-

A real estate firm focused on gentrifying neighborhoods is showing cracks after a group of its apartment buildings in New York’s Upper West Side and Harlem filed for bankruptcy.

December 30 -

Recipients can’t charge penalties for, or engage in, evictions solely for nonpayment, must provide a written notice of tenant rights, flexibility in repayment and, where applicable, 30-day vacate notices.

December 24 -

The availability of financing hasn’t been an issue to date, but it still could be.

December 23 -

About 4,400 loans started the foreclosure process in November, alongside 176,000 mortgages in active foreclosure.

December 22 -

The FHA’s deadline was extended as part of its latest renewal of other coronavirus-related contingencies. The move follows a request from state regulators to provide ample notice of the forbearance program’s expiration.

December 22 -

The forbearance rate rose behind slowed economic recovery, according to the Mortgage Bankers Association.

December 21 -

The new bill ordering $600 stimulus checks and $25 billion in emergency rental assistance won't be enough to help millions of Americans struggling to make housing payments, according to industry watchers.

December 21 -

The company expects a good year ahead for mortgage insurers, assuming that rising employment, higher home prices and payment timing deferrals will help them to mitigate risk.

December 18 -

With infection rates rising and unemployment claims increasing since Thanksgiving, mortgages in coronavirus-related forbearance rose by 37,000 last week, according to Black Knight.

December 18 -

The forbearance rate continued its improvement, but the surge of COVID-19 cases could lead to more borrowers needing mortgage relief, according to the Mortgage Bankers Association.

December 14 -

While 12,000 mortgages exited forbearance, the most borrowers entered forbearance protection in a week since early September, according to Black Knight.

December 11 -

The November foreclosure rate represented an 80% decline from the year before, according to Attom Data Solutions.

December 10 -

Borrowers who exit CARES Act-related forbearance in the spring and have stacks of other bills to attend to may be in search of liquidity via such products, the company predicts.

December 10 -

While distressed mortgage rates crept down overall, serious delinquencies still tripled year-ago rates in September, according to CoreLogic.

December 8 -

The surge of COVID-19 cases slowed economic recovery and hampered improvements in the forbearance rate, according to the Mortgage Bankers Association.

December 7 -

Lower cure rates and possible rises in foreclosures and claims could force these companies to raise capital next year, Fitch Ratings said.

December 4 -

The Federal Housing Finance Agency said that Fannie Mae and Freddie Mac would extend the measures until “at least” Jan. 21, 2021.

December 3 -

The extension of the FHA’s willingness to conditionally endorse loans with suspended payments came amid a renewed push by public and private entities to spread awareness of the CARES Act option.

November 30 -

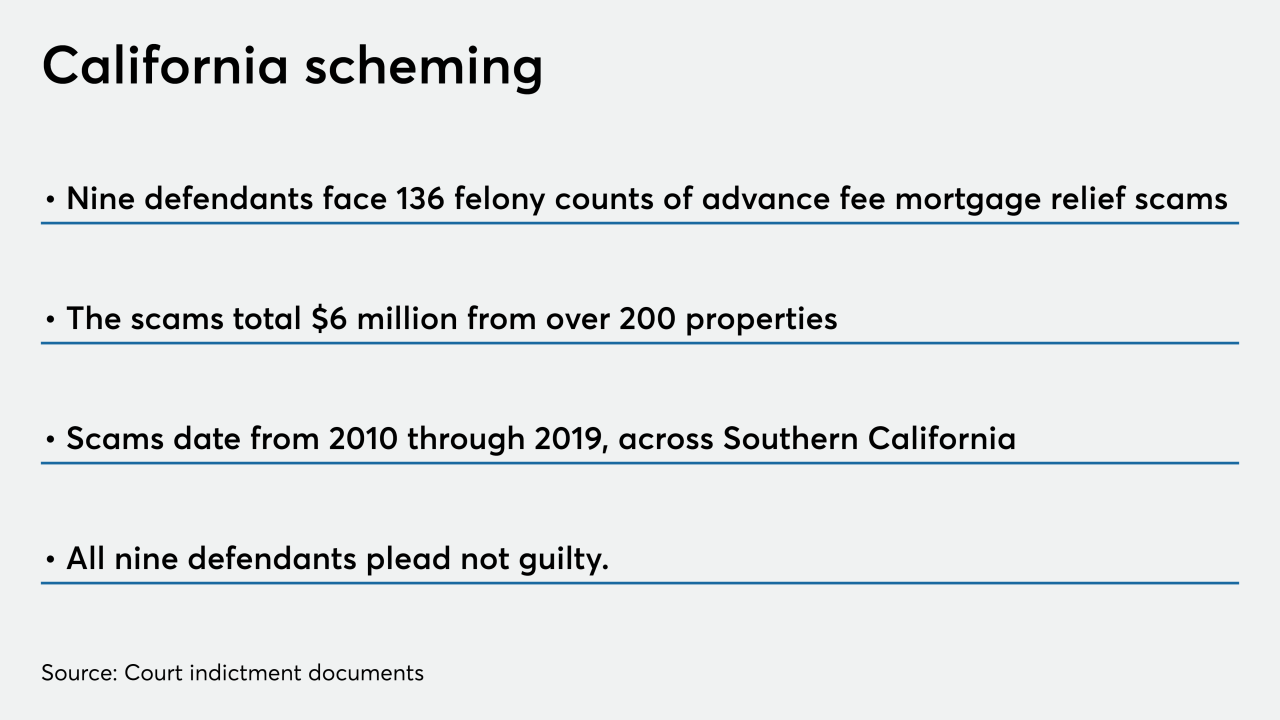

The nine arraigned individuals face 136 counts of felony charges for allegedly running an advance fee mortgage relief scheme over the last decade, totaling $6 million.

November 24 -

While sales increased 24% over August, they were still down 78% from the prior year, Auction.com reported.

November 24