-

Bank of America's first-mortgage production dropped almost 26% year-over-year in the fourth quarter of 2018, but it experienced a less severe 10% decline in home equity lending during the same period.

January 16 -

Late payments on mortgages are expected to keep dropping and credit is expected to remain strong next year, in part because housing prices remain healthy in most areas, according to TransUnion.

December 13 -

Intense competition among homebuyers remains as shown by the continual growth of median down payments, according to Attom Data Solutions.

December 13 -

Time and again, two former associates of President Trump deceived banks in connection with loan applications. Their wealth, proximity to power and willingness to tell big lies all appear to have helped them get away with brazen schemes.

December 12 -

Weakening prices from the most expensive metro areas caused the first decline in available equity since the market started recovering from the housing crisis, according to Black Knight.

December 10 -

Online personal lending pioneer Prosper is developing a home equity line of credit product that it will offer in partnership with banks. The embrace of traditional depositories marks a departure from fintech lenders that typically seek to disrupt and displace legacy institutions.

November 14 -

Ellie Mae is tackling home equity lines of credit loans with its latest Encompass Digital Mortgage Solution update as signs point to a surge in home equity borrowing.

October 22 -

A surge in home equity borrowing may be around the corner as household equity levels surpassed their previous housing bubble peak, according to a TransUnion study.

October 19 -

A stronger economy, easing house price appreciation and slightly improving inventory conditions aren't enough to push up home sales this year, according to Freddie Mac.

September 24 -

Mortgage origination volume continues to decline as homebuyers receiving loans bring more money to the closing table.

September 13 -

The mortgage delinquency rate dropped to its lowest level in 12 years despite foreclosure starts and active foreclosures both increasing in July, according to Black Knight.

September 10 -

The gap between equity-rich homeowners and mortgage borrowers who are seriously underwater narrowed in the second quarter, highlighting the uneven nature of the housing market's recovery since the Great Recession.

August 9 -

Despite available home equity shooting up in the first quarter, the share of total equity withdrawn by borrowers hit a four-year low, likely due to an increase in interest rates, according to Black Knight.

July 9 -

From medical expenses to home improvements, here's a look at some of the most frequently cited reasons homeowners are borrowing against their home equity.

June 26 -

Though mortgage originations were down overall in the first quarter, home equity lines of credit spiked on higher home prices, according to Attom Data Solutions.

June 14 -

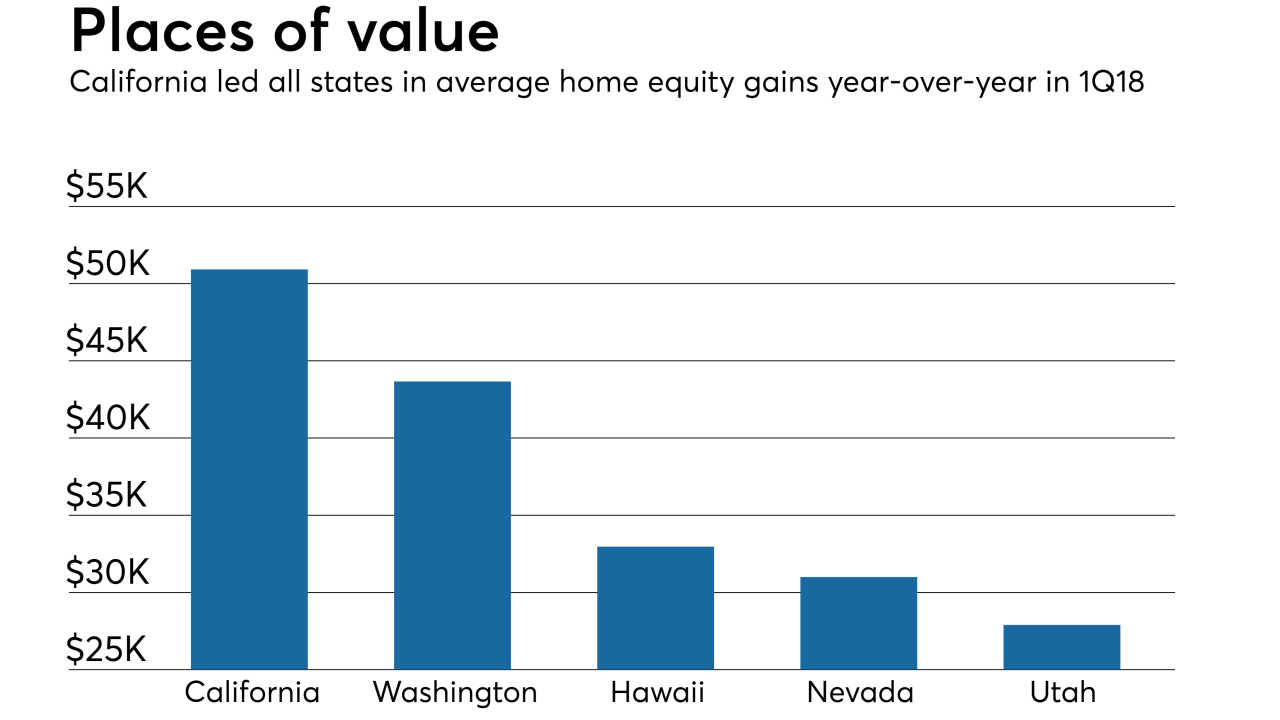

As house values continued growing, homeowners with mortgages saw their equity increase 13.3% year-over-year in the first quarter, a gain of over $1.01 trillion, according to CoreLogic.

June 8 -

The post-recession boom in auto loans and credit cards for borrowers with marred credit histories has been winding down in recent months.

May 17 -

Businesses are investing more, people are finding jobs, and inflation is picking up, meaning higher interest rates for homebuyers.

April 26 -

HELOCs make up just 2.9% of the $281 million pool of collateral; 81.8% of the HELOC borrowers are currently ineligible to make draws; another 18.2% are permanently frozen.

April 16 -

Mortgage borrowers collectively hold more equity in their homes than at any other time on record, but they've been slow to borrow against this newfound wealth, according to Black Knight.

April 2