-

Retiring baby boomers will intensify the affordable housing shortage unless public officials find a way to add significantly more low-cost homes to the market.

October 12 NHP Foundation

NHP Foundation -

One report found that 95% of homebuyers searched websites before buying a home, and that number jumps to 99% among millennials. In short, almost everyone starts shopping online, and a vast majority are going to Zillow.

October 10 J.D. Power

J.D. Power -

Millennials are targeting homeownership within the next few years, but many are buying into certain house-purchasing myths, according to Bank of America.

October 10 -

The state's red-hot housing market may be cooling a bit, according to the head of the New Hampshire Housing Authority.

October 5 -

August's share of conventional mortgages closed by millennials reached a three-year high as lenders added products to meet their lifestyle, Ellie Mae said.

October 3 -

Homebuyers put about 15% toward a down payment on house, spend $40,000 in one-time fees and thousands in closing costs, presenting an opportunity for lenders to leverage education and product offerings to prepare them for a purchase.

October 2 -

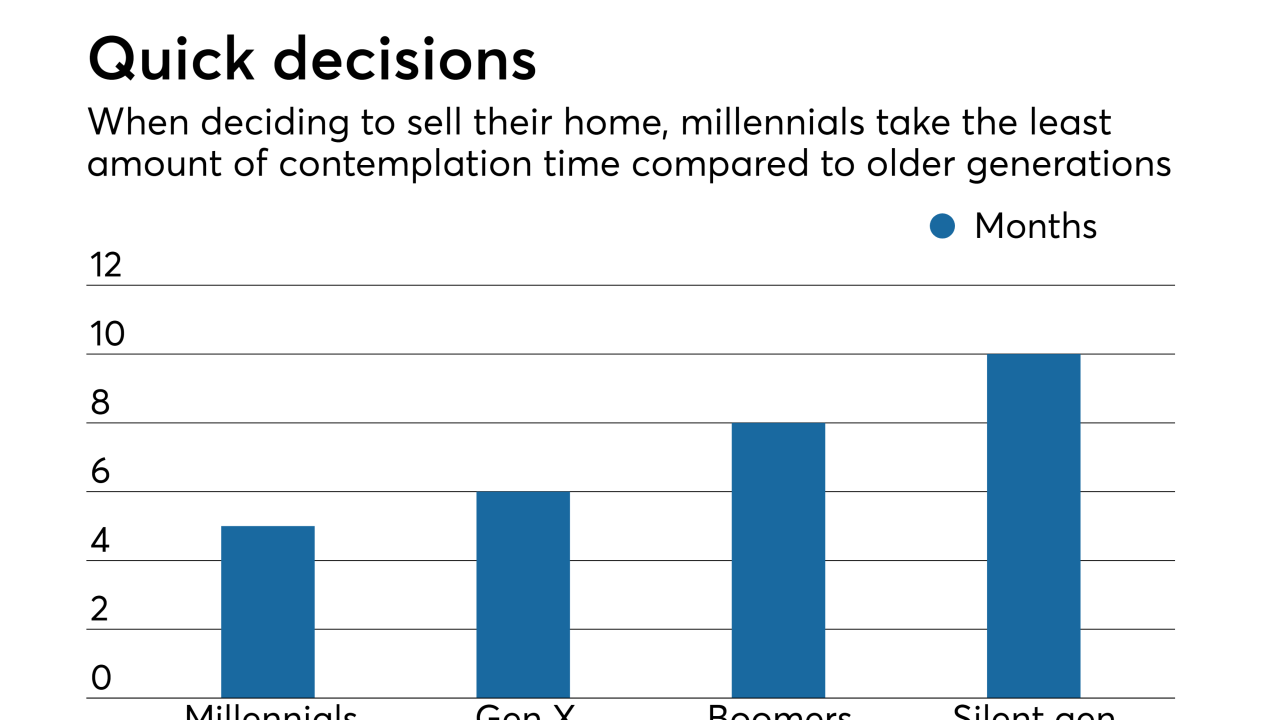

Millennials make up the largest constituent group for both homebuyers and sellers, which could put a squeeze on lending and eventually shift the market.

September 28 -

When it comes to attracting millennials, mortgages could be the key to capturing this demographic for the long haul – provided CUs are willing to put in the work.

September 26 -

A new study from Pentagon Federal Credit Union finds a sizable portion of consumers will be shopping for a mortgage within two years, but it also revealed some major misconceptions surrounding the process.

September 18 -

Nearly half of July's millennial homebuyers were single, a sign that they are not waiting for certain milestones like marriage before deciding to become homeowners, according to Ellie Mae.

