-

As more homeowners decide to age in place, the amount of equity rich properties continues to rise, according to Attom Data Solutions.

February 7 -

Ocwen Financial subsidiary PHH Mortgage will pay a total of $750,000 to six military members and increase employee training to settle Department of Justice allegations that it conducted foreclosures that violated the Servicemembers Civil Relief Act.

February 6 -

Better credit quality and the influx of refinancing during the low interest rates of the last few years pushed mortgage performance to the highest levels since the turn of the century, according to Black Knight.

February 4 -

New York State is providing additional funding to municipalities that will boost efforts regarding mortgage servicer compliance with the state and local vacant property laws.

January 28 -

Risk aversion, economic momentum and the multidecade nadir of unemployment rates helped push delinquencies to the lowest year-end measure of the 21st century, according to Black Knight.

January 23 -

The distressed real estate market has bounced back from the housing bubble as most foreclosures are due to natural disasters, according to Attom Data Solutions.

January 17 -

The agency wants mortgage servicers to extend special forbearance plans to those affected by the partial government shutdown and evaluate borrowers for loss-mitigation options.

January 9 -

The strong economic headwinds from last fall facilitated a declining loan delinquency rate across the country, though areas hit by natural disasters had increased defaults, according to CoreLogic.

January 8 -

As the government shutdown enters its third week, mortgage servicers are activating the response plans they normally use during hurricanes and wildfires to assist federal workers who may have trouble paying their mortgages.

January 4 -

A Wilmington Township, Pa., man accused of illegally purchasing properties he formerly owned through a tax sale has pleaded guilty to a felony charge of deceptive business practices.

December 24 -

Home retention actions from Fannie Mae and Freddie Mac through the first three quarters of 2018 already eclipsed 2016 and 2017 while forfeitures kept declining, according to the Federal Housing Finance Agency.

December 21 -

Many servicers expect their Federal Housing Administration mortgage portfolios to grow in the next year or two, and that increase could coincide with an uptick in delinquencies, warns Altisource Portfolio Solutions.

December 21 -

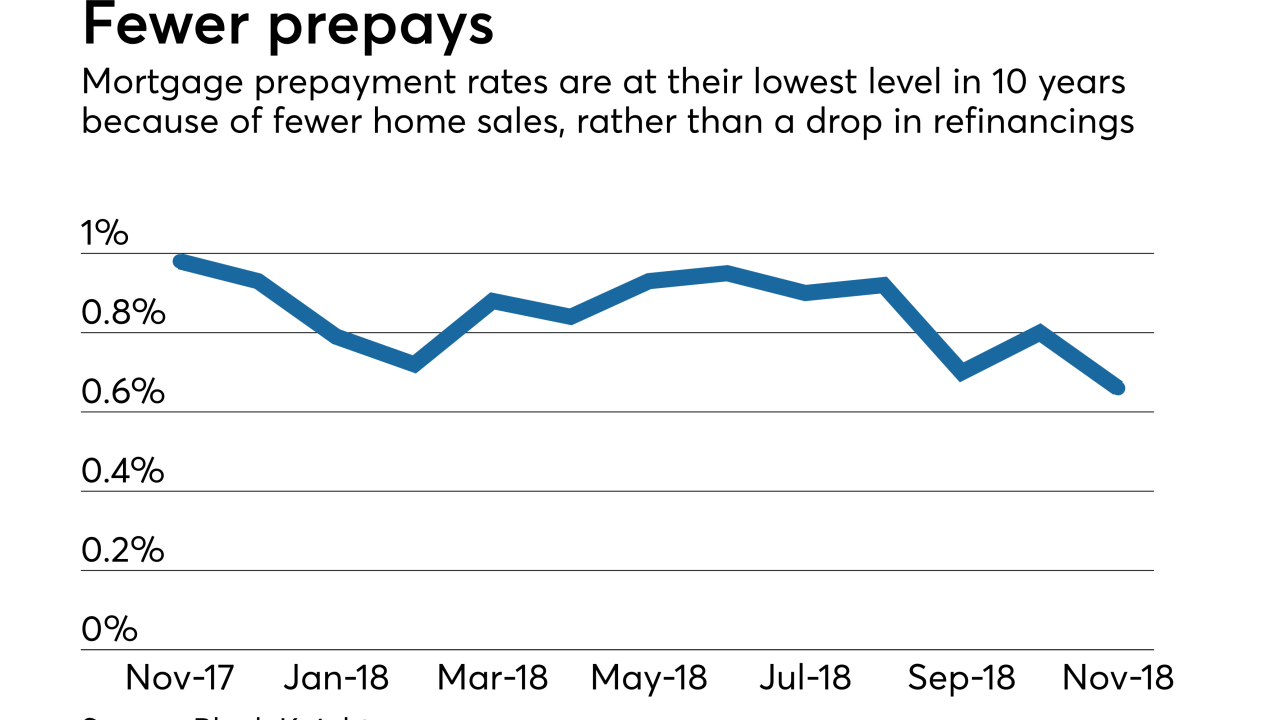

Mortgage prepayment speeds fell to their lowest level in 10 years in November as rising interest rates took a toll on origination activity, according to Black Knight.

December 20 -

An agency report said servicing portfolios have shrunk by nearly half in 10 years as much of the mortgage market has shifted to nonbanks.

December 12 -

Other than in areas hit by natural disasters, delinquency rates are falling with help from a healthier labor market, but a rise in riskier lending habits could signal trouble for borrowers should housing conditions change, according to CoreLogic.

December 11 -

The government-sponsored enterprises are suspending eviction lockouts for the holiday season.

December 10 -

Weakening prices from the most expensive metro areas caused the first decline in available equity since the market started recovering from the housing crisis, according to Black Knight.

December 10 -

Casper's Parkway Plaza hotel has a new owner as GreenLake Real Estate Fund bid $15.5 million at a foreclosure sale to purchase the property.

December 7 -

Foreclosure activity is down nationwide from a year ago, but certain local housing markets are telling a different story.

December 5 -

The government-sponsored enterprises sold fewer nonperforming loans in the first half, but the drop-off in the number of sales year-to-year is less severe than it was in 2017 as a whole.

December 5