-

Strong loan performance continued into December as all delinquency stages fell annually behind equity gains and the sustained rise of home prices, according to CoreLogic.

March 12 -

Mortgage foreclosure filings across New York dropped 46% between 2013 and 2018, from 46,696 to 25,334, according to a report issued by New York State Comptroller Thomas DiNapoli.

March 11 -

Whether through greater investments in technology and talent, or streamlining back-end processes to improve the decision-making process, mortgage servicers are doing more to prioritize borrowers. Here's a look at seven of these borrower-focused initiatives and how they're reshaping mortgage servicing.

March 1 -

Mortgage prepayment speeds fell to a 19-year trough despite recent interest rate declines, but could rise if those lower rates lead to an increase in home purchases, according to Black Knight.

February 25 -

Fewer mortgage borrowers are falling behind on their payments, and consumers' broader borrowing habits indicate an increased willingness to turn to nontraditional sources like fintechs for their lending needs, according to TransUnion.

February 22 -

In what some real estate professionals are referring to as part of the "after-effects" of the recession, is a spike in the sale of foreclosures across Staten Island.

February 20 -

Mortgage delinquencies in the fourth quarter were at their lowest level in nearly 19 years, helped by wage growth, low household debt and low unemployment, the Mortgage Bankers Association said.

February 15 -

Mortgage loan performance remained strong in November as serious delinquencies fell to their lowest reported level since before the housing bubble burst, according to CoreLogic.

February 12 -

A year after forming, the Erie County, Pa., land bank is compiling a list of blighted, tax-delinquent properties outside the city that need to be demolished or rehabilitated.

February 12 -

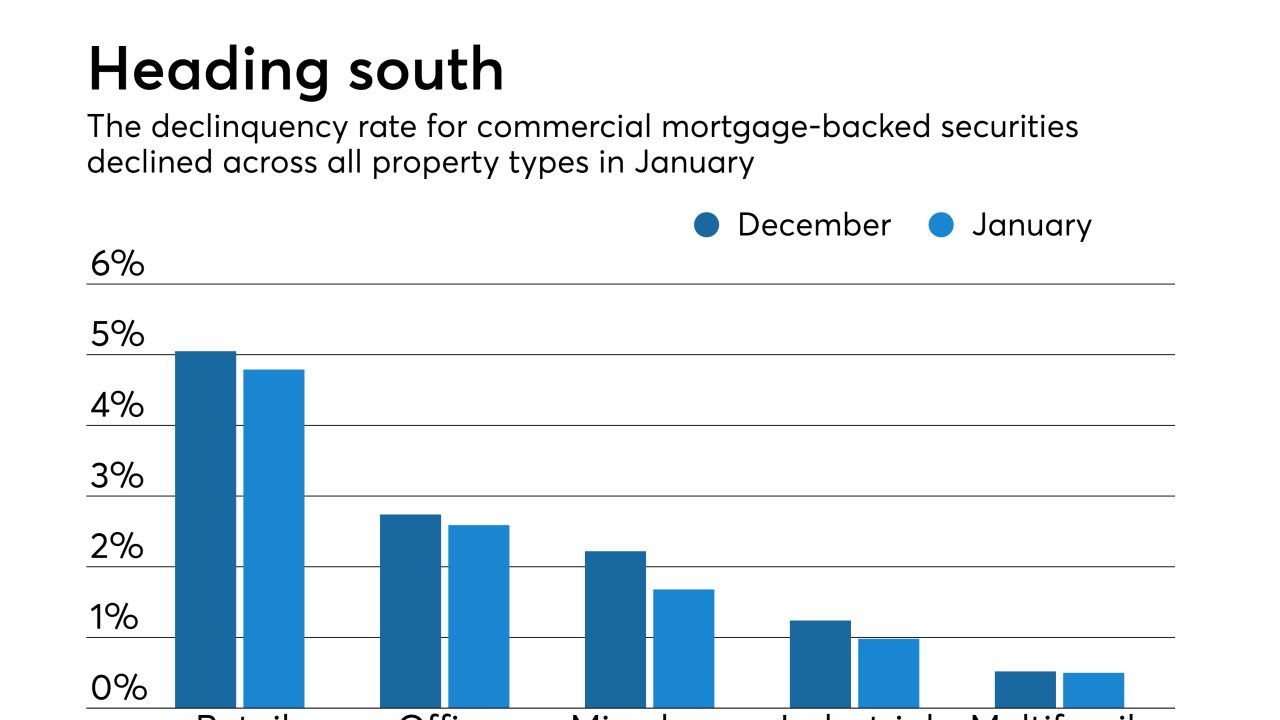

Late payments on loans backing commercial mortgage bonds continued falling at the start of the year, due to strong new issuance volume and continued resolutions for precrisis loans by special servicers, according to Fitch Ratings.

February 11 -

As more homeowners decide to age in place, the amount of equity rich properties continues to rise, according to Attom Data Solutions.

February 7 -

Ocwen Financial subsidiary PHH Mortgage will pay a total of $750,000 to six military members and increase employee training to settle Department of Justice allegations that it conducted foreclosures that violated the Servicemembers Civil Relief Act.

February 6 -

Better credit quality and the influx of refinancing during the low interest rates of the last few years pushed mortgage performance to the highest levels since the turn of the century, according to Black Knight.

February 4 -

New York State is providing additional funding to municipalities that will boost efforts regarding mortgage servicer compliance with the state and local vacant property laws.

January 28 -

Risk aversion, economic momentum and the multidecade nadir of unemployment rates helped push delinquencies to the lowest year-end measure of the 21st century, according to Black Knight.

January 23 -

The distressed real estate market has bounced back from the housing bubble as most foreclosures are due to natural disasters, according to Attom Data Solutions.

January 17 -

The agency wants mortgage servicers to extend special forbearance plans to those affected by the partial government shutdown and evaluate borrowers for loss-mitigation options.

January 9 -

The strong economic headwinds from last fall facilitated a declining loan delinquency rate across the country, though areas hit by natural disasters had increased defaults, according to CoreLogic.

January 8 -

As the government shutdown enters its third week, mortgage servicers are activating the response plans they normally use during hurricanes and wildfires to assist federal workers who may have trouble paying their mortgages.

January 4 -

A Wilmington Township, Pa., man accused of illegally purchasing properties he formerly owned through a tax sale has pleaded guilty to a felony charge of deceptive business practices.

December 24