September 5 -

The Office of the Comptroller of the Currency’s questions for the public to comment on the decades-old law could illuminate a path forward as regulators struggle to agree on an updated policy.

August 30 -

An improved economy, a healthy labor market and the large population of millennials should have accelerated home sales much higher, but all hope for more transactions this year is not yet lost, according to the NAR.

August 20 -

As housing affordability continues eroding on growing property values and mortgage rates, nearly a quarter of millennials believe they need to delay having children to afford a home purchase.

August 15 -

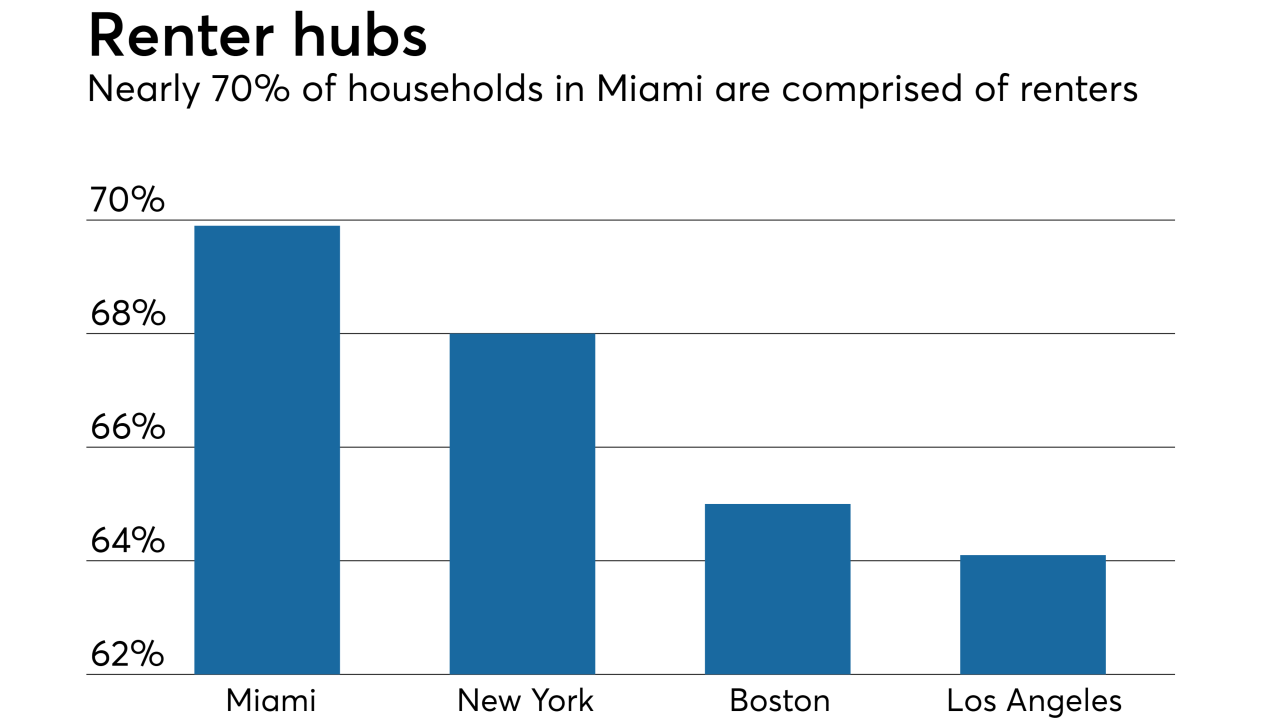

Home price appreciation is preventing consumers from entering the housing market, forcing an accelerated number of potential homeowners to rent.

August 8 -

Growth in home prices continued wearing down affordability at the start of the season, preventing first-time buyers from entering the housing market.

August 7 -

An increase in millennials making home purchases is a call to the mortgage industry for a quicker, more efficient digital process.

August 1 -

The average millennial borrower credit score remained unchanged in May, but values by city painted very different pictures, according to Ellie Mae.

July 11 -

With the supply of housing down and more jobs available in cities, millennials have flocked to urban neighborhoods at a comparable rate to the suburbs for the first time in decades.

July 6 -

The decline in homeownership among young adults can be attributed to a variety of financial headwinds like student loans and societal shifts like marriage rates, but rising housing costs are the core issue, according to research by Freddie Mac economists.

July 2 -

Greg Englesbe resigned as CEO of New Jersey lender E Mortgage Management after a jury awarded $3 million to a woman who accused Englesbe of injuring her when he grabbed and forcibly kissed her at a Philadelphia restaurant.

June 29