-

An interactive dialogue with Founder and CEO of NorthOne on the fintech industry, the growing needs of challenger banks, and the future of SMB banking.

-

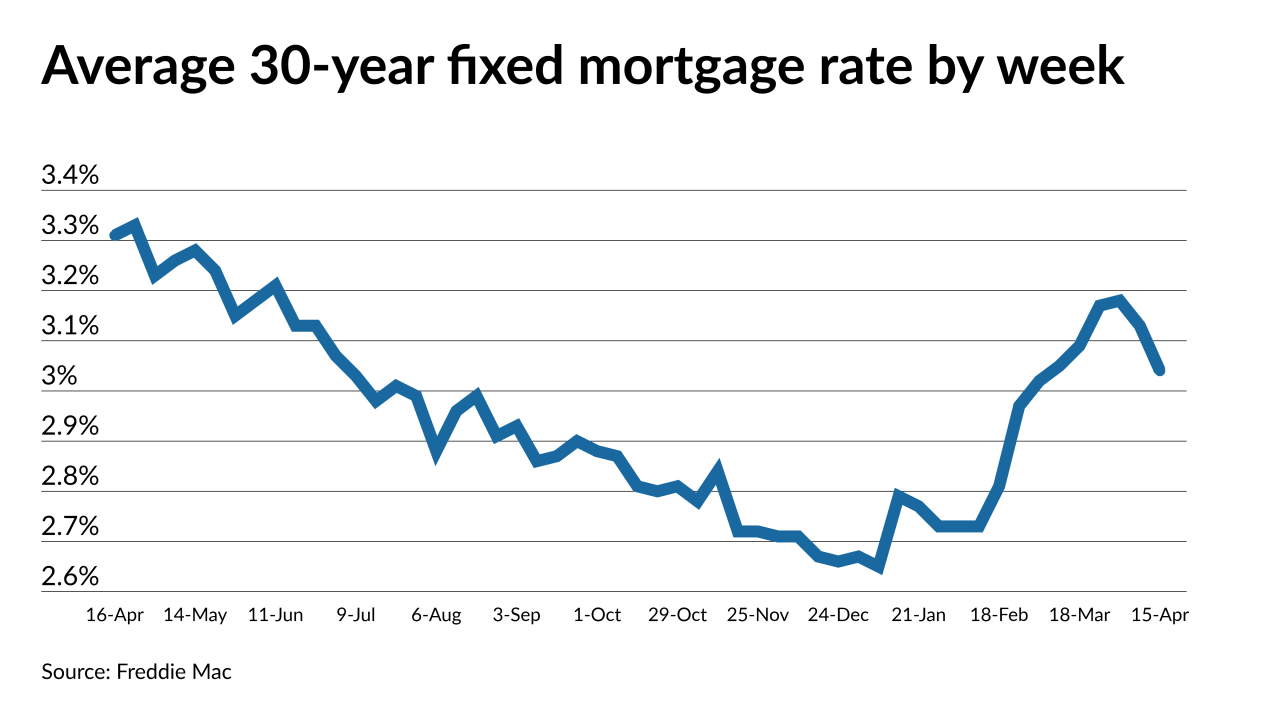

Rising cases and vaccine issues caused bond yields to fall, but inflationary pressures will likely reverse that course.

April 15 -

The markets and the Fed are not on the same page about the future of inflation. Luke Tilley Senior Vice President and Chief Economist at Wilmington Trust will discuss the economy and inflation.

-

The diverse group of loans in the servicing rights portfolio offers a potentially attractive recapture opportunity and would be a sizable transaction for their era.

April 12 -

Nonbanks claimed more of the top slots based on loan volume, while the origination gains experienced by Hispanic, Black and Native American borrowers were weaker than those of other groups.

April 9 -

The Financial Stability Oversight Council has struggled to find its footing since its creation in Dodd-Frank. The Treasury secretary has signaled a more aggressive role for the panel, including reviving its authority to target nonbank behemoths.

April 8 -

The development bodes well for outcomes on distressed loans backed by major government-related mortgage investors Fannie Mae and Freddie Mac.

March 26 -

The FHFA’s forbearance extension to September is forcing nonbank servicers to buy out more delinquent loans. It's also upended loss estimates for investors and made racial and income disparities in the mortgage market worse.

March 25 -

Stuck between local zoning hurdles and a lack of ideal federal financing, ADUs could be an important aspect to unlocking much-needed inventory.

March 24 -

The San Diego-based company produced $10.6 billion in the fourth quarter, and has done $6.1 billion in the first two months of 2021.

March 23 -

Also: How 9.3 million renters could enter the purchase market, lessons from Flagstar’s data breach and a possible 15-year plan for Fannie and Freddie.

March 19 -

Household formations, looser credit and an improved economy will overcome higher rates — and even the inventory shortage.

March 19 -

Proptech CEOs and investors fully expect a huge year for the sector due to the pandemic’s “watershed” effect on digitization, according to Keefe, Bruyette & Woods.

March 18 -

Relying on retained earnings alone, it would be until at least 2036, if not longer, before government control of Fannie Mae and Freddie Mae might end.

March 18 -

New assistance for renters may help but past efforts, while necessary, failed to get relief to renters in an expedient way, said David Brickman, who is now the head of a new agency lending platform backed by Barings and Meridian Capital.

March 17 -

The Blackstone-affiliated company recently took out a cash-out refi mortgage for a 17-property portfolio, an opportunity aided by high demand for its R&D facilities for COVID-19 research.

March 17 -

But building permits near an almost 15-year high point to further gains in home construction in the months ahead. The data coincide with still-elevated homebuilder sentiment as the industry works to replenish lean inventory and meet housing demand.

March 17 -

The announcement signals an openness to creating something many GOP lawmakers have long resisted: a federal guarantee of the trillions of dollars of mortgage bonds that Fannie and Freddie issue, a rep for P.A. senator said.

March 16 -

The Federal Housing Finance Agency is preparing to retire certain loan underwriting flexibilities after extending them one additional month to April 30.

March 12 -

The government-sponsored enterprise announced Wednesday it will change eligibility criteria for vacation homes and investor properties starting April 1 to fulfill a directive by former Treasury Secretary Steven Mnuchin.

March 11