-

But knowledge of HELOCs and HECMs is higher among Gen Z and millennials than boomers.

July 26 -

The new product is an extension of its FraudGuard offering for the first lien mortgage market.

June 23 -

Volumes generated for the home equity product increased by 28% over the past year, showing particular strength in Western markets.

June 10 -

Non-depositories historically haven't been big originators of home equity lines of credit, but fintechs that offer the easily automated countercyclical products are reporting growth.

May 26 -

In the fourth quarter of 2021, home equity line of credit volume was up 31% from the same period the year before.

May 13 -

Forecasting that it will not turn a profit in the 2022 fiscal year, the company plans to make job cuts, suspend dividends and introduce new products.

May 10 -

While first-quarter profits were up considerably, CEO Michael Nierenberg said the company will offer more products to counter market conditions that are “only going to get worse.”

May 3 -

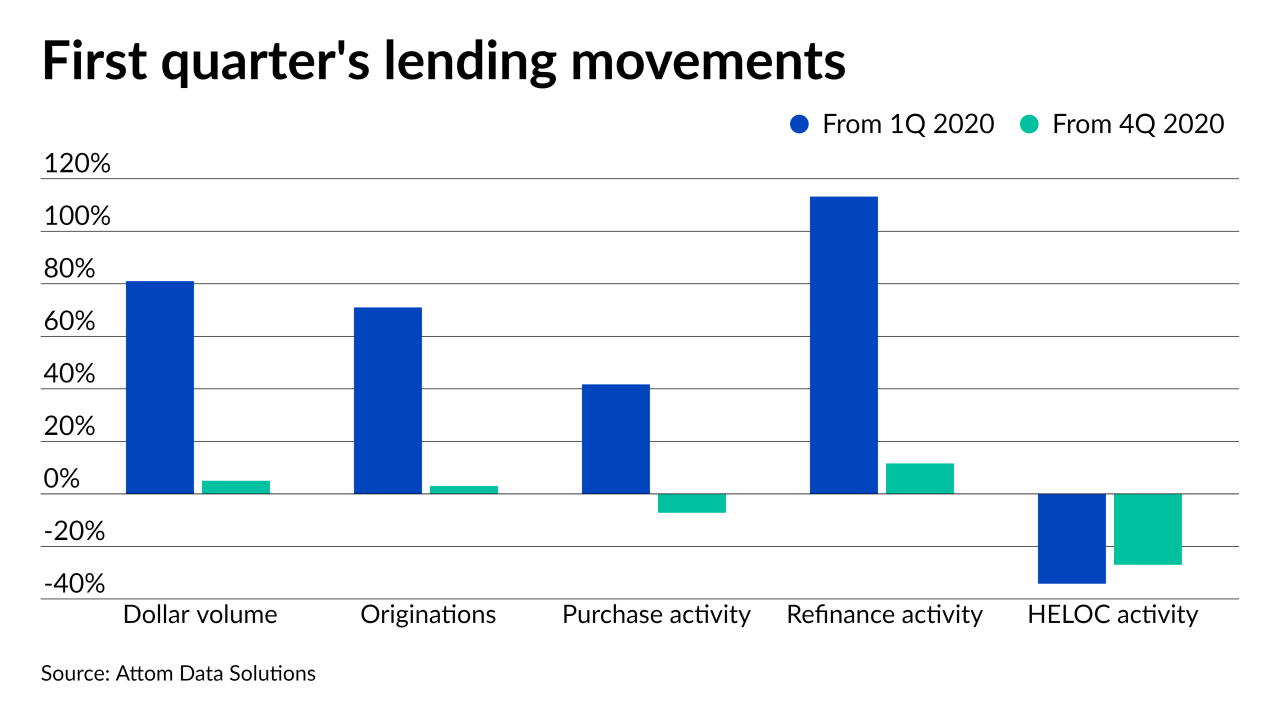

Purchase activity dominated the period and experienced the most growth while refinances cooled off and home equity lines of credit made a comeback, according to Attom Data Solutions.

August 19 -

Refinancings more than doubled the year-ago amount and made up for the slowed purchase activity, according to Attom Data Solutions.

June 3 -

As mortgage rates stayed below 3% in the third quarter, originations spiked to the highest quarterly total since 2007 and highest dollar volume since 2005, according to Attom Data Solutions.

November 20 -

The two companies first started collaborating last year, but now BBVA has white-labeled Prosper’s technology on its own website.

November 10 -

With mortgage rates tumbling near 3% in the second quarter, refinance originations spiked 400% in some housing markets, pushing overall volume to its highest point since 2009, according to Attom Data Solutions.

August 20 -

Home-renovation loans to add features such as offices and pools could be one source of lending as credit unions struggle with overall sluggish loan demand.

July 24 -

The Consumer Financial Protection Bureau seeks to address challenged posed by the sunset of the London interbank offered rate at the end of 2021.

June 4 -

With mortgage rates reaching all-time lows in the opening quarter, refinance originations were up in 97% of housing markets during 1Q, according to Attom Data Solutions.

May 21 -

Wells Fargo will temporarily stop accepting applications for home equity lines of credit, following a similar move by rival JPMorgan Chase.

April 30 -

Is JPMorgan Chase an outlier or the canary in the coal mine when it comes to home equity lending during the coronavirus spread?

April 28 -

The nation's largest bank is temporarily reducing its exposure to the mortgage market amid rising unemployment and estimates that home prices could drop by 10%.

April 16 -

The worsening economy brought on by the coronavirus pandemic has big banks rethinking who they will lend to.

April 2 -

JPMorgan Chase & Co. is shifting workers to handle an expected surge in demand for home loans as the American housing market looks forward to its strongest spring in at least a decade and the coronavirus sends mortgage rates lower.

February 28