-

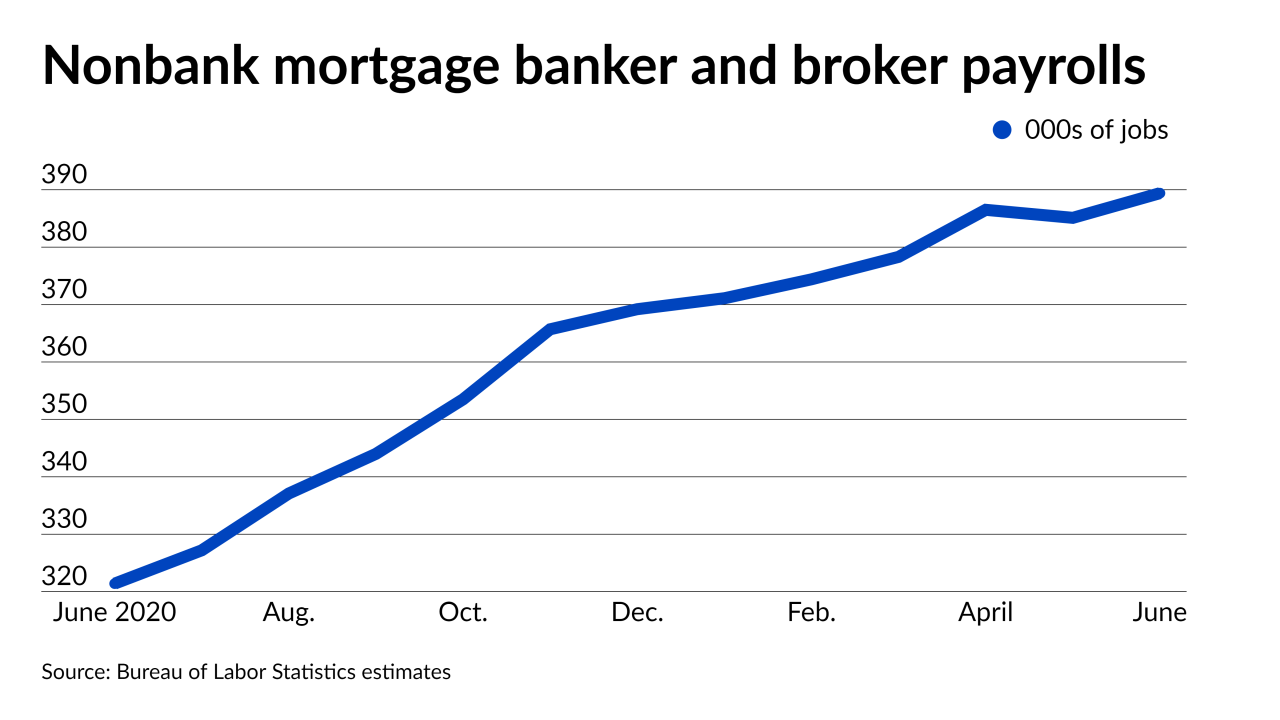

The May uptick in nonbank housing-finance payrolls came almost entirely from lender hiring as loan broker numbers plateaued and construction demand persisted.

July 7 -

Staff retained or added for the spring homebuying season has stemmed the tide of layoffs for now, according to the Bureau of Labor Statistics' latest figures.

June 2 -

Lenders and brokers have slashed two-thirds of the positions added since 2020, but the question now is whether reducing staffing to the level seen that year will be enough.

May 5 -

But that was not enough to offset the fourth consecutive monthly decline in total nonbank industry jobs, according to the Bureau of Labor Statistics.

October 7 -

The industry has cut tens of thousands of positions since January, according to the latest Bureau of Labor Statistics estimates.

September 2 -

But the overall employment picture was bright in July, returning to a level last seen before the pandemic, the Bureau of Labor Statistics data found.

August 5 -

And as long as broader unemployment remains low and inflation stays high, monetary policymakers will likely keep raising short-term rates in ways that could challenge home lending.

July 8 -

But several companies have cuts pending, and overall employment remains strong enough to keep putting some upward pressure on rates.

June 3 -

The March estimates for payrolls of nonbanks involved in home lending confirm widespread anecdotal reports of industry layoffs, but strength in broader financial-services hiring could pick up the slack.

May 6 -

Broader hiring remained relatively strong and unemployment fell to a pandemic low during March, but a yield curve inversion — which can signal a recession — is concerning some.

April 1 -

But recent rate drops in response to the Ukraine invasion and increases in broader employment suggest another uptick in housing finance payrolls is not out of the question.

March 4 -

Employment numbers suggest that interest in home purchases is bearing up well despite some limits on consumer spending and normalization in the mortgage market after two banner years.

February 4 -

Total U.S. jobs came in below consensus estimates in December, according to the Bureau of Labor Statistics.

January 7 -

But the latest employment report also reveals that if construction hiring remains sufficiently strong, home purchase originations are on track to grow to $1.7 trillion from $1.6 trillion next year.

December 3 -

The deal between the two fintechs aims to cut mortgage decisioning times for lenders and expand access to financing for consumers.

November 16 -

Plans to taper rate stimulus could further dampen industry employment, depending on the extent to which decreased volume is offset by staffing needs driven by the shift to work-intensive purchase loans.

November 5 -

But overall improvement in September employment numbers are likely to encourage the Federal Reserve to begin tapering their asset purchases.

October 8 -

The gain reinforces other estimates that suggest more work-intensive purchase originations have spurred companies to increase staffing. Hiring addressing changing needs in servicing may come next.

August 6 -

The tool is designed to help lenders adjust their underwriting to address the growing faction of non-W2 employees, which is expected to make up half of the workforce by 2027.

July 29 -

The plateau in non-depository estimates for new jobs in the field reported Friday follows anecdotal accounts of reorganization by banks and nonbanks in the past week.

July 2