-

Three people who fraudulently obtained $9.3 million in mortgage loans involving homes in Modesto, Patterson and Lathrop, Calif., have received multiyear federal prison sentences.

November 13 -

Mortgage delinquencies inched up, in part from natural disasters hindering homeowner performance, but a stronger economy is still keeping defaults low, according to the Mortgage Bankers Association.

November 8 -

Wells Fargo said Tuesday that an internal error that affected customers requesting mortgage modifications to remain in their homes impacted hundreds more people than the bank initially thought.

November 6 -

Excellent credit quality and strong performance of post-housing-crisis originations resulted in a steep decline in foreclosure starts in September, according to Black Knight.

November 5 -

Housing policies are helping the number of vacant foreclosure homes drop, which could also mean homebuyers have been taking advantage of these properties as inventory continues to be constrained, according to Attom Data Solutions.

October 30 -

After falling to its lowest level in over 12 years, servicers expected September's surge in delinquencies following the damage of Hurricane Florence, according to Black Knight.

October 24 -

The Federal Housing Administration is making it easier for reverse mortgage servicers to submit insurance claims by expanding the types of supporting documentation it will accept on defaulted loans.

October 22 -

Natural disasters are now the leading driver of lenders' foreclosure risk, with last year's hurricanes causing a rise in third-quarter filings in affected markets, according to Attom Data Solutions.

October 11 -

The mortgage delinquency rate fell to a 12-year low, with declines expected to continue as the unemployment rate stays down, according to CoreLogic.

October 9 -

Destruction from Michael's storm surge and flooding has potential to affect 57,000 homes, with a worst-case total of $13.4 billion in reconstruction cost value, according to CoreLogic's latest estimates.

October 9 -

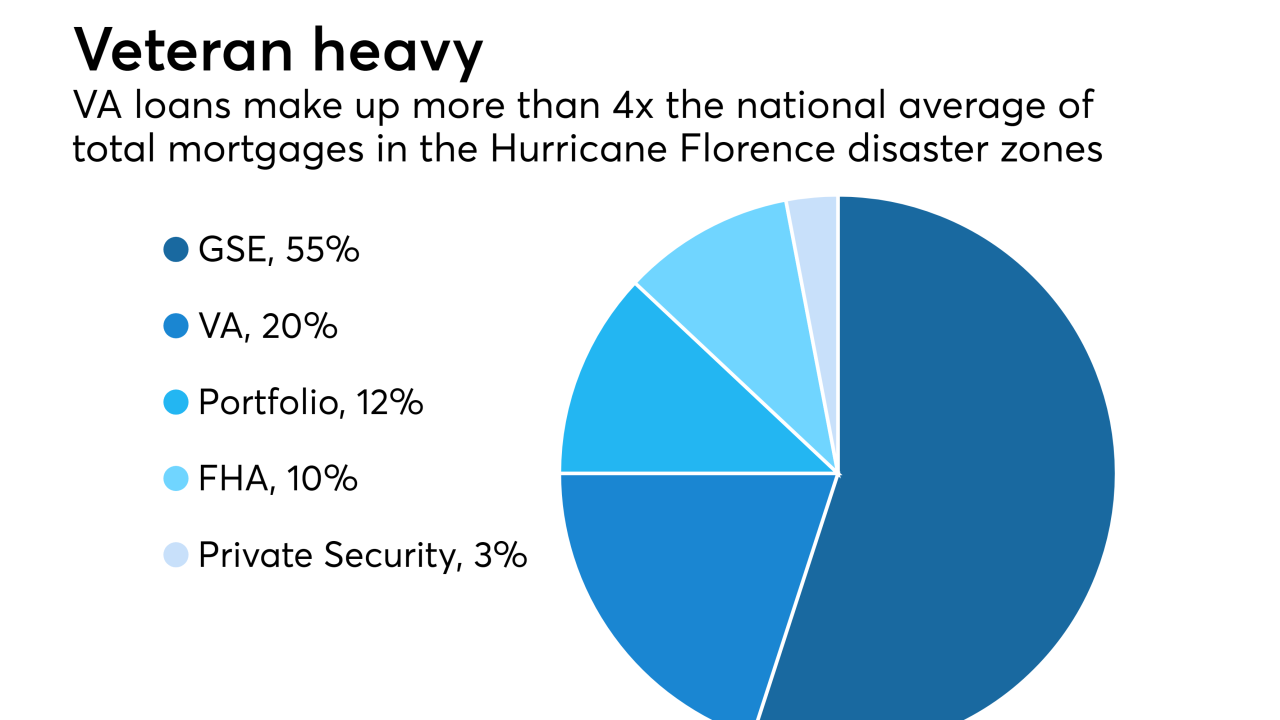

Delinquencies will be on the rise and Veterans Affairs loans have greater density within FEMA-declared disaster zones from Hurricane Florence, according to Black Knight.

October 8 -

Property values for homes that were foreclosed on during the Great Recession are outpacing the nation's average house price appreciation, according to Zillow.

October 5 -

During the foreclosure crisis, thousands of Floridians turned to Mark Stopa for help in saving their homes.

October 1 -

Fannie Mae and Freddie Mac issued new capital requirements for private mortgage insurers that will create big swings in carriers' asset reserves.

September 27 -

Foreclosure starts increased 9% in August compared with July, slightly higher than the historic norm between the two months, according to Attom Data Solutions.

September 27 -

Florence's flooding and wind destruction affected about 700,000 residential and commercial properties across North Carolina, South Carolina and Virginia, according to CoreLogic's latest estimates.

September 25 -

The mortgage delinquency rate dropped to its lowest level in over 12 years, but servicers should expect an increase following the impact of Hurricane Florence, according to Black Knight.

September 24 -

A Jacksonville, Ill., church facing foreclosure has a new lease on life after months of fundraising.

September 20 -

Commercial mortgage-backed securities delinquency rates are likely to continue to decrease for the rest of the year, as new issuances outpace maturing loans and precrisis loans continued to get resolved by special servicers, Fitch Ratings said.

September 17 -

While the severity of Florence was reduced prior to Friday morning's landfall, mortgage servicers are taking proactive steps in addressing the emergency situation.

September 14