-

The company had lower losses on its mortgage servicing rights investments compared with the second quarter.

October 26 -

And how people involved with Replay Acquisition made it more attractive than an initial public offering, according to CEO Patricia Cook.

October 22 -

If the underwriters' option is exercised, proceeds will bring in $112 million instead of a possible $176 million.

October 22 -

The pandemic has turned stress-testing around liquidity from theory into an actual case study. And while lenders shore up their cash reserves, they explain why many have been hesitant to take advantage of Ginnie Mae's Pass-Through Assistance Program.

October 21 -

Minus various expenses including corporate, legal and servicing rights valuation, Ocwen had adjusted pretax income of $13.5 million.

October 20 -

Strong mortgage and capital markets activity helped offset credit costs and one-time items in the third quarter at Citizens Financial Group. In a period of low rates, CEO Bruce Van Saun says he’d like to buy more fee-generating businesses.

October 16 -

But current owner Blackstone and FOA management will keep 70% of the company after its merger with a SPAC.

October 13 -

If mortgage lenders need to learn anything from the pandemic, it is relying on a single source for any service could disrupt their activities.

October 7 Lereta

Lereta -

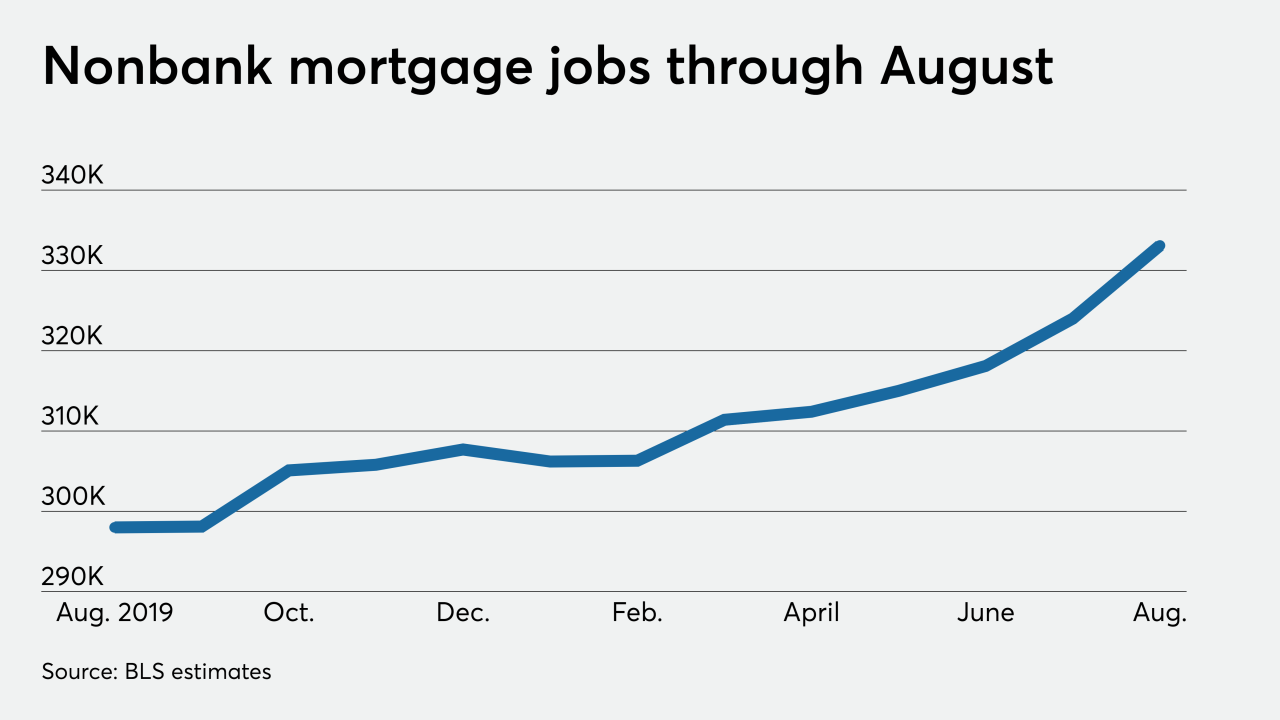

There was an estimated total of 333,100 people on nonbank mortgage banker and broker payrolls in August, and that's the highest recorded since at least 2010.

October 2 -

The future of Fannie Mae and Freddie Mac, the Fed’s supervisory regime for the biggest financial institutions, reform of the Community Reinvestment Act and a host of other industry-related issues are on the ballot this November.

September 17 -

Mortgage lender loanDepot is taking steps toward rebooting plans for an initial public offering, about five years after scrapping one at the last minute, according to people with knowledge of the matter.

September 17 -

The only rational strategy for holding MSRs is to be very aggressive on protecting the servicing assets via loan recapture. This is one of the chief reasons that banks have been willing to give up their share in lending and servicing as they collapse back to retail-only lending strategies.

September 16 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

After being approved, retroactively denied and having a second application rejected, the firm is appealing the decision with federal regulators.

September 15 -

The company's outgoing CFO discussed ways the asset cap is stunting growth, but provided no updates at an industry conference on when the restriction might be lifted or the types of jobs it will cut.

September 14 -

When Jane Fraser takes the reins of Citigroup in February, she will have to tackle the company’s cards slump, lagging performance metrics and challenges presented by employees’ return to the office.

-

While employment typically ebbs as home buying slows in the fall, several nonbanks have ambitious hiring plans in the works, which call for them to add thousands of workers by year-end.

September 4 -

When it comes to branch cleanliness and mask-wearing, the San Francisco bank is more diligent than its rivals in helping to reduce the spread of coronavirus, according to a new study.

September 4 -

But federal elections and the pandemic make projections on the sustainability of industry profitability especially tricky.

September 2 -

The new reality for investors and originators accounts for forbearances and ability-to-repay.

August 28 -

The Federal Reserve could ease capital rules, foster the creation of special-purpose banks and take other steps to strengthen minority communities and businesses without legislation being sought in Congress — if it has the will to do so, experts say.

August 25