-

The Community Home Lenders Association’s letter adds to criticism of the changes made to the GSEs’ preferred stock purchase agreement and indicates that its mandates are proving tough to meet.

June 17 -

Federal Reserve officials held interest rates near zero while signaling they expect two increases by the end of 2023, pulling forward the date of liftoff and projecting a faster-than-anticipated pace of tightening as the economy recovers.

June 16 -

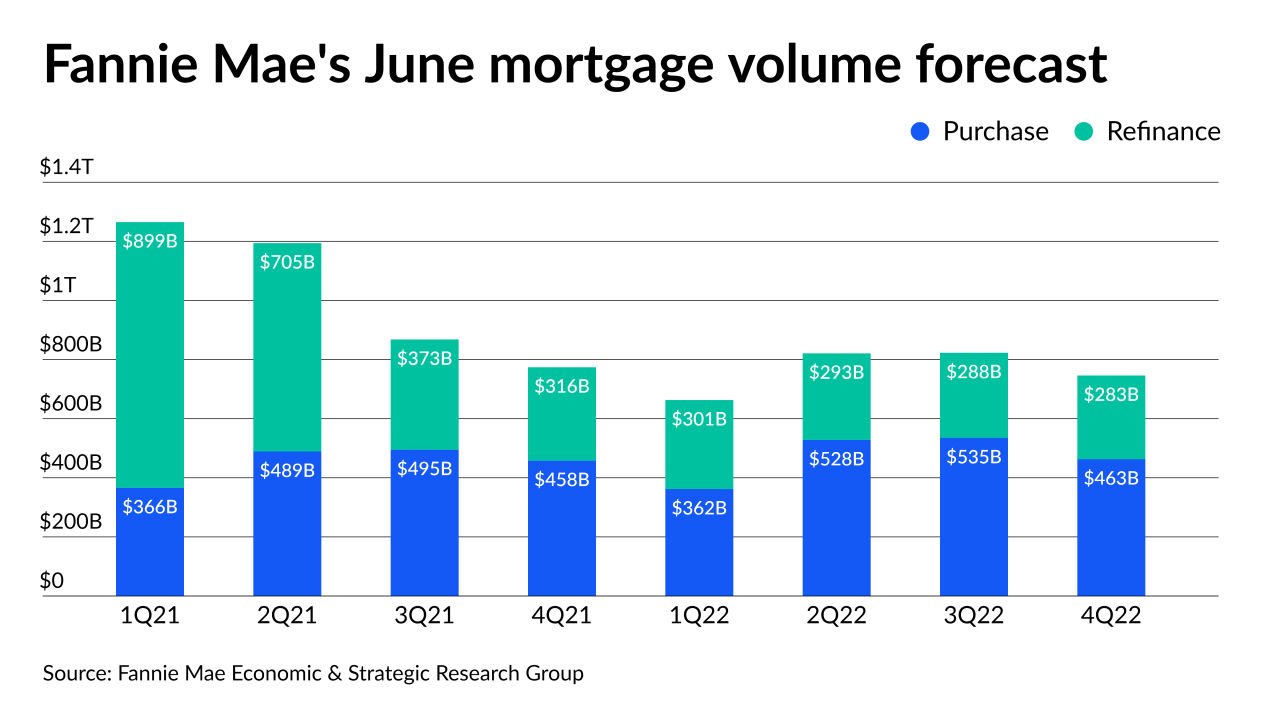

But the government-sponsored enterprise raised its total origination volume forecast for 2021 based on slightly stronger than expected refinance activity.

June 16 -

Residential starts rose 3.6% last month to a 1.57 million annualized rate, according to government data released Wednesday

June 16 -

A $28.8 billion rise in multifamily debt made up 65% of the $44.6 billion quarter-to-quarter gain, the Mortgage Bankers Association reported.

June 15 -

The real estate technology company had a $498 million valuation, according to PitchBook, but it could get a sizable premium to that if it were to go public.

June 15 -

The guidance addresses confusion related to how lenders should handle situations in which borrowers have not paid for a year and need additional help due to a natural disaster.

