-

Home retention actions from Fannie Mae and Freddie Mac through the first three quarters of 2018 already eclipsed 2016 and 2017 while forfeitures kept declining, according to the Federal Housing Finance Agency.

December 21 -

Many servicers expect their Federal Housing Administration mortgage portfolios to grow in the next year or two, and that increase could coincide with an uptick in delinquencies, warns Altisource Portfolio Solutions.

December 21 -

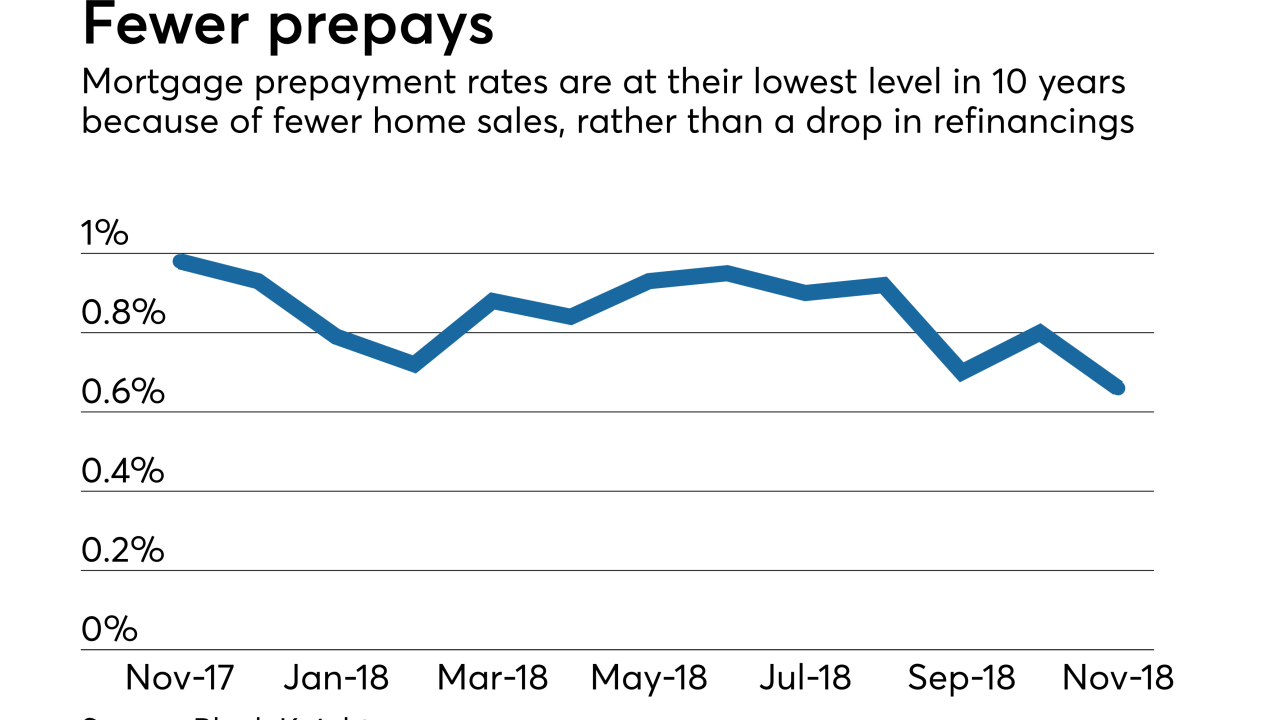

Mortgage prepayment speeds fell to their lowest level in 10 years in November as rising interest rates took a toll on origination activity, according to Black Knight.

December 20 -

An agency report said servicing portfolios have shrunk by nearly half in 10 years as much of the mortgage market has shifted to nonbanks.

December 12 -

Other than in areas hit by natural disasters, delinquency rates are falling with help from a healthier labor market, but a rise in riskier lending habits could signal trouble for borrowers should housing conditions change, according to CoreLogic.

December 11 -

The government-sponsored enterprises are suspending eviction lockouts for the holiday season.

December 10 -

Weakening prices from the most expensive metro areas caused the first decline in available equity since the market started recovering from the housing crisis, according to Black Knight.

December 10 -

Casper's Parkway Plaza hotel has a new owner as GreenLake Real Estate Fund bid $15.5 million at a foreclosure sale to purchase the property.

December 7 -

Foreclosure activity is down nationwide from a year ago, but certain local housing markets are telling a different story.

December 5 -

The government-sponsored enterprises sold fewer nonperforming loans in the first half, but the drop-off in the number of sales year-to-year is less severe than it was in 2017 as a whole.

December 5 -

Two more real estate investors have admitted conspiring to rig bids at foreclosure auctions, bringing to nine the total who say they cheated at the public auctions held at South Mississippi courthouses.

November 29 -

That old fixer-upper house down the block may have seen better days, but in an environment where new-home prices are on the rise, older homes remain in demand in many markets.

November 28 -

October's loan delinquencies, especially those in serious delinquency, got much healthier after improving from the fallout of the last two hurricane seasons, according to Black Knight.

November 27 -

A National Fair Housing Alliance-led group plans to amend and refile a recently dismissed complaint against Deutsche Bank, Ocwen Financial Corp. and Altisource Portfolio Solutions alleging racial discrimination in property preservation.

November 21 -

Over the last 20 years, at least 145,000 Detroit properties have been put up for sale in the annual Wayne County Tax Auction, and, of that number, an estimated 50,000 properties were occupied at the time of foreclosure.

November 20 -

Wells Fargo will lay off 1,000 workers primarily from its mortgage unit in the first major round of a previously announced plan to cut the bank's workforce by as much as 10% over the next three years.

November 15 -

The 48,390 homes dubbed at extreme or high risk from the California wildfires burning through the state could cost $18 billion in reconstruction, according to a CoreLogic analysis.

November 14 -

The scheme's perpetrators were based in Irvine, Calif., the FTC said in a complaint filed in U.S. District Court in Maryland.

November 14 -

The bank recently notified an upstate New York man that he was wrongly denied a mortgage modification, and enclosed a $25,000 check. But details of what went wrong have been hard to come by.

November 13 -

The mortgage delinquency rate dipped to a 12-year low, but overvalued housing markets and eventual reversal in the unemployment rate present risk for future delinquencies, according to CoreLogic.

November 13