-

The conventional market recaptured a lot of the first-time homebuyers it lost during the financial crisis, but service members instead have increasingly stuck with loans insured by the Department of Veterans Affairs.

March 1 -

Arch Capital’s next offering of credit risk transfer notes features heavy exposure to residential mortgages that have been modified by Fannie Mae or Freddie Mac.

March 1 -

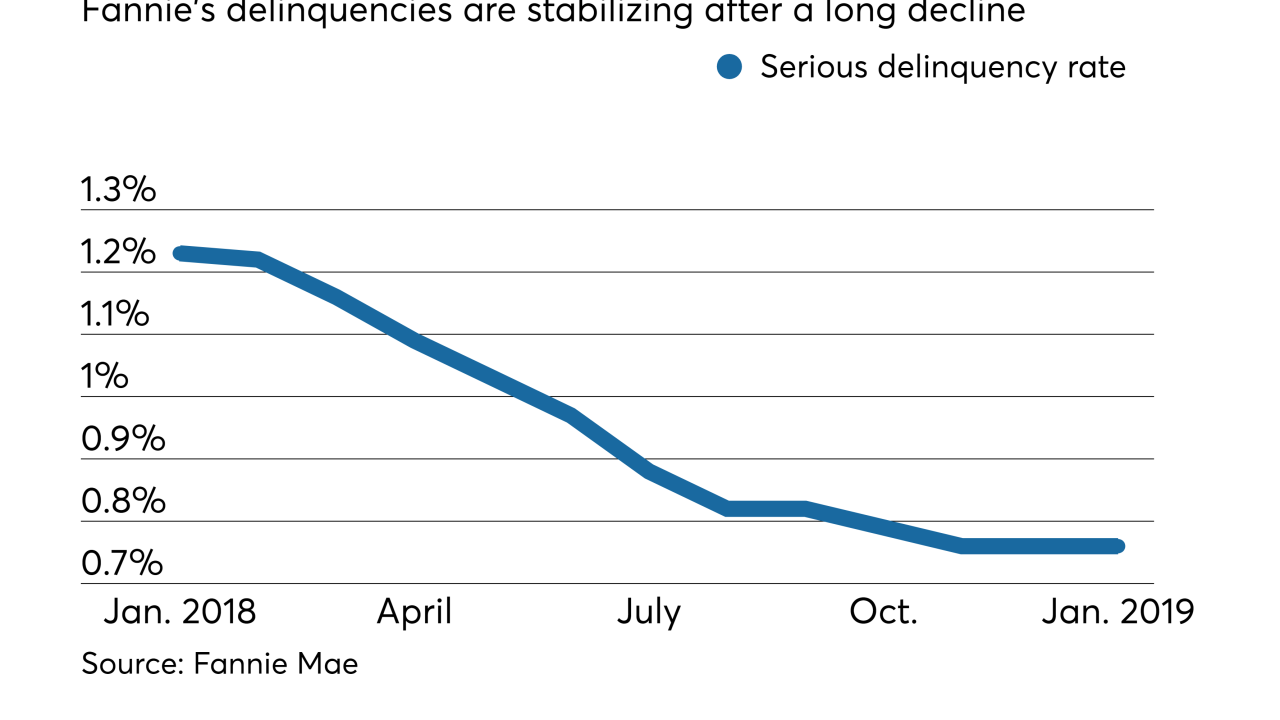

Fannie Mae's serious delinquency rate stood firm for the third month running, adding to evidence that it has hit a floor after dropping for most of the past year.

March 1 -

Freddie Mac again increased its origination forecast for the next two years, as the rate drops of the past few months are expected to boost refinance volume.

March 1 -

The new regulation, codifying requirements already in practice, is meant to help the mortgage giants prepare for the adoption of a uniform security in June.

February 28 -

Being too dependent on the automated underwriting tools created by the government-sponsored enterprises to originate loans underlying private-label mortgage-backed securitizations could negatively affect their credit quality, a report from Moody's said.

February 26 -

If confirmed to lead the Federal Housing Finance Agency, Mark Calabria would have a central role in any efforts to reform the government-sponsored enterprises Fannie Mae and Freddie Mac

February 26 -

The Federal Reserve Bank of New York is streamlining its Ginnie Mae holdings by combining mortgage-backed securities with similar characteristics into larger pass-through instruments.

February 25 -

The six private mortgage insurers had a great year as they continued to grab market share from the Federal Housing Administration. Despite some headwinds, 2019 is shaping up to be another good year.

February 22 -

From FICOs to purchase volume, here's a look at seven mortgage lending trends that will shape the housing market this year.

February 20 -

The administration is sending conflicting signals on whether it has a plan to overhaul the housing finance system, further complicating an already complex debate.

February 19 American Banker

American Banker -

Refinance volume slipped following growth in mortgage rates, and loans refinanced through the Home Affordable Housing Program barely made a dent in overall volume, according to the Federal Housing Finance Agency.

February 15 -

The government-sponsored enterprises are going through a transition period. From proposals for rebuilding their capital cushions to tackling shortages in affordable housing, Fannie Mae and Freddie Mac face a number of key challenges with wide-ranging consequences this year.

February 14 -

Rep. Blaine Luetkemeyer, R-Mo., told the mortgage giants' chief federal regulator that the Financial Accounting Standards Board’s new model for estimating loan losses could pose risk across the mortgage market.

February 14 -

Industry observers will be closely monitoring Mark Calabria's testimony before the Senate Banking Committee on Thursday for hints about how the Trump administration plans to proceed on mortgage finance reform.

February 13 -

Recent developments give the impression that the administration and lawmakers are in direct competition, but the ultimate framework may rely on coordination from both branches of government.

February 5 -

Absent some policy change, nearly a third of the loans backed by Fannie Mae and Freddie Mac could be in violation of the Consumer Financial Protection Bureau's Qualified Mortgage rule in two years.

February 4 -

Despite the release of Senate Banking Committee Chairman Mike Crapo's outline of a government-sponsored enterprise reform plan, most policy changes will likely come from the White House, and may even materialize this year, said Keefe, Bruyette & Woods.

February 4 -

As policymakers consider administrative reforms to Fannie and Freddie, they must address the problem of capital arbitrage to avoid overleveraging the mortgage system.

February 4

-

China Oceanwide's acquisition of Genworth has been postponed until March, prolonging uncertainty about the fate of the acquired company's U.S. private mortgage insurance unit that could be resolved by the deal.

January 31