June 11 -

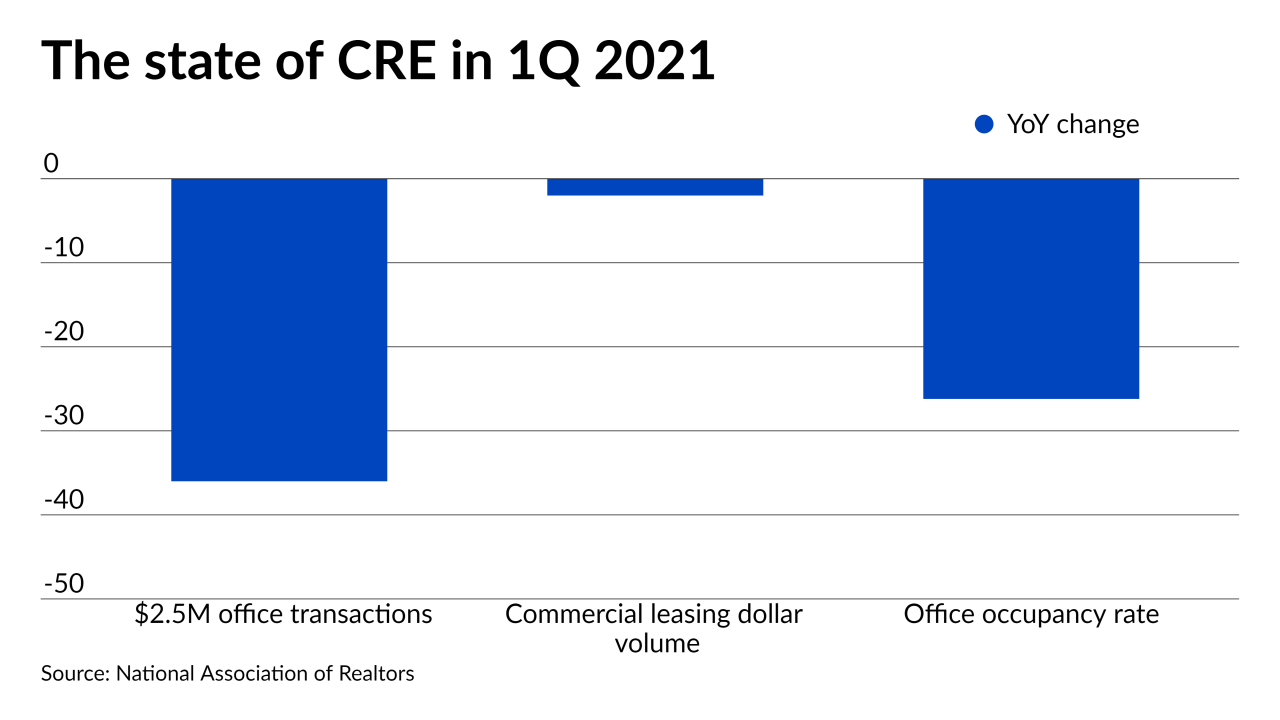

With residential supply severely lagging behind demand, redeveloping unused office space into multifamily properties seems like a perfect solution, but it’ll take governmental collaboration and tax breaks to make such projects financially compelling, developers say.

June 11 -

The Federal Housing Finance Agency said it is reviewing compensation policies for Fannie Mae and Freddie Mac and requesting feedback from the public. Some have said the $600,000 limit for executives imposed by Congress makes it hard to find talent.

June 10 -

According to the latest Federal Deposit Insurance Corporation (FDIC)’s “How America Banks” report, there is an estimated 7.1 million unbanked households in 2019. Given the record levels of unemployment, the pandemic has brought on the FDIC expects this number to rise. Join Joe Adler, American Banker’s Washington Bureau Chief and Leonard Chanin, Deputy to the Chairman of the FDIC as they discuss the FDIC’s stance on financial inclusion and how banks can get millions of unbanked Americans into the traditional banking system.

-

More than two-thirds surveyed said they expect to make less money over the next three months as price reductions ramp up along with a market shift to purchases.

June 10 -

In addition to earning ancillary fee income, it provides originators with an opportunity to connect with current and potential clients mired in student loan debt.

June 9 -

The government-sponsored enterprises have been returning to normal underwriting and are buying more loans than last year, but annual limits they have in place could become a concern.

June 8 -

For two decades, Alfred Pollard served as the general counsel for Fannie Mae and Freddie Mac’s regulator. He had a front-row seat for the establishment of the Federal Housing Finance Agency, the government’s subsequent seizure of the mortgage giants amid mounting losses in 2008 and the more recent legal dispute over the FHFA’s authority.

June 7 -

The more gradual upward drift in job numbers this year may hint at a slight softening in the market that analysts have flagged.

June 4 -

While there was a small uptick in missed payments for multifamily loans, the rate remained in the same area it's been at for the last year, according to the Mortgage Bankers Association.

June 3 -

Many put aside their own financial planning during the boom year of 2020 and some, as independent contractors, have no retirement savings at all. Here’s why they shouldn’t rely on selling their own companies or client lists to support themselves after they exit the workforce.

June 3 -

The digital title insurance, closing, escrow, and recording services provider has now raised a total of $110 million in funding.

June 2 -

The program, announced last October, looks to provide services to minority-owned banks and credit unions so they can increase homeownership rates in their communities.

June 2 -

The funding requests break sharply with the Trump administration's calls to eliminate key housing funds and backing for community development financial institutions. The White House also wants to substantially increase the budgets of the Treasury Department and the Small Business Administration.

May 28