-

While moratoria keep foreclosures low compared to last year's rates, October activity jumped 20% from September, according to Attom Data Solutions.

November 10 -

The forbearance rate continued recovering in lockstep with employment improvement, according to the Mortgage Bankers Association.

November 9 -

For most of the underwriters it was a strong quarter, but concerns remain over government-sponsored enterprise reform and potential claims after forbearances end.

November 6 -

Under 2.9 million borrowers sit in coronavirus-related forbearance as GSE-backed mortgages drove the latest decrease, according to Black Knight.

November 6 -

Growing equity levels increased the share of equity-rich and pulled borrowers out from underwater in the third quarter, according to Attom Data Solutions.

November 5 -

And an uptick from second-quarter numbers is attributed to seasonality rather than any upswing in the economy.

November 3 -

Getting ahead of the next wave of mortgage fraud calls for rock-solid systems with several protective tools deployed at once. But that only goes so far without the proper employee preparation.

November 3 -

The forbearance rate improved to the a level not seen since early April, but getting back to pre-COVID levels will require employment gains or additional government stimulus measures, according to the Mortgage Bankers Association.

November 2 -

Meanwhile, the delinquency rate is up 89% year-over-year, according to Black Knight.

November 2 -

The origination boom generated another profit for the company in the third quarter, when also it obtained a novel source of liquidity to support its servicing operations.

October 30 -

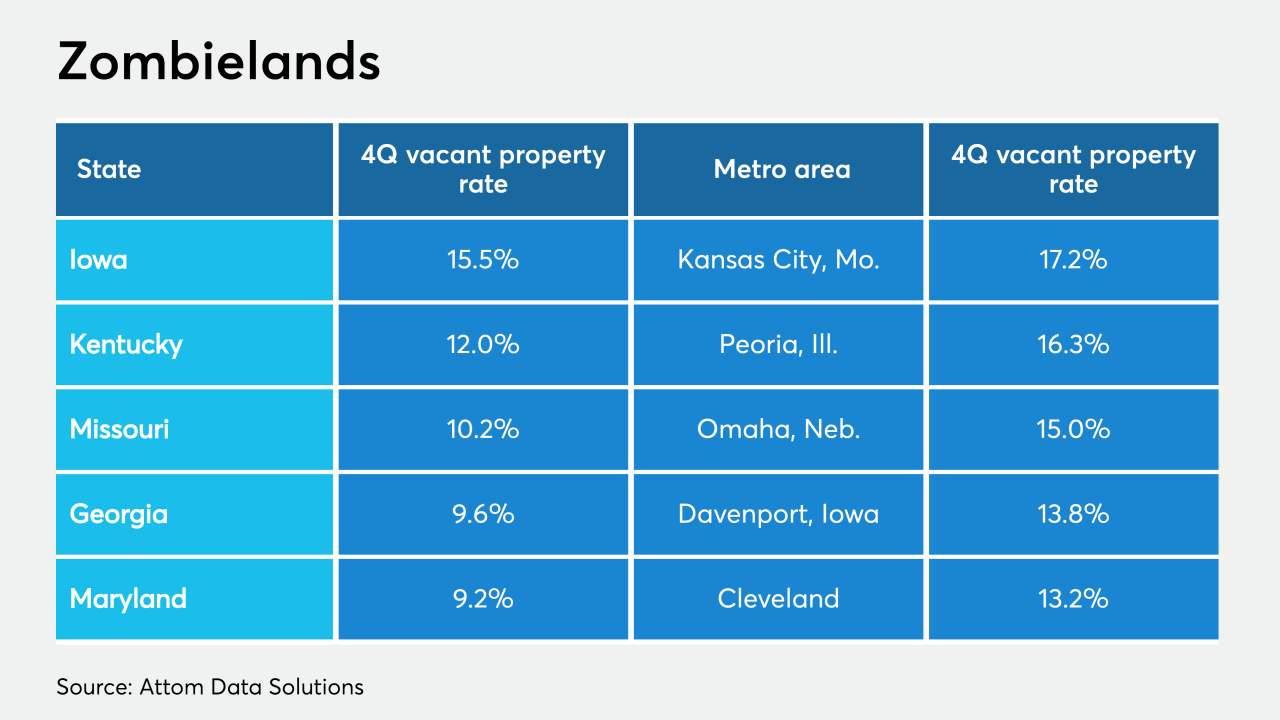

While the total foreclosures continued to fall with coronavirus moratoria in place, the share of zombie properties rose in the fourth quarter, according to Attom Data Solutions.

October 30 -

The government-sponsored enterprise also saw a 22% increase in net worth from the second quarter.

October 29 -

Researchers are increasingly focused on the risks related to owner-occupied loans with low balances and low-income properties with a limited number of renters.

October 29 -

The scheme targeted distressed homeowners in the Filipino community, most of whom were nonnative English speakers, forcing some of them into bankruptcy and homelessness, according to law enforcement officials.

October 29 -

A booming housing market contrasts with a slow-to-improve job market, making for lopsided improvement in the number of troubled mortgages, according to numbers from the Mortgage Bankers Association.

October 26 -

To continue providing liquidity for lenders, Fannie Mae lengthened the period in which it would continue the purchase of forborne mortgages and pools of mortgage-backed securities into 2021.

October 22 -

As of the end of July, there were more than 1 million past-due mortgages not in forbearance plans, and the majority likely would have qualified for forbearance under the CARES Act.

October 22 -

HUD Deputy Secretary Brian Montgomery questioned "whether we could ever totally accept desktop-only appraisals" at the Mortgage Bankers Association conference this week.

October 21 -

The pandemic has turned stress-testing around liquidity from theory into an actual case study. And while lenders shore up their cash reserves, they explain why many have been hesitant to take advantage of Ginnie Mae's Pass-Through Assistance Program.

October 21 -

Minus various expenses including corporate, legal and servicing rights valuation, Ocwen had adjusted pretax income of $13.5 million.

October 20