Diversity and equality

-

The Trump administration's executive order to terminate and replace federal enforcement of anti-discrimination policies at the local level, citing the burden it put on municipalities, enraged advocates of equitable housing practices.

July 23 -

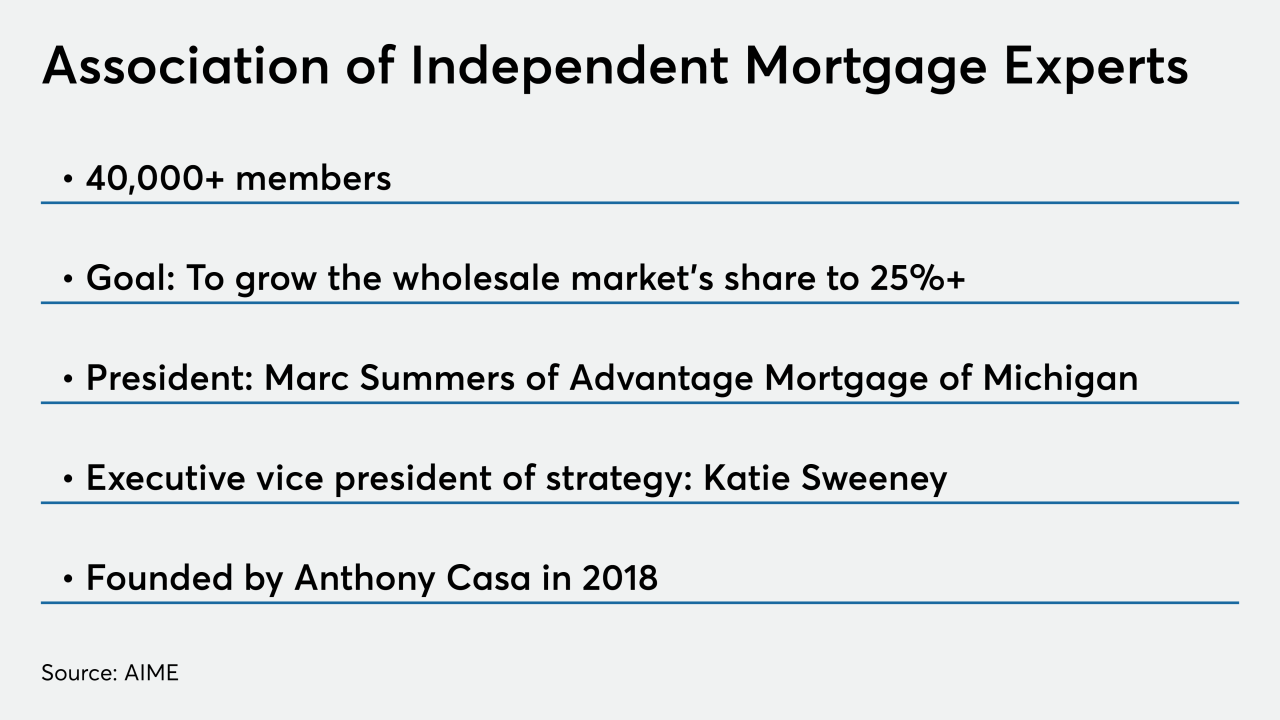

The chairman of the Association of Independent Mortgage Experts is distancing himself from the organization after a Quicken Loans executive's wife filed a defamation lawsuit against him for vulgar group texts.

July 17 -

Remarks that the head of the mortgage broker association made about a Quicken Loan executive's wife in a video text exchange led to a defamation lawsuit, and housing-finance companies are taking sides.

July 16 -

-

The consumer agency alleges Townstone Financial's CEO and president made statements on a radio show discouraging applicants living in Black neighborhoods from seeking home loans.

July 15 -

He co-founded California Rural Legal Assistance, Public Advocates and the Greenlining Institute.

July 14 -

A man who started a mortgage brokers group issued a statement indicating he regretted saying "lewd" personal things about a Quicken Loans executive’s spouse while sparring over a professional matter.

July 13 -

The existing framework should not be revised until a consensus has been achieved among stakeholders, including civil rights experts, according to Quicken.

July 13 -

A bevy of housing advocates spoke against President Trump's threat to remove the Affirmatively Further Fair Housing Rule, a regulation that aims to end racial segregation.

July 2 -

The gap between Black and white homeownership rates is extremely wide in some areas, and it could get worse if the industry fails to proactively address local and national inequities.

June 30 -

For potential higher-end homebuyers, the pandemic was merely a pause, but for those seeking affordable properties — often people of color — it created yet another barrier.

June 23 -

How the mortgage and housing industries react to the current civil rights moment could shape policies and bridge the homeownership divide for the Black community.

June 19 -

As protesters continue to take to the streets to express outrage over racial injustice and inequality, banks — for the first time — will commemorate the date that marks the end of slavery in the U.S.

June 16 -

The agency flagged faulty risk management and other issues at the Federal Home Loan Bank of Des Moines and Federal Home Loan Bank of San Francisco in exams conducted last year.

June 15 -

Though outlawed by the Fair Housing Act in 1968, the racist housing practice perpetuated a wealth gap for Black people still widening today.

June 12 -

IBM called for rules aimed at eliminating bias in artificial intelligence to address concerns which range from identifying faces in security-camera footage to making determinations about mortgage rates.

January 21 -

The Department of Housing and Urban Development has proposed an overhaul of an Obama-era rule meant to guide local jurisdictions in how they comply with the Fair Housing Act.

January 7 -

The two Democrats sent a letter "raising grave concerns about whether the bureau is fulfilling its statutory obligations."

December 18 -

Better.com saw huge growth in mortgages to traditionally underserved customer bases in 2019 and believes digital applications led to the avoidance of discriminatory lending.

December 17 -

Despite assurances by Director Kathy Kraninger that the agency is cracking down on discrimination, it has not filed an enforcement action or sent a Department of Justice referral on a fair-lending violation in two years.

December 17