percentage of millennial purchasers.

December 19 -

Tackling millennial hurdles has been top of mind for the mortgage industry, but the youngest non-homeowners have the smallest share claiming that qualifying for a mortgage will be a big challenge, according to the National Association of Realtors.

December 19 -

Ordinarily, declining property sales will cool the costs for housing. But existing-home sales have been underperforming their potential for 40 straight months and property values are still on the rise, according to First American Financial Corp.

December 17 -

Putting down 20% of the sales price has been the industry standard when buying a house, but less than half of consumers do that much, according to Zillow.

December 14 -

Growing home prices and climbing interest rates didn't stop millennials from buying houses in October, Ellie Mae said.

December 5 -

It's in lenders' best interests to show first-time homebuyers how to avoid overextending themselves, which is easy to do in a housing market short on inventory and long on big down payments, the CEO of Freedom Mortgage says.

December 4 -

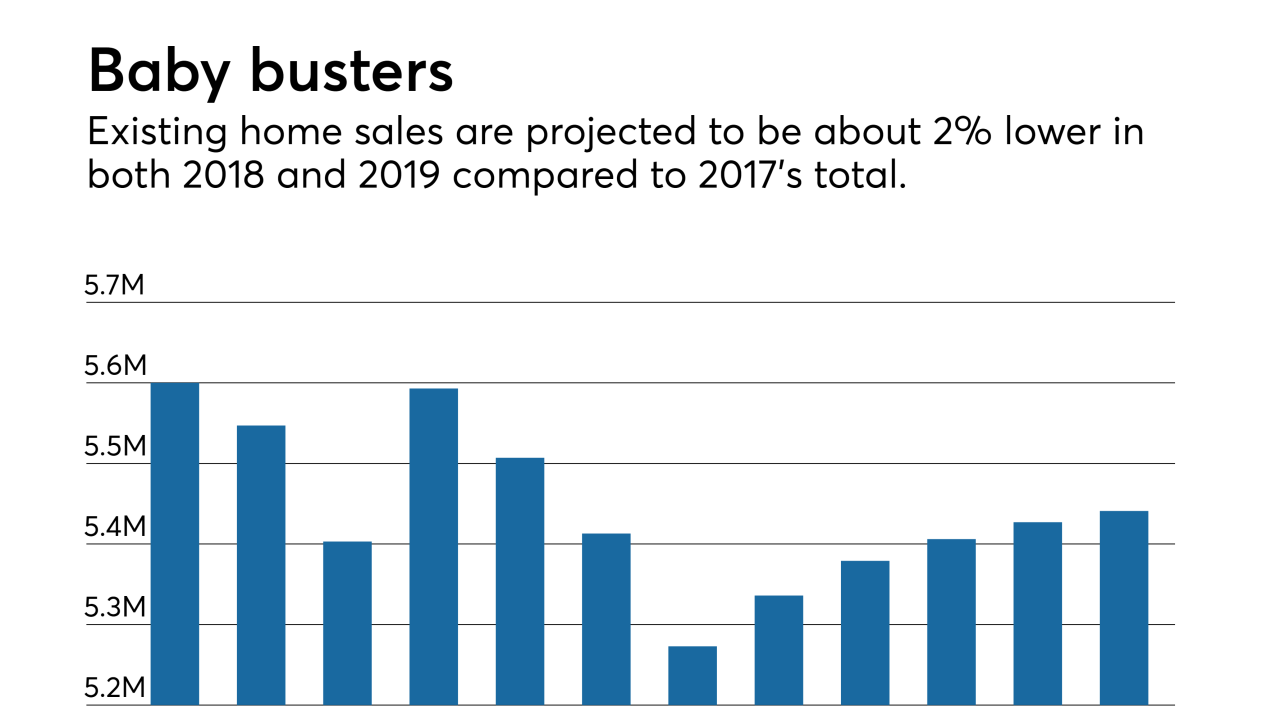

Existing-home sales are on pace to fall 2.3% year-over-year in 2018, and the baby boomer generation is a big reason why, according to Fannie Mae Chief Economist Doug Duncan.

November 29 -

Investing in community partnerships can feel counterintuitive at a time when most mortgage lenders are cutting costs, but it can pay off by attracting a key homebuyer demographic.

November 27 Cultural Outreach

Cultural Outreach -

From Provo, Utah, to Dallas, here's a look at 10 housing markets with the youngest average consumer age.

November 21 -

Rising interest rates are holding back existing homeowners from listing their properties, driving the gap between existing and potential sales even as that disparity narrows, First American Financial said.

November 19 -

As interest rates rise, mortgage originators need to teach millennial homebuyers about the product options outside of conventional loans, Ellie Mae said.

November 14 -

Consumers blame speculative home flippers and wealthy out-of-towners for soaring home prices, but the blame may be misplaced, given many economists' views about the broader factors at play.

November 13 -

Most millennials are purchasing fixer-uppers in order to afford a house, with 75% planning to finance renovations by tapping the equity in their home, according to a Chase Home Lending report conducted with Pinterest.

November 12 -

Eighty percent of millennials said they plan on moving within the next five years, while nearly three-quarters claim affordability as their biggest hurdle in the buying a home.

November 6 -

A combination of moderate rises in mortgage rates and dipping growth in home prices are projected to boost existing and new housing sales through 2020, according to Freddie Mac.

October 31 -

Student debt continues to weigh down potential homebuyers, as the share of first-timers decreased for the third-consecutive year, according to the National Association of Realtors.

October 29 -

With home values nearly doubling income growth in the last 20 years, it's now taking homebuyers 7.2 years to put together a down payment, according to Zillow.

October 23 -

While mortgage volume is expected to shrink next year, it should increase during the following two years and beyond as millennials start buying homes, the Mortgage Bankers Association forecasts.

October 16 -

The departing CEOs of Fannie Mae and Freddie Mac oversaw significant cultural and operational shifts that made the housing finance system safer and more responsive to market needs, but a tough job lies ahead for their successors.

October 16 -

As the mortgage industry confronts tight margins, shifting market share and regulatory uncertainty, a new leader emerges at the Mortgage Bankers Association.

October